via Zerohedge:

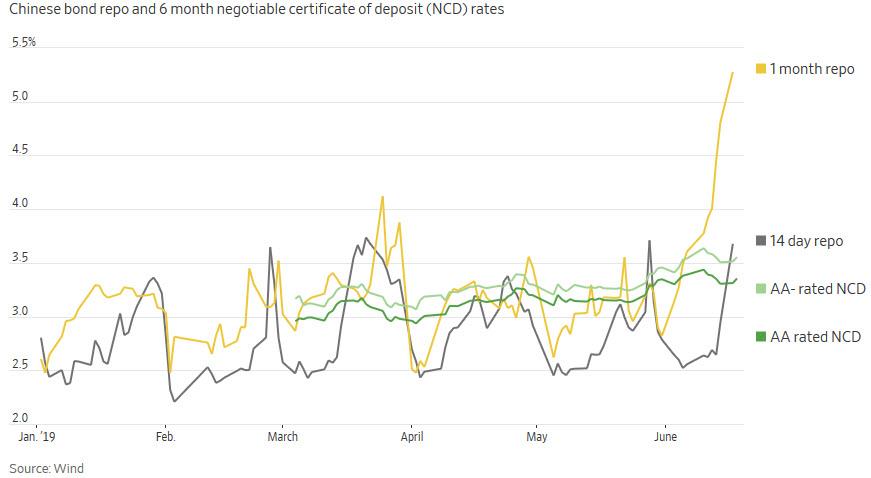

It’s probably not a coincidence that just days after we reported that China’s interbank market was freezing up in the aftermath of the Baoshang Bank collapse and subsequent seizure, which led to a surge in interbank repo rates and a spike in Negotiable Certificates of Deposit (NCD) rates…

… that Beijing is doing everything in its power to keep liquidity flowing within the world’s largest, ~$40 trillion, financial system.

Case in point: China’s overnight SHIBOR lending rate tumbled overnight, sliding from 1.253%, and 1.924% a week ago, to just 1.11% today. This, as Commodore Research points out, marks the lowest level seen since June 12, 2015.

In fact, the only other time this decade that SHIBOR rates fell to such a low level was back in 2015 (which was a period when China was likely undergoing a recession). Prior to 2015, the previous time that SHIBOR rates fell to 1.11% (or lower) was during the global financial crisis in 2008/2009.

As Commodore further notes, “there recently has remained talk of liquidity problems and banking fears in China (and these concerns have only grown since the Baoshang Bank failure in May). Low SHIBOR lending rates are supportive and accommodative in nature — but rates sitting at rare multi-year lows are likely an indication that China is facing significant banking stress at the moment.”

The report’s conclusion: “It is very rare for the overnight SHIBOR lending rate to be set as low as 1.11%.”

Meanwhile, as the world’s biggest financial time bomb ticks ever louder, traders and analysts are blissfully oblivious, focusing instead on central banks admitting that the recession is imminent and trying to spin how a world war with Iran would be bullish for stocks.