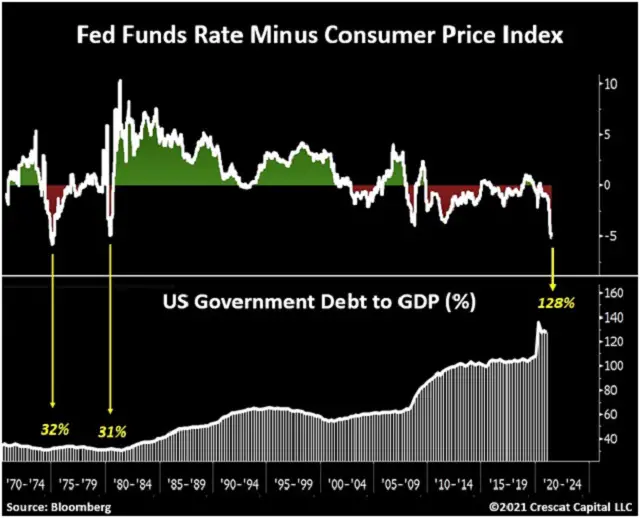

Short-term interest rates are now as negative as they were in the inflationary 1970s.

But that’s where the similarity ends. As the above chart shows, 1970s indebtedness was relatively modest as a percentage of GDP, which gave that financial system the resiliency to withstand the double-digit interest rates necessary to throttle inflation and bring things back into balance. Today, debt in both nominal terms and as a percent of GDP is off the charts, which means even modestly higher interest rates would bankrupt the world.

So what tools does that leave for today’s would-be monetary maestros? None whatsoever. And when it becomes clear that our financial mess will have to be resolved via market forces rather than government manipulation, things might go, um, non-linear.

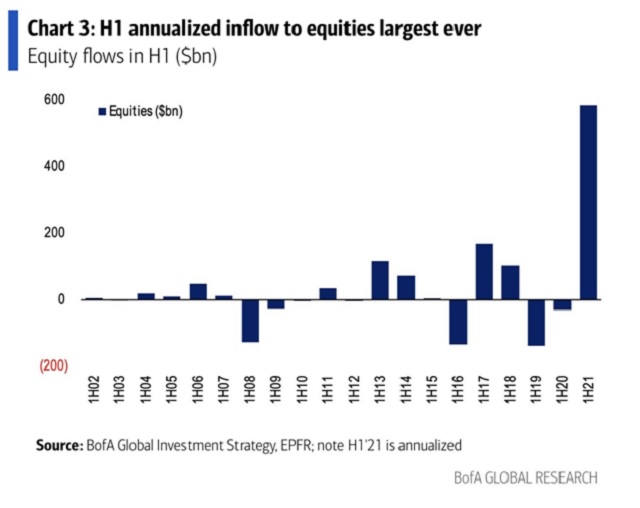

In spite of the above (or maybe because of it, who knows?) capital has been pouring into equities, one of the highest-risk asset classes on the traditional investment spectrum. As an example of how crazy things have become, Larry Fink, CEO of giant investment company BlackRock, now recommends that would-be retirees allocate 100% of their nest eggs to equities.

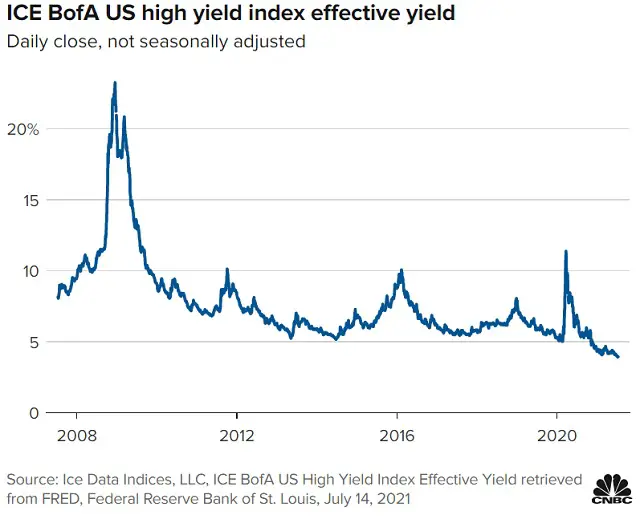

Meanwhile, junk bonds — nearly as volatile as equities — are on fire, now yielding the least ever (which is to say trading at record high valuations):

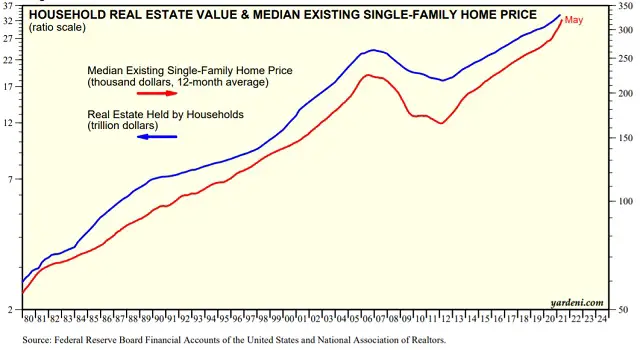

And of course houses — volatile and cyclical assets because they’re generally financed — are now more expensive than at the peak of the previous decade’s real estate bubble:

Combine negative interest rates, massive debt, and an investment community that’s wildly over-attached to risky assets, and the only reasonable expectation is chaos. In other words, lots more days like today: