by Denali Guide

PICK THE TWO(2) DECISIVE EVENTS

FOR THIS WEEKS PRICE ACTION

-

-

- BLACK SWAN ATTACKED SAUDI OIL PLANT;

- OVERNITE INTEREST BETWEEN BANKS SOARS TO 10%;

- JUSTIN TRUDEAU APPEARS IN “BROWN-FACE”;

- RUSSIA PREDICTS OIL PRICES FALL TO $25 NEXT YEAR;

- US NAVY CONFIRMS “UFO”s ARE IN FACT, REAL;

- FED LENDS $100 BILLION TO BANKS THIS WEEK TO COVER LOSSES.

- BRENT CRUDE OIL SPIKES TO $70 A BBL, SETTLES AT $60

- SAUDI ARABIA SAYS ALL DAMAGE TO OIL PLANT REPAIRED

-

Which two (2) events, in your mind, had the greatest effect on price action in the markets this week?

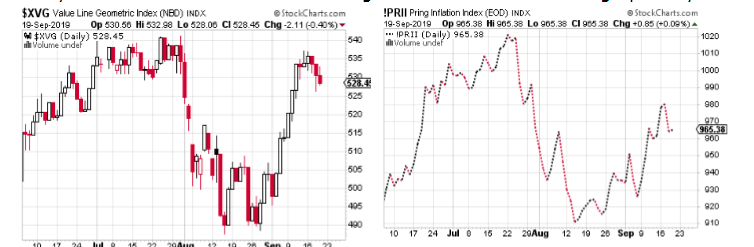

To my mind, not anything on this list had any more than a 24 hiccup effect on any of the markets out there. Nothing. These two charts show graphically.

Now if all this is true, why is the Inflation Index lying to us in the open ?

Because the inflation index, knows The Truth as to what happens on its turf.

Except for items # 2 and #3, there is little we can do to verify any of this.

Even the best due diligence investigation we can do, cannot produce any real evidence of any of this, except by what we are told by “Official Sources”.

Thus, like John Snow of “Game of Thrones” fame, we “know nothing.”

I don’t need to boggle you with packs of charts. Evident, is that someone knew something. We know it was known to “them” in the month of August. Who “they” were cannot be verified, but chances are its the “usual suspects”.

Rather than the laundry list of our most recent bad actors, lets look at WHAT happened that we can verify, and “cui bono?”, Latin for “who benefits?”

In the chart of XVG, we see prices languish during August, only to sprint in September to a level yet below their hights in July. XVG is the “average share” of stock in Value Line’s Index, so the changes would appear in most every stock out there. OK, that is a fun fact, so what? It means to me, that “they” or someone, knew by end of August that a rally was imminent. Now with oil prices declining to $25 a bbl, by the end of next year, it would mean that many oil producers and Saudi Arabia, in reality, would be bankrupt. Now if a huge player, a “whale” as they are named, bet that, it could make or lose a lot of money. The “whale” bet lost, as evidenced by the FED having to pump $100 Billion into the market for overnite bank lending. Banks would not or could not lend that $100 Billion to keep the “whale” afloat, so the Fed had to step in or watch the whole lending system lock up as it did in 2008.

So what ? Well the current situation, due to all the money pumping that occurred from 2008 to now, means that we are now exponentially far above the place from where the economy and markets fell in 2008 – 2011, and with far less support. Given a scientific wild guess on the subject, I would we are one hundred (100) or more times pumped up than where we were in 2008. A simple reading of Zombie companies (those who would be insolvent without constant borrowing),

I think would support that supposition. So what ? Well what happens when the lending stops? Something breaks in the financial system with a loud snap as it did this week, and the Fed has to step up and throw bundles of funny money at it, to try to stem the bleeding in the wound. Why is that a problem? Because, friends, someone is not a believer or beleaguered to the extent they must act in a contrary fashion to protect themselves and cause the financial system to start bleeding from a new wound. This is a self-replicating cycle, and each wound becomes larger than the previous, and creates consequences many times that of the wound. You see where this ends? I do! The safest thing to do is to buy things of known value, mostly likely with physical value and assets, that cannot be expropriated by others, man, nor beast, nor government. I leave the selection to you, and invite you to subscribe to the DGS Letter to learn more. Good Luck!!