Submitted by Eric Peters, CIO of One River Asset Management

Vomit

He started his career in 1989, with Fed Funds at 9.75%. The Fed slashed rates to 8.25% in Dec 1989 as the S&L Crisis unfolded. They continued cutting until Aug 1992, when rates hit a mindboggling low of 3.00%. The Fed kept money that cheap for 1.5yrs. Investors had recently earned 9.75% for taking no risk and found themselves starved for returns. So banks structured complex products that offered enhanced yields by selling volatility – they were great, provided the Fed neither hiked nor cut rates. They flew off the shelves. Salespeople gouged their clients.

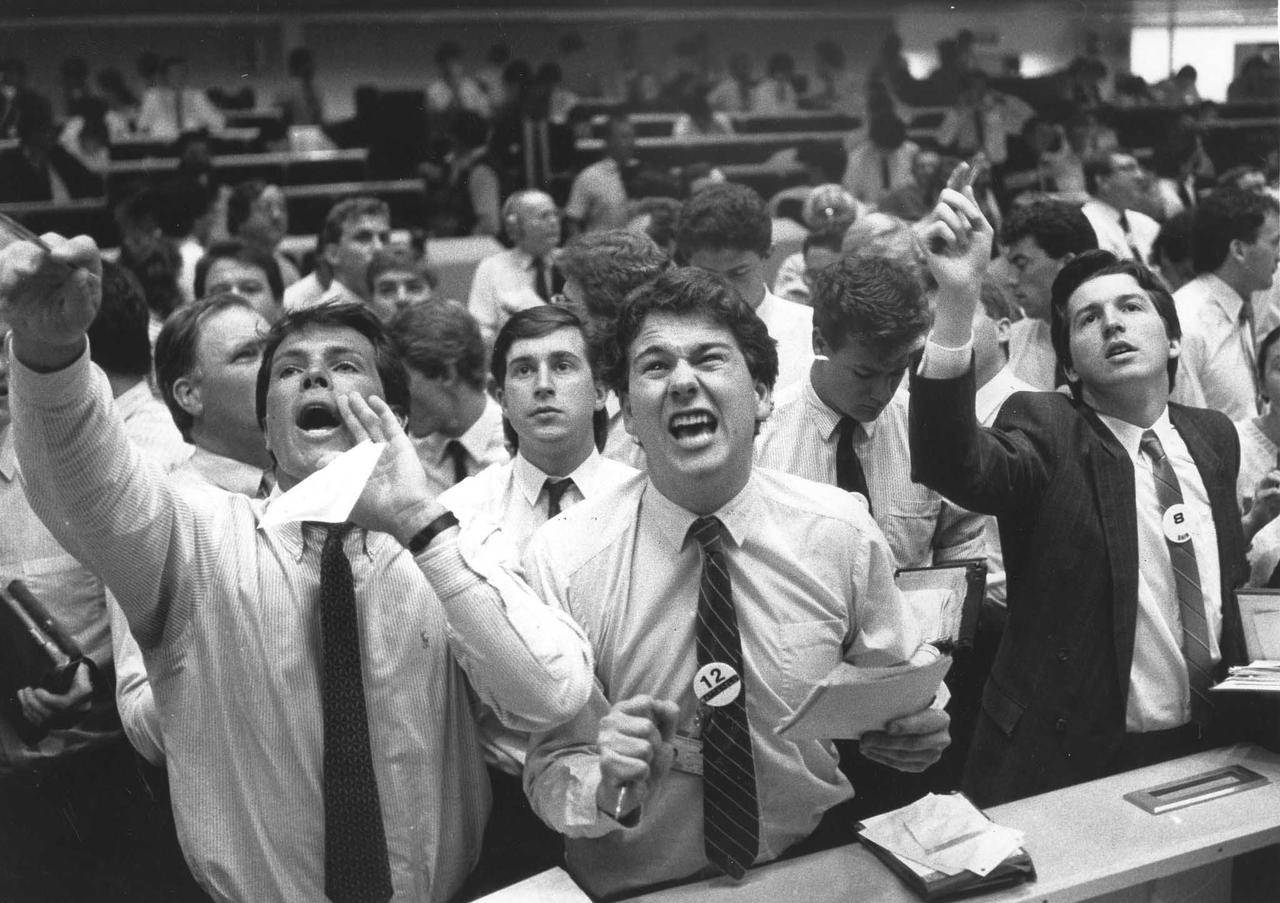

The Fed hiked 25bps to 3.25% in Feb 1994. Grown men cried on the trading floor. Salesmen. They were soon laid off. Their clients suffered staggering losses. They too were fired. And as their bosses and boards discovered the scale of their unbounded risk, they instructed the banks to get them out at the best price. Whenever that happened, the cost was far bigger than expected. And this in turn was reflexive. Those clients who had earlier assured themselves that they could stomach the ride – because they were long-term investors – were forced to vomit.

They call that period The Great Bond Massacre. But it seemed like every few years, another great massacre would unfold in one thing or another. So he assumed that this is how the world worked. Of course, he wasn’t alone. Global central bankers also recognized this to be the case. So they strived to avoid new massacres. But their tools only worked when the mechanic applied greater leverage with each use.

Massacre after massacre, they cranked away. By 2019, they had produced the longest economic expansion and equity bull market in American history.

* * *

Bedtime Story

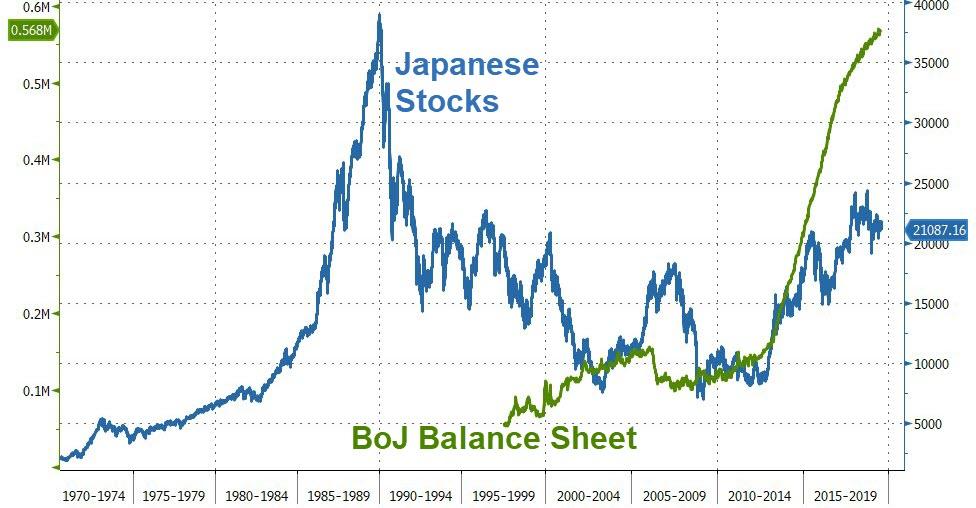

“The Bank of Japan cut interest rates to 0% in 1999 and was first to print money and buy bonds,” he told his children. “Any ghosts in the story?” asked the kids. “Nope, this one’s really boring,” he replied. “Anyhow, in 2001 they started cranking the printing presses,” he said. “Dragons, samurai?” asked the kids. “No dragons, no samurai, shut up and listen or the story ends,” he said. “They bought government and corporate bonds, REITs, stocks. And as government debt swelled to 250% of GDP, the central bank owned roughly half of it.”

“Is it at least funny?” asked the kids. “No. It’s boring,” he repeated, losing patience.

“Anyhow, after 20yrs of zero rates and printing over 100% of GDP, Japan’s stock market is roughly where it peaked in 2000, and 47% below its 1989 high,” he said. “So that’s it. That’s the story,” he said. “That story sucks,” cried the kids. “It does, and because you’re still awake, I’ll tell you another,” he said.

“Europe thought QE worked so it copied Japan, and its stocks remain 38% below their 2000 peak. That’s that story.” But by then, they’d fallen asleep.