The market is a sea of red this morning.

The issue at hand is China’s massive Evergrande property developer. The company is effectively insolvent, with over $300 billion in bad loans. Many are calling this “China’s Lehman Moment.”

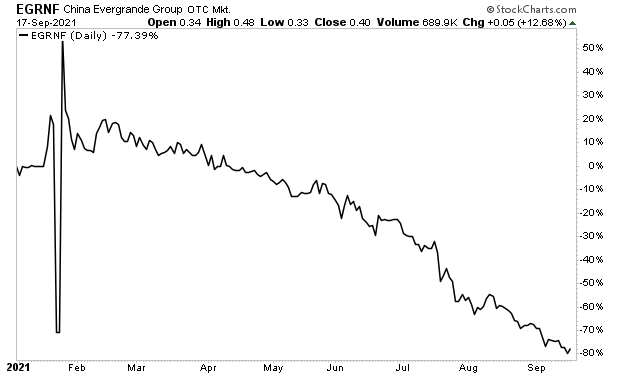

The company’s stock is down 80% Year to Date.

How serious is this?

Serious.

Real estate comprises nearly 8% of China’s economy. Construction is another ~8%. So, all in all, you’re looking at 16% of the second largest economy in the world experiencing the bankruptcy of one of its largest players. This has significant implications for everything from commodities (use in construction) to finance (the loans used to build the buildings and finance the mortgages for consumers).

And in these types of situations, there is never just one player at risk.

Contagion has already begun. Hong Kong property developers and Chinese industrial producers are getting hit. And if you think this will be confined to China you are mistaken.

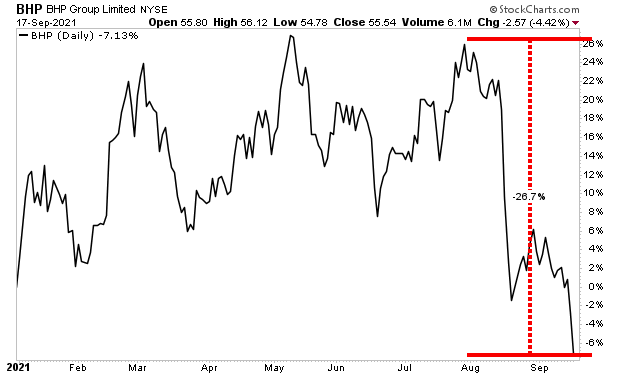

Australia supplies much of the commodities China uses for its construction. It is not coincidence that BHP Group (BHP) and other major Australian miners are nosediving, crashing 26% in the last few weeks.

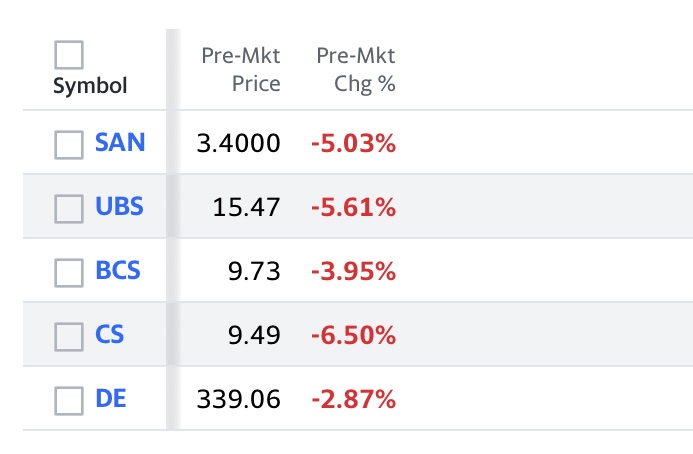

And then there’s European banks, which have massive exposure to China. By the look of the bloodbath this morning, things are spreading to there as well.

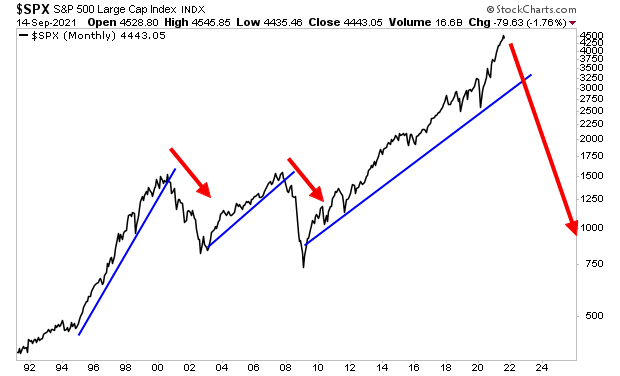

This is the problem with an Everything Bubble: you never know where the black swan is going to come from.

With the financial system in the single largest bubble of all time, and leveraged to the hilt by easy debt courtesy of Central Bank policies, even a single spark can set the whole thing to blow.

As I warned a few weeks ago, this whole mess will come crashing down one day. In market terms, this is going to happen, it’s just a matter of time.

The question of course is “when”?

To figure that out, I rely on certain key signals that flash before every market crash.

I detail them, along with what they’re currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

https://phoenixcapitalmarketing.com/predictcrash.html

Best Regards