*CHINA URGES EVERGRANDE FOUNDER TO PAY DEBT WITH PERSONAL WEALTH

All $300BN of it?

— zerohedge (@zerohedge) October 26, 2021

Global financial crash warning: China fears debt default after poor firm management

With China’s Evergrande company facing economic turmoil, Beijing has now admitted some firms have been poorly managed. Despite attempting to allay fears over the financial state of the country, and therefore the world economy, a statement admitted concern over defaults on debt repayments. In an article published by the state-backed Xinhua Agency, a comment piece revealed property companies were facing the risk of defaulting on payments.

While not naming Evergrande, it read: “It should be understood that there will be clues if a property is likely to default on its debts, so the risk of spillover to the financial industry can be predicted.”

It added that property companies were facing debt default issues due to poor management and a failure to adjust their operations to market changes.

Evergrande is one of the largest companies in the world and second-largest real estate company in China but is facing the possibility of failing to repay its vast debt.

Indeed, it owes $300billion (£221billion) in debt repayments, which accounts for two percent of China’s GDP.

Before all the jokes came in, there are indeed quite some Evergrande's debts have his personal guarantee on it, this is actually quite reasonable https://t.co/wpuickRMRz

— yiktin (@timdayipper) October 26, 2021

Blow to China’s $82 trillion property industry could impact Australia

The property developer China Evergrande is like a burning plane waiting to crash, but its not the only issue in the country that could impact on Australia.

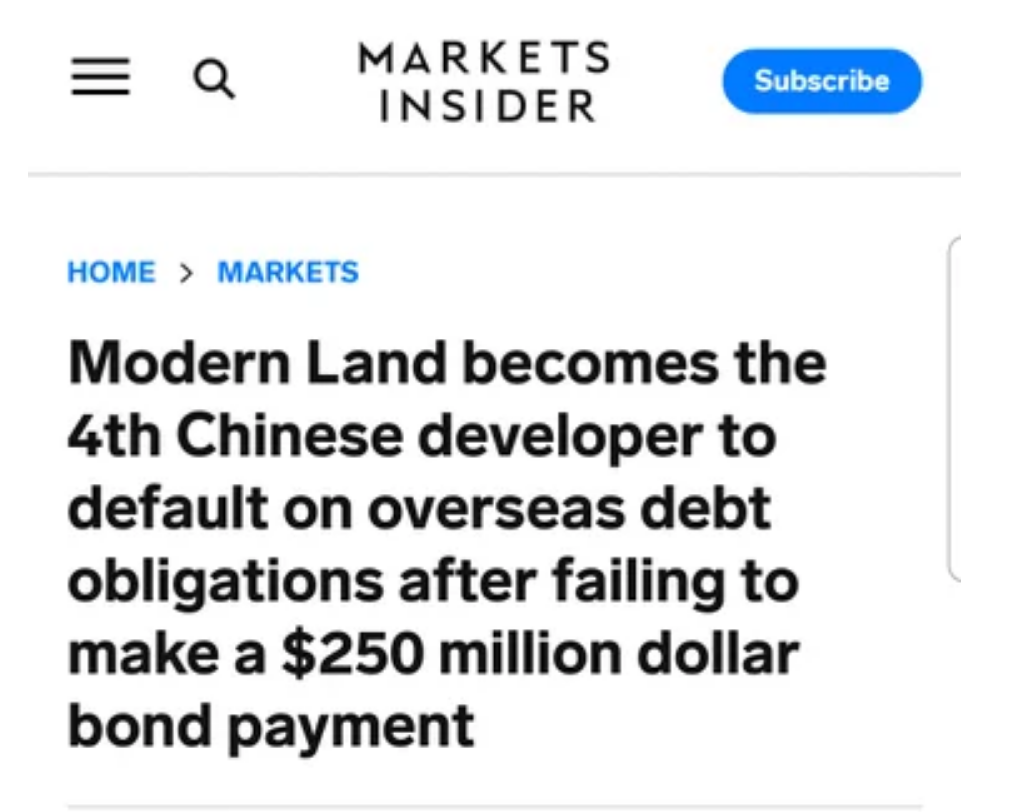

Another Chinese property developer defaults, shares drop

China Urges Evergrande Founder to Pay Debt With Personal Wealth

Directive came after missed coupon payment deadline last month

Hui’s $7.8 billion net worth based on company stake, dividends

h/t Doorbert Returns