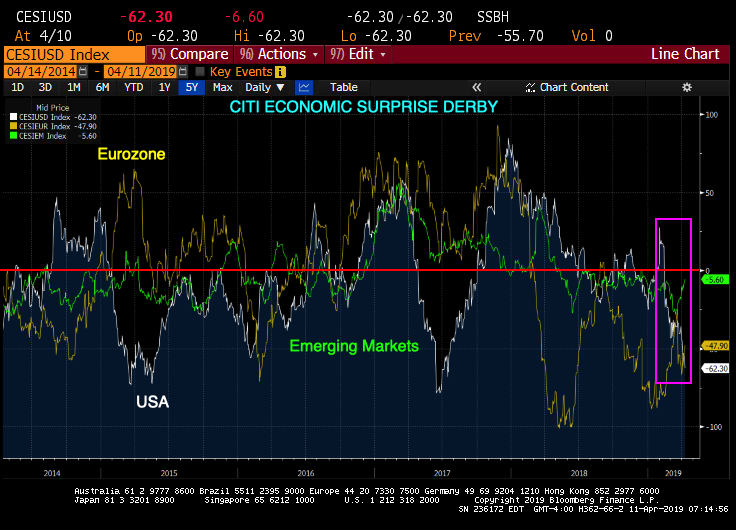

The Citi Economic Surprise Indices measure data surprises relative to market expectations. A positive reading means that data releases have been stronger than expected and a negative reading means that data releases have been worse than expected.

Unfortunately for the USA, it has a negative economic surprise measure, followed closely by the Eurozone (also negative). The “leader” in the Economic Surprise Derby is … Emerging Markets. ALSO negative.

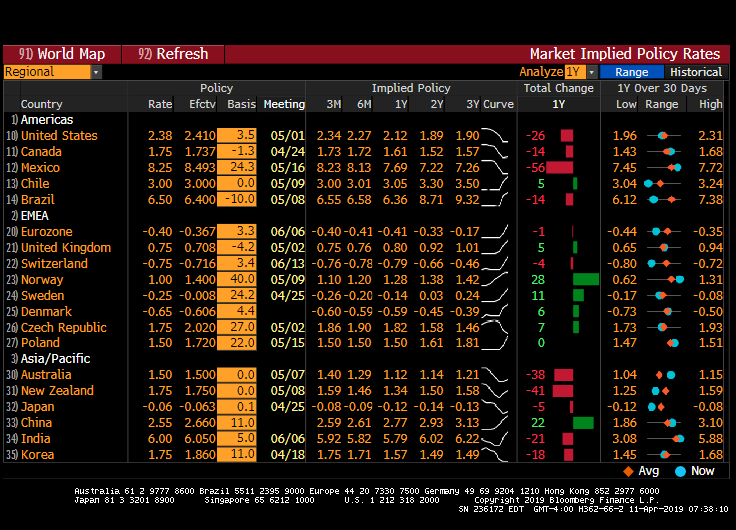

As a sign of meh economic growth, market implied policy rates are 2.38% for the USA, -0.40% for the Eurozone and -0.06% for Japan.

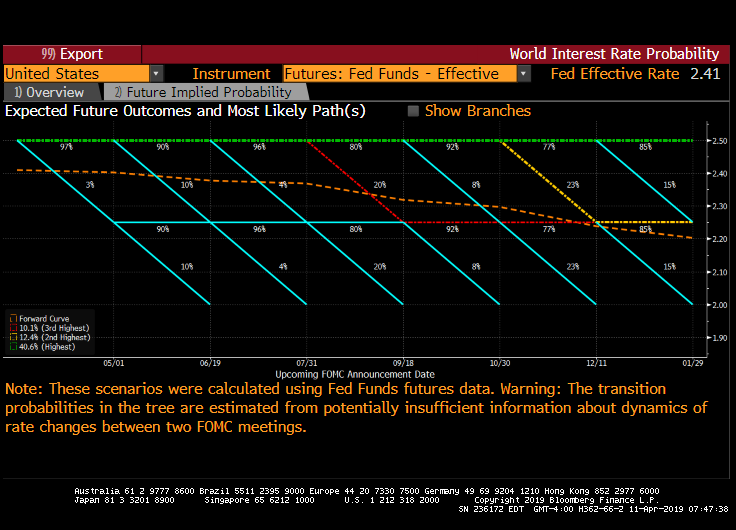

The expected Fed Funds target rates are trending downwards.

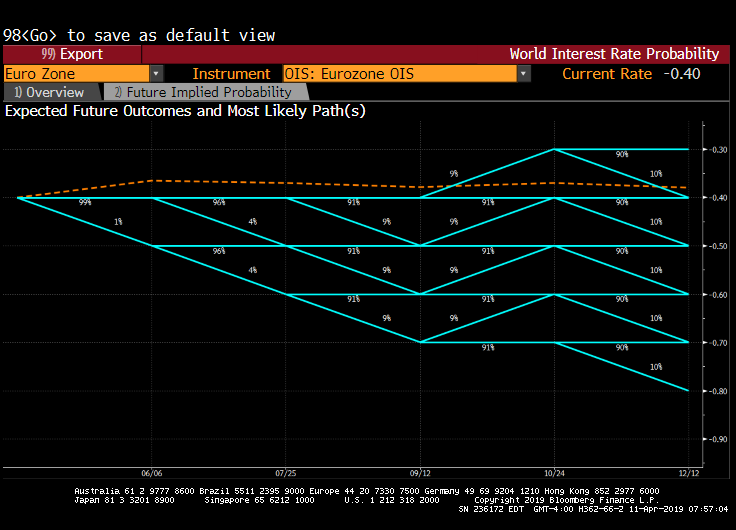

Eurozone expected target rates are negative.

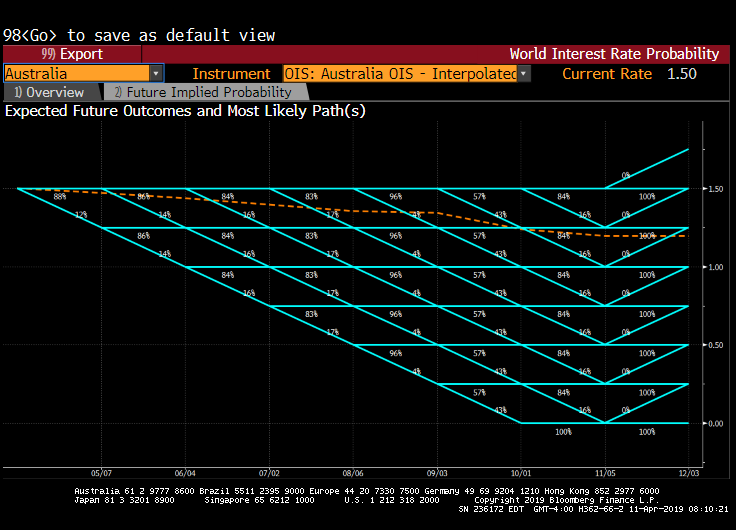

Even Australia is downward trending. Like an overcooked shrimp on the barby.

True, the lofty expectations for the US economy are not being met.