As of the end of the first quarter of 2019, nonfinancial corporate debt was nearly $10 trillion, which is almost 47% of GDP, the highest it has been since data has been available.

…

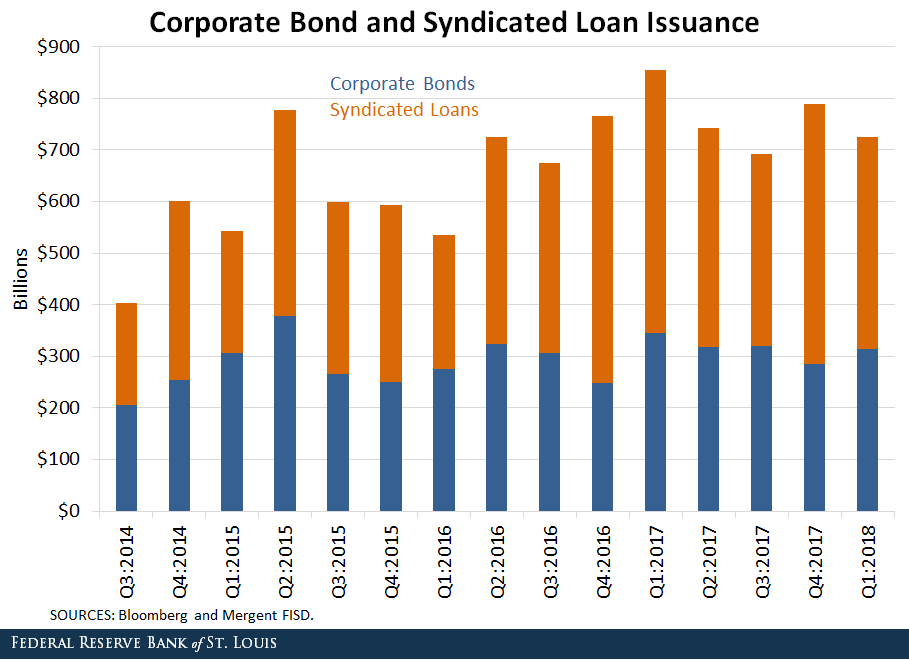

The figure above shows total corporate bond and syndicated loan issuance since 2014. Total debt issuance via these two types of instruments has been rising, and syndicated loan issuance accounts for over a little more than half of total issuance (57% of issuance as of the first quarter of 2018).

Debt Quality

Syndicated Loans

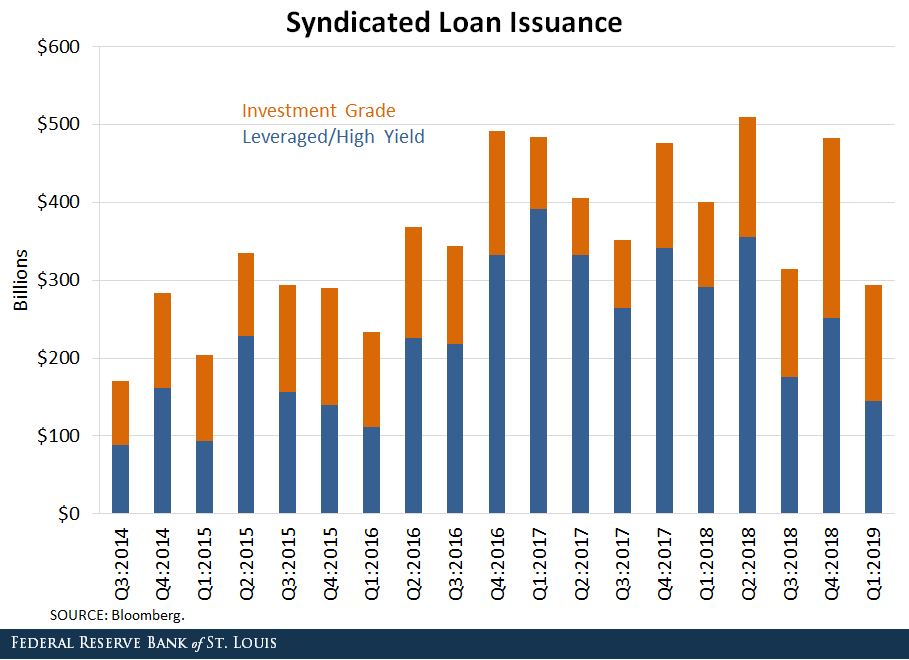

What about the quality of this debt? Is it riskier than usual? To analyze this, we broke down syndicated loan issuance between leveraged (or high-yield) loans and investment-grade loans:

- Leveraged loans are typically considered riskier by ratings agencies, since these are loans extended to firms with already high levels of debt or poor credit histories.

- Investment-grade loans are loans made to firms with good credit ratings, and these loans present a relatively low risk of default.

We observe from the graph below that the syndicated loans issued are mostly of the leveraged variety. In 2018, 63% of the syndicated loans issued were leveraged.

Corporate Bonds

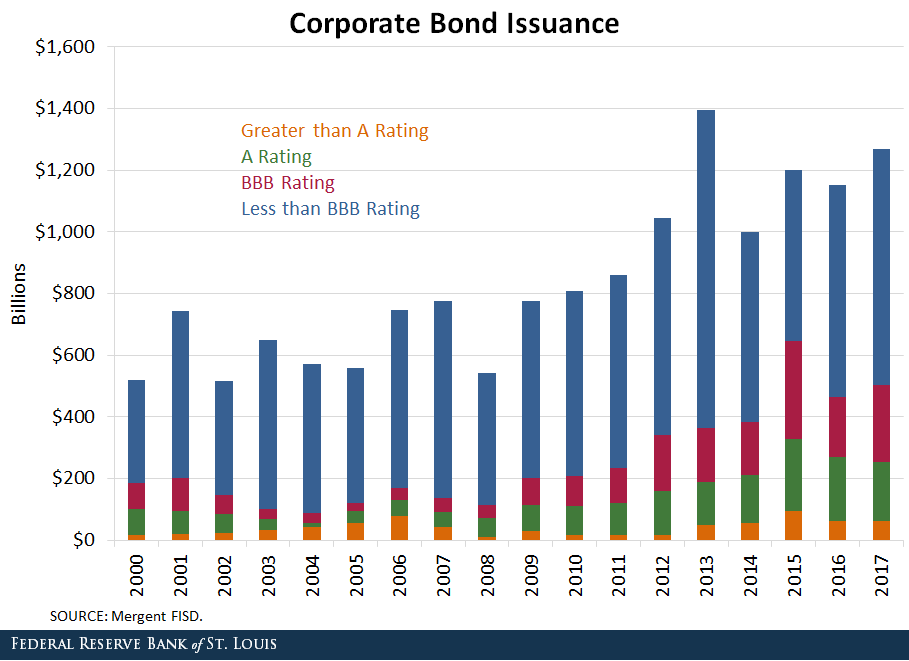

We observed a similar trend for corporate bonds as well, with high-yield bonds making up nearly 60% of total bonds issued in 2017. This can be seen in the figure below. Bonds with ratings of BBB or higher (that is, AAA, AA, A and BBB) are generally considered relatively safe. Bonds with ratings below BBB (BB, B, CCC, etc.) are considered low credit quality and riskier than investment-grade bonds.

While there is no consensus among economists on the degree to which corporate borrowing can affect the economy, it is worth noting that a large proportion of loans have recently been extended to firms with relatively high probabilities of default.

Notes and References

1 See the Financial Accounts of the United States from the Federal Reserve Board of Governors.

2 See, for example, Powell, Jerome. “Business Debt and Our Dynamic Financial System.” Speech at the 24th Annual Financial Markets Conference, Federal Reserve Bank of Atlanta, May 20, 2019.

Additional Resources

- On the Economy: What Types of Financial Assets Do People Hold?

- On the Economy: Does Age Matter for Your Portfolio Mix?

- On the Economy: Domestic Debt Before and After the Great Recession

https://www.stlouisfed.org/on-the-economy/2019/august/corporate-debt-great-recession

Investor aversion to riskiest US corporate debt nudges yields higher

https://www.ft.com/content/5f5d6006-bf7d-11e9-89e2-41e555e96722

The growing threat of a corporate bond market meltdown.

https://latest.13d.com/threat-corporate-bond-market-meltdown-investors-debt-38a346a01d12

Corporate debt & the next crisis in India

Credit Suisse revealed that about 40% of India’s corporate debts are with firms that are unable to even earn enough to pay the interest costs.

As a result, such sums of money that these firms are unable to repay ought to be written off by the banks and declared as NPAs. The Credit Suisse report further says that out of the $ 530 billion total debt, almost two-thirds of it is with firms that have not covered interest payments for at least 11 of the past 12 quarters. About 30% of the total debt is with firms that have reported losses.

http://www.cadtm.org/Corporate-debt-the-catalyst-for-the-next-crisis-in-India

USA is in a similar situation!

16% of US companies are zombies.

12% of all companies globally are now “zombie firms,” meaning that they can barely pay the interest on their debts, according to the Bank of International Settlements. 16% of US companies are zombies.

In the early 1990s, the zombie rate was just 2%.

In debt we trust: Federal Deficit Hit Record Highs, $3.7 Trillion

AC