by Dismal-Jellyfish

Source: www.cftc.gov/PressRoom/PressReleases/8703-23

Commissioner Caroline D. Pham announced today the 2023-2025 proposed work program for the Commodity Futures Trading Commission’s Global Markets Advisory Committee (GMAC), including the Global Market Structure Subcommittee, the Digital Asset Markets Subcommittee, and the Technical Issues Subcommittee. Commissioner Pham is the sponsor of the GMAC and is seeking input to the proposed work program. The deadline for input is May 30, 2023.

“I am excited to announce the GMAC’s proposed work program, following our expert presentations by GMAC members of the most significant issues in global markets at our inaugural February 13 meeting. This proposal is a key milestone for the GMAC and the result of our global stock-taking exercise over the past year, including public comments and international policy dialogues. The GMAC and its Subcommittees will work over the next two years to recommend pragmatic and actionable solutions,” said Commissioner Pham. “I expect to announce Subcommittee appointments in the coming weeks and look forward to our next GMAC meeting in July.”

The Commission previously established each Subcommittee to provide report(s) and/or recommendations to the GMAC that will identify and examine key issues, and will assess and inform international standards through engagement with international policymakers and authorities in other jurisdictions, with a focus on global market structure, digital asset markets, and technical issues, respectively.

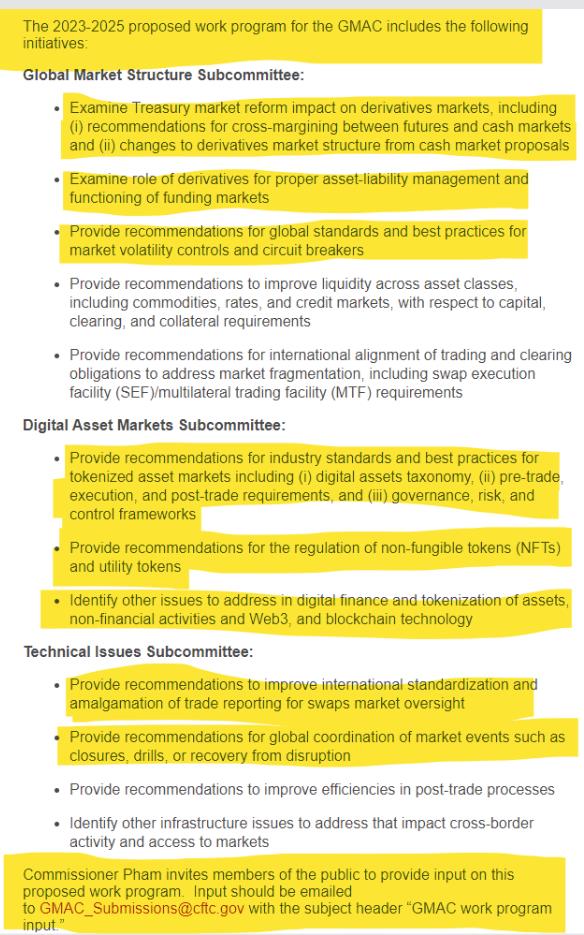

The 2023-2025 proposed work program for the GMAC includes the following initiatives:

Global Market Structure Subcommittee:

- Examine Treasury market reform impact on derivatives markets, including (i) recommendations for cross-margining between futures and cash markets and (ii) changes to derivatives market structure from cash market proposals

- Examine role of derivatives for proper asset-liability management and functioning of funding markets

- Provide recommendations for global standards and best practices for market volatility controls and circuit breakers

- Provide recommendations to improve liquidity across asset classes, including commodities, rates, and credit markets, with respect to capital, clearing, and collateral requirements

- Provide recommendations for international alignment of trading and clearing obligations to address market fragmentation, including swap execution facility (SEF)/multilateral trading facility (MTF) requirements

Digital Asset Markets Subcommittee:

- Provide recommendations for industry standards and best practices for tokenized asset markets including (i) digital assets taxonomy, (ii) pre-trade, execution, and post-trade requirements, and (iii) governance, risk, and control frameworks

- Provide recommendations for the regulation of non-fungible tokens (NFTs) and utility tokens

- Identify other issues to address in digital finance and tokenization of assets, non-financial activities and Web3, and blockchain technology

Technical Issues Subcommittee:

- Provide recommendations to improve international standardization and amalgamation of trade reporting for swaps market oversight

- Provide recommendations for global coordination of market events such as closures, drills, or recovery from disruption

- Provide recommendations to improve efficiencies in post-trade processes

- Identify other infrastructure issues to address that impact cross-border activity and access to markets

Commissioner Pham invites members of the public to provide input on this proposed work program. Input should be emailed to [GMAC_Submissions@cftc.gov](mailto:GMAC_Submissions@cftc.gov) with the subject header “GMAC work program input.”

The GMAC was created to advise the Commission on issues that affect the integrity and competitiveness of U.S. markets and U.S. firms engaged in global business, including the regulatory challenges of a global marketplace that reflects the increasing interconnectedness of markets and the multinational nature of business. The GMAC also makes recommendations regarding international standards for regulating futures, swaps, options, and derivatives markets, as well as intermediaries. Members include financial market infrastructures, market participants, end-users, service providers, and regulators. For more information, visit GMAC. The archived webcast of the GMAC’s February 13, 2023 meeting is available here and the materials are available here.

The GMAC is one of five active Advisory Committees overseen by the CFTC. They were created to provide advice and recommendations to the Commission on a variety of regulatory and market issues that affect the integrity and competitiveness of U.S. markets. These committees facilitate communication between the Commission and market participants, other regulators, and academics. The views, opinions, and information expressed by the Advisory Committees are solely those of the respective Advisory Committee and do not necessarily reflect the views of the Commission, its staff, or the U.S. government.