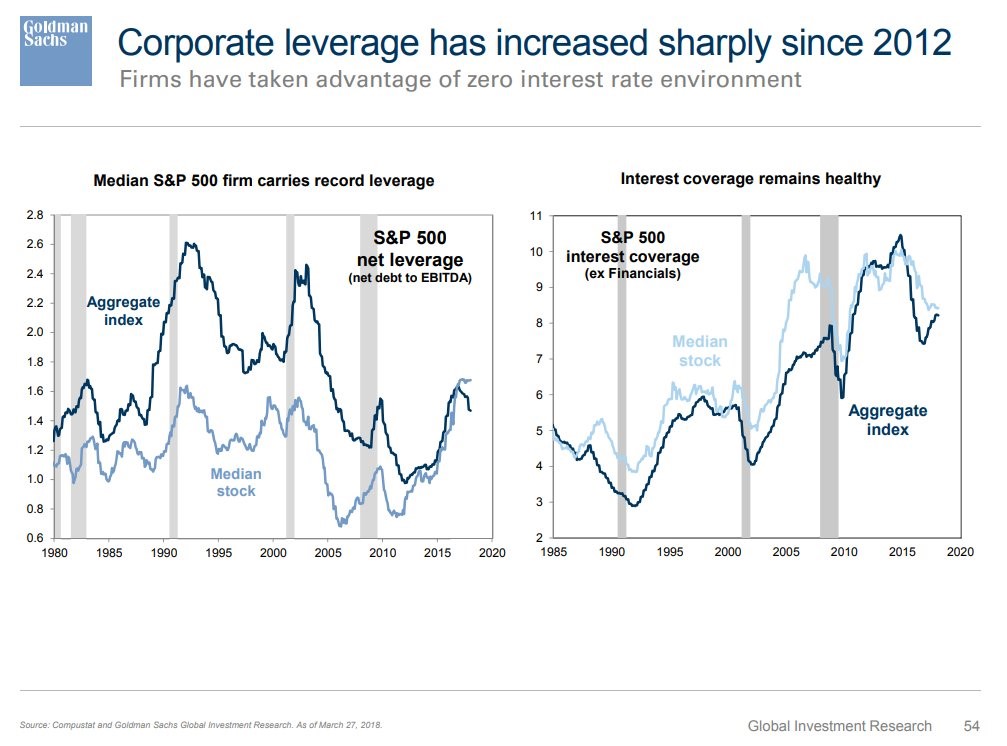

Firms are taking advantage of the low interest rates and 9 years of expansion. An elongate business cycle is a situation where being cautious hurts. If a firm decided to take less risk a few years ago because management thought a recession was coming, the firm would have missed out on many opportunities to grow its business.

The chart on the right shows the interest coverage ratio of aggregate firms and median firms. Both are very healthy because interest rates are low. If interest rates were to increase, there would be a problem as the debt would need to be re-issued at higher rates after it expired. The interest coverage ratio would sink quickly.

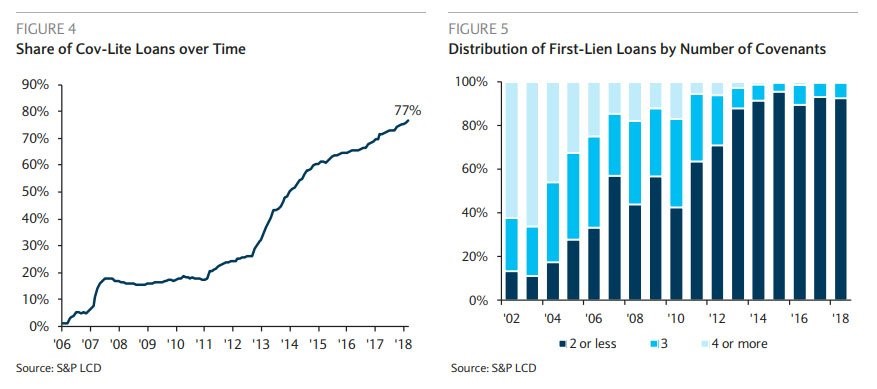

Covenant Lite Loans Could Be A Big Problem

The riskiest part of the debt market is covenant lite loans. The chart on the left shows 77% of the leveraged loan market is made up of covenant lite loans.