via David Yong

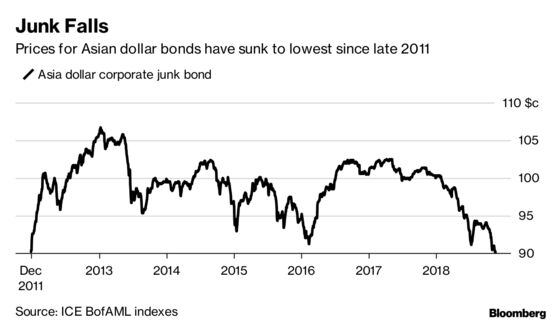

(Bloomberg) — Signs of credit stress globally are increasing. In Asia, prices for the region’s riskiest debt slid to the lowest level in almost seven years, and the cost to protect against default climbed amid a sell-off in global markets.

The average price for junk-rated corporate notes fell to 90 cents on the dollar on Nov. 20, a level not seen since December 2011, according to an ICE BofAML index. Investors demand 730 basis points over Treasuries to own the debt, putting the risk premium at the highest since the first quarter of 2016, the data show.

Tightening by the Federal Reserve, geopolitical risks, and China deleveraging have all weighed on risk assets in Asia, according to Neeraj Seth, head of Asian credit at BlackRock Inc. “2018 so far has been a tough year, it has been a tough year across all of the risk assets.”

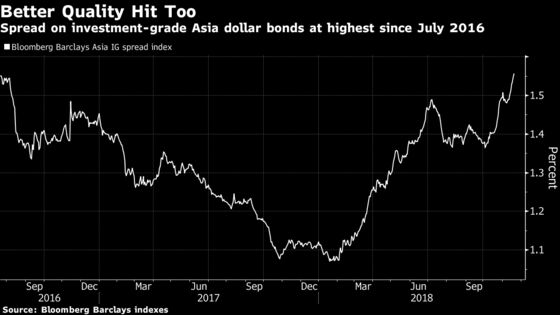

The stress hasn’t spared top-notch companies, with yield premiums on investment-grade Asian dollar bonds at their highest since 2016.

Credit-default swaps are also moving wider, raising hedging costs. The insurance to protect investment-grade sovereign and corporate debt in the Asia ex-Japan region is set to rise a basis point to about 100, according to traders, which would be the ninth day of increases. The CDS jumped about 5 basis points on Tuesday, the biggest surge in two months, according to CMA data.

The Federal Reserve has been raising its key interest rate since late 2015, while emerging-market currencies have lost almost 7 percent against the greenback since April. In China, defaults among companies in the onshore market are at record.