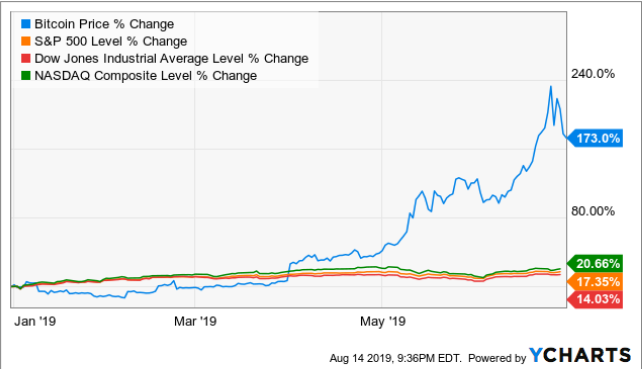

The volatility of the cryptocurrency market is legendary. In 2018, cryptocurrencies suffered a bear market that saw the price of Bitcoin crashing from around $19,000 to about $3,500 by the end of the year. The cryptocurrency market is off to an interesting start in 2019, Bitcoin gained about 173% in the first half of the year and the market cap of the entire cryptocurrency market rose by 172.22% within the same period.

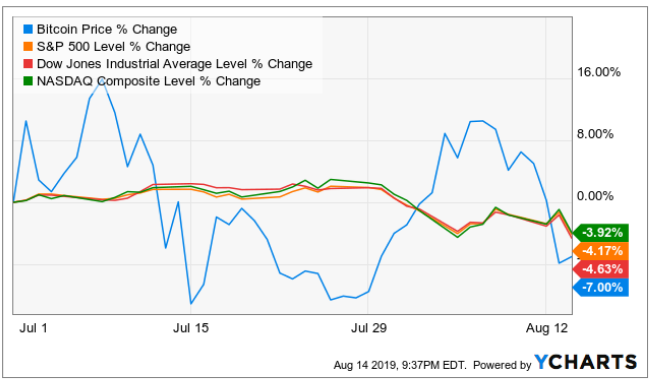

It is very easy to be a cryptocurrency trader during a bull market when almost all the coins are in an uptrend. Anybody can become an expert in using the “buy low, sell high” strategy. However, many traders and investors are often at a loss of what to do when the market stagnates or when the market gets into a downturn.

Cryptocurrency derivatives are gradually gaining prominence among cryptocurrency traders as a means to take advantage of market volatility to make profitable trades irrespective of whether the market is trading up or down. This piece provides a comprehensive guide to help you get started trading cryptocurrency derivatives.

What Are Crypto Derivatives?

Cryptocurrency derivatives are trading instruments layered on cryptocurrency assets to provide traders with an exponential simulation of the cryptocurrency market without requiring them to buy, own, or hold the actual crypto assets. Cryptocurrency derivatives are not cryptocurrencies, but their performance is correlated with the performance of their underlying cryptocurrency.

Understanding the Basics of Derivatives

The basic building blocks of derivatives trading are the concepts of “Longs” and “Shorts”.

A Long trade is premised on the assumption that the price of an underlying cryptocurrency asset will increase in the future. Hence, a Long derivative trade purchases contracts or options that give the holder the right (and, or obligation) to profit from the upswing.

Conversely, a short trade is premised on the assumption that the price of an underlying cryptocurrency asset will decrease in the future. Hence, a short derivative trade (shorting the coin) purchases contracts or options that give the holder the right (and, or the obligation) to profit from the downtrend.

How To Start Trading Cryptocurrency Derivatives

Open a crypto derivatives trading account

The first step for getting started with cryptocurrency derivatives is to open a trading account. Some traditional cryptocurrency exchanges such as Binance and OKEx have margin trading accounts that provide some semblance of derivatives trading. However, you’ll be better off opening an account with a platform designed exclusively for trading cryptocurrency derivatives.

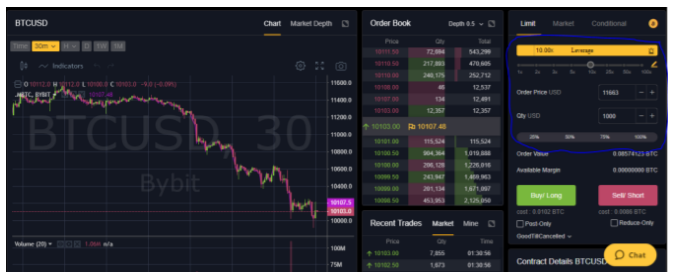

ByBit, Bitmex or Deribit are three of the most popular exchanges built exclusively for trading cryptocurrency derivatives. Bybit’s account opening process is incredibly fast and it can be completed under 30 seconds since it only requires you to enter your email, chose a password, and confirm the email address. The best part is that Bybit has a welcome bonus policy to help new users to try the platform with no risk for the first time with up to $60 real money.

Bitmex’s account opening process is also short and it doesn’t require any personal information beyond asking for your email and password creation. Deribit’s account opening process is also short but requires more personal information than both Bybit and Bitmex.

The general assumption is that you’ll already have experience trading cryptocurrencies before you start thinking about trading crypto derivatives. ByBit’s Testnet (screenshot below) provides traders with demo trading accounts to practice derivatives trading with real-time market data. Other trading platforms such as Bitmex and Deribit also provide demo trading Testnets where you can understudy the market without risking your actual funds.

Choosing your preferred derivatives

When trading cryptocurrency derivatives, you’ll essentially be trading one (or a combination) of Futures, Options, or Swaps.

Crypto Futures is an obligatory agreement between two counterparties to buy or sell an underlying cryptocurrency at a predefined price on a specified future date. One party takes a Long position and the counterparty takes a Short position. When the specified future date arrives, the counterparties must buy and sell the cryptocurrency at the predefined price irrespective of whether the actual price of the cryptocurrency has increased or decreased over the waiting period.

Crypto Futures are furthermore divided into Regular Future and Perpetual Futures. Unlike the Regular Crypto Futures, Perpetual Futures do not have an expiration date. Rather; these contracts charge an interest rate that is factored as the difference between the spot price of the underlying cryptocurrency and the price of the futures contract. Perpetual contracts were developed as a solution to the challenges faced when the price of futures contracts converge towards the index price.

Crypto Options is a contractual instrument that gives the holders the right but not the obligation to buy (call) or sell (put) an underlying cryptocurrency as a predefined price on a specified future date. When the specified future date arrives, the trader holding the Call Options has the right (but not the obligation) to execute the contract to buy the underlying cryptocurrency at the pre-agreed price. Conversely, the trader holding the Put Options has the right (but not the obligation) to execute the contract to sell the underlying cryptocurrency at the pre-agreed price.

A trader will typically buy call options when they expect the price of a cryptocurrency to increase so that they can execute the contract and buy the target cryptocurrency at a significantly lower price than the prevailing market price at the point of execution. Trades tend to buy put options when they expect the price of the underlying cryptocurrency to fall; they can then execute the contract to sell the target cryptocurrency at a significantly higher price than the prevailing market price.

Understanding technical and fundamental analysis

The next step is to take some time to understand the core components of technical analysis (and maybe some fundamental analysis). Your understanding of technical analysis will naturally lead you to decide on going long on or shorting the market. Technical analysis might look dauntingly mysterious with its polysyllabic terms and tiny squiggly lines; however, it can be logically understood.

The first underlying assumption of technical analysis is that the market discounts everything. The second assumption is that price moves in cryptocurrency is often part of a trend and seldom in isolation. The third assumption is that history tends to repeat itself.

Beginner traders will do well to take the time to study the uses of technical indicators such as Stochastic RSI, Moving Averages, and Support & Resistance Trendlines. Also, you’ll need to know the technical indicators for identifying when a coin is Oversold, which means that it’s trading significantly below its intrinsic value. Conversely, you should be able to spot when a coin in Overbought, which means that it is trading above its intrinsic value.

Determine Your Risk Appetite

Cryptocurrency derivatives could be used as risk management solutions for people trading or investing in cryptocurrencies. However, if you are trading crypto derivatives for profit as opposed to being a hedge; then it is expedient that you incorporate risk management strategies into your trading.

Many crypto derivatives platforms such as ByBit (see screenshot above) will give you up to 100X in leverage on your trade. Hence, funding your account for a $100 trade could provide you with enough leverage to place a trade worth $10,000. If the trade goes right as you expected, your profit will be the equivalent of owning $10,000 worth of that trade.

However, the fact that your exchange is offering you 100X doesn’t mean that you should use 100X leverage on all your trades. For instance, while a winning trade with 100X could earn you 100 times more profit, you might be liable for 100X more losses if the trade goes against you. You could lose all your initial deposit and be obligated to provide more funds to cover your debt. You’ll need to identify the triggers of FOMO and FUD; identify the rallying cry to HODL, and then intelligently place your trades accordingly. In the words of legendary investor, Warren Buffet, be fearful when others are greedy and be greedy when others are fearful.

Here’s What the Future Could Hold for Crypto Derivatives

The very idea of cryptocurrency is built around decentralized money outside the control of governments and their agents. While the government probably can’t shut down Bitcoin, it can regulate the trading, transactional and investment appeal of cryptocurrencies. For instance, the CFTC has revealed that it is paying attention to how the market will naturally resolve the volatility in cryptocurrency. In the U.S, the SEC has been consistent in delaying deciding on Bitcoin ETFs.

Recently, the SEC choose to err on the side of caution by postponing its decision on Bitcoin ETF proposals submitted by asset managers Bitwise Asset Management, VanEck/SolidX, and Wilshire Phoenix until Autumn. The ETF proposals suggest that the derivative asset will be trading on NYSE Arca and Cboe BZX.

Going forward, regulators in the other parts of the world will most likely be taking cues from the U.S. regulators inasmuch as crypto derivatives trading is concerned. Once crypto derivatives get a legitimate right to exist in the U.S, you can reasonably expect to see rapid growth in the global cryptocurrency derivatives industry.

Disclaimer: This content does not necessarily represent the views of IWB.