The Briefing

- In 2020, a handful of companies thrived in the face of the pandemic

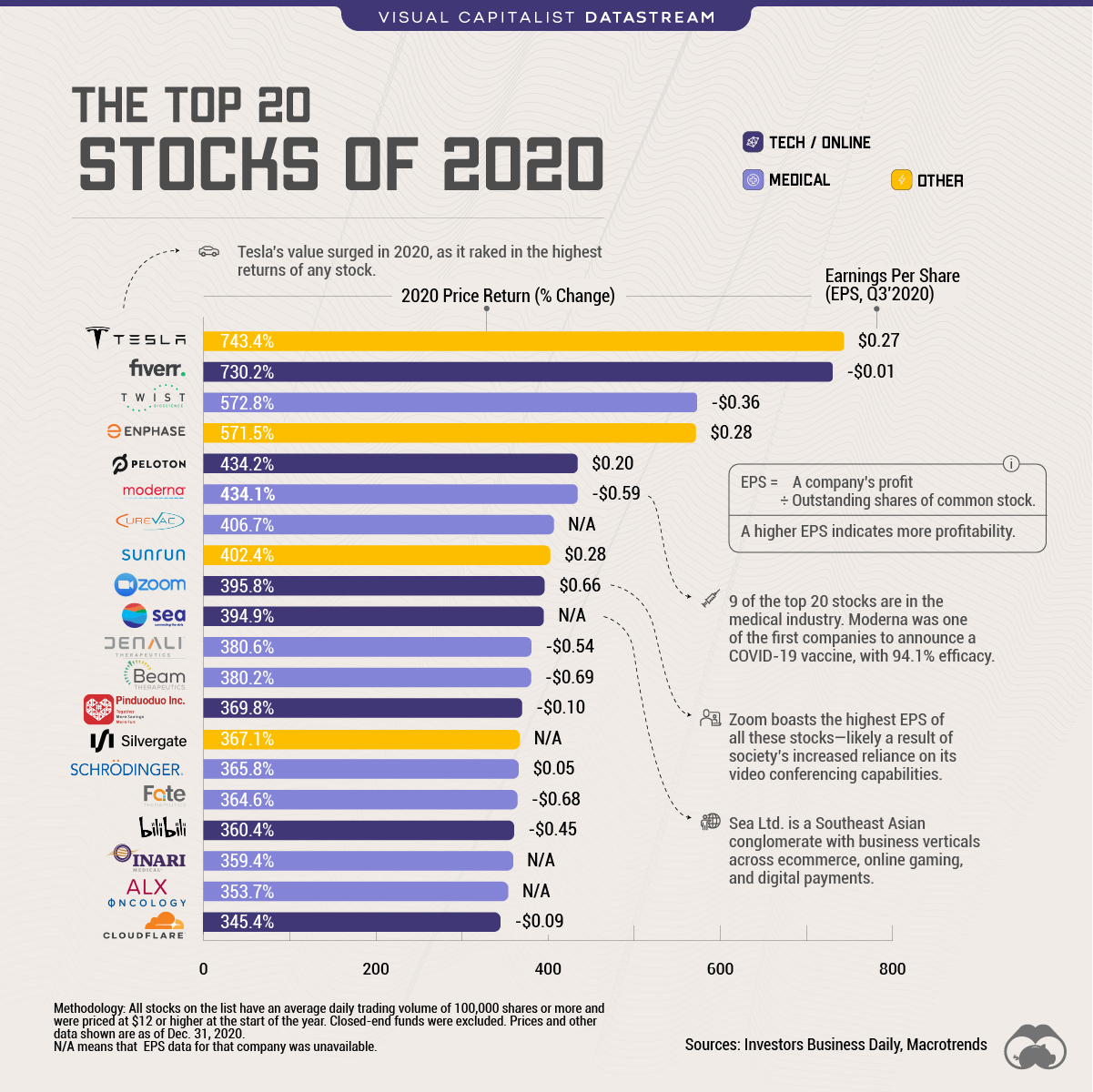

- Medical stocks made up nine of the top 20 stocks, followed by seven in the Tech/Online category

Chart: The 20 Top Stocks of 2020, by Price Return and EPS

In the whirlwind of the pandemic, most businesses experienced chaos. From shuttered physical stores to the rapid rise of online activity, only a select few companies successfully weathered the storm.

We look at the 20 top stocks of 2020 by price return (% change), and earnings per share (EPS), which is an indicator of a company’s profitability.

EPS is calculated by dividing a company’s profit by its outstanding shares of common stock. The higher an EPS value, the more profitable a company is deemed.

A Closer Look at the Leaderboard

Tesla’s value surged in 2020, as it raked in 743.4% in returns—the highest of any stock. In fact, it’s the only automaker to enter this list.

Zoom comes out on top with $0.66 in earnings per share. This is likely a result of society’s increased reliance on its videoconferencing capabilities, a trend that became clear quite early on last year.

Notable Stocks by Category

If we look at the overall categories, the medical industry pulled in nine of the top 20 stocks in 2020. As the world scrambled to develop an immunization against COVID-19, Moderna was one of the first companies to get there, announcing a vaccine with 94.1% efficacy. As a result, the company showed an impressive 434% in returns.

The Tech/Online category came in second, although slightly more diversification is found here, ranging from software to retail and leisure:

- In the growing global gig economy, Fiverr’s platform connects freelancers with those in need of their services.

- Peloton is tapping into the lucrative home fitness market, particularly with people now spending more time at home.

- Sea Ltd. is a Southeast Asian conglomerate with business verticals across ecommerce, online gaming, and digital payments.

One final interesting observation is that of the stocks in the Other category, two of them deal in the business of solar energy, exhibiting high returns and similar EPS values, likely from a global shift towards cleaner energy sources.

Where does this data come from?

Source: 2020 Price Return (% Change) values are from Investors Business Daily

EPS values come from Macrotrends, the latest data reported by all companies is from Q3’2020.

Methodology: All stocks on the list have an average daily trading volume of 100,000 shares or more and were priced at $12 or higher at the start of the year. Closed-end funds were excluded. Prices and other data shown are as of Dec. 31, 2020. N/A means that EPS data for that company was unavailable.