Problems in China are looming on top of an already very tenuous and misunderstood situation in the US Financial Markets. Additionally, Federal Reserve Policy has made the situation even more combustible!

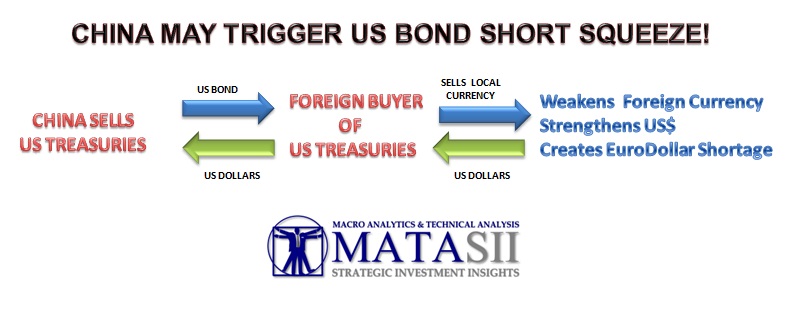

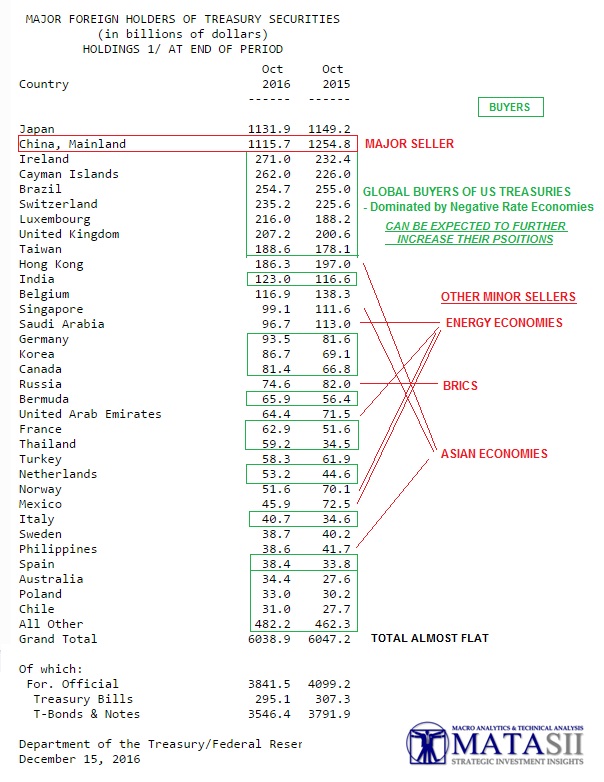

As a result of a Trump Victory inspired bond market massacre there are now few places that a yield starved world can presently find better risk-adjusted yields than in US Treasuries. With China now being forced to sell their FX Reserves and thereby creating the much needed supply so eagerly craved by foreign investors, it is also further depleting an already restricted EuroDollar pool required to buy this supply. There are consequences of this combination of shifting global parameters.

The Obama administration had been quite successful in orchestrating and limiting Treasury supply, thereby assisting the Fed in driving yields lower! That is all potentially about to rapidly change. In fact, the match may have already been lit!

AN EXTREMELY TENUOUS SITUATION

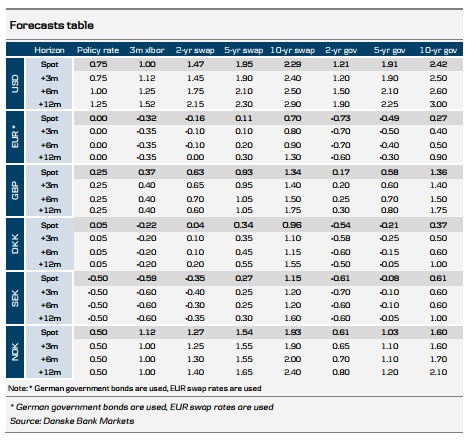

Though US Bond Yields are likely to head higher later in the year as Trumponomics unfolds, there are some serious and unexpected imbalances to be corrected in the near term.

The imbalances have all the ingredients for a short squeeze which triggers a classic “rotation”.

PRESENTLY BEING MADE MUCH WORSE BY FED POLICY!

IN A NIRP WORLD (~$12T)

THE RISK-ADJUSTED, DOLLAR DENOMINATED US TREASURY HAS SUDDENLY BECOME THE HOLY GRAIL!

MEANWHILE MONEY IS FLEEING CHINA ANYWAY IT CAN – DESPITE FUTILE CAPITAL CONTROL ATTEMPTS.

CHINA IS TRAPPED AND IS NOW BEING FORCED TO SELL US FX RESERVES

Reserve requirements are lowered alongside falling FX reserves. These are coordinated in order to mitigate negative effects from changes in the domestic money supply.

CHINA’S MERCANTILE, EXPORT LEAD STRATEGY MAY HAVE NO OTHER WAY OUT IN THE NEAR TERM!

You may want to read a more technical analysis we recently published entitled: A BROKEN BOND BOUNCE BECKONS!