via zerohege:

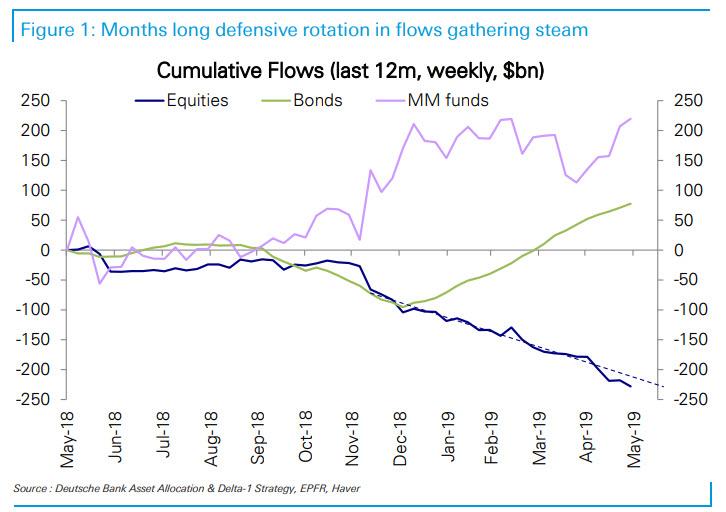

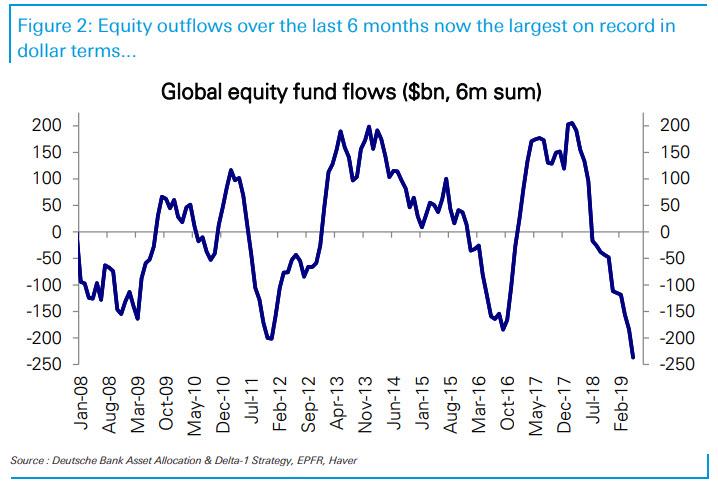

Yesterday, when observing the latest equity fund flows, we showed two striking charts: according to Deutsche Bank, equity funds have now seen outflows of -$132bn YTD and -$237bn since December.

This means that outflows over the last 6 months in dollar terms have now been larger than over any prior 6-month period.

There was a silver lining: while discretionary funds had continued selling stocks to satisfy redemption requests both when the S&P was at its all time highs in last April, and during the worst May for markets in decades, systematic funds had kept a far lower profile, preferring to sit on the sidelines for now.

That is changing.

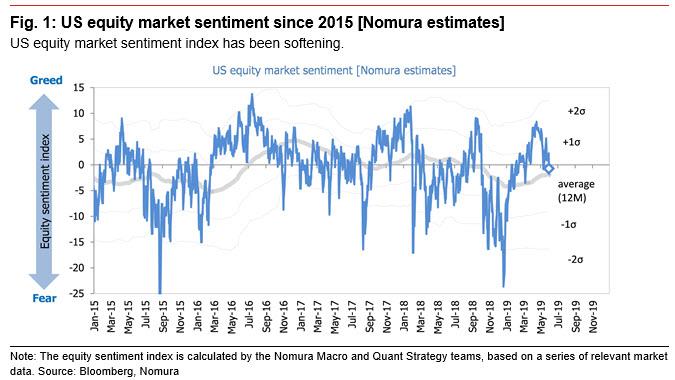

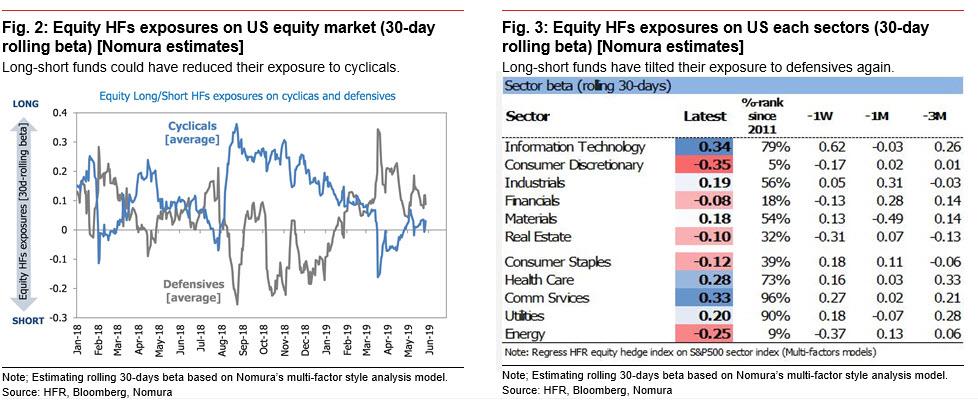

Overnight, Nomura’s quant team led by Masanari Takada writes that equity long/short funds shifted to selling cyclicals (mainly tech) and buying defensives (mainly utilities and healthcare), returning once again to conservative positions as a result of sentiment once again dipping into negative territory (-1.8) on trade policy concerns which added momentum to risk-off trades.

This selling does not, however, look to have gone far enough to trigger an excessive volatility shock, with the VIX still stubbornly rangebound, as long/short funds’ selloff of cyclical stocks has been minimal compared with the selloffs in February and October 2018.

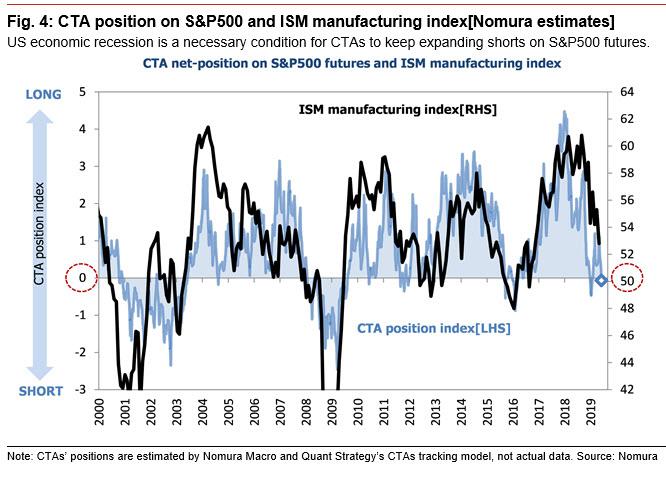

However, what has so far been a relatively tame selloff may get much worse in the coming days, as trend-following algos (CTAs and risk-parity funds) continue have now started to to sell equities. In fact, as Nomura warns, CTAs have shifted to shorting Russell 2000 futures, “and it looks like only a matter of time before they turn short on S&P 500 futures as well.”

Making matters worse is that speculators are now making trades premised on a recession in the US, and Nomura sees the risk of a further jump in volatility. And with the latest ISM manufacturing index print coming in well-below expectations and at fresh multi-year lows, this will only lend further impetus US equity bear trades.

If this were to happen, Nomura’s main focus would be whether CTAs maintain their net selling for more than seven business days after they turn short on the S&P 500. Such protracted equity selling by CTAs could imply that this is not a mere technical selling but a growing consensus among market participants that the US economy is headed for recession.

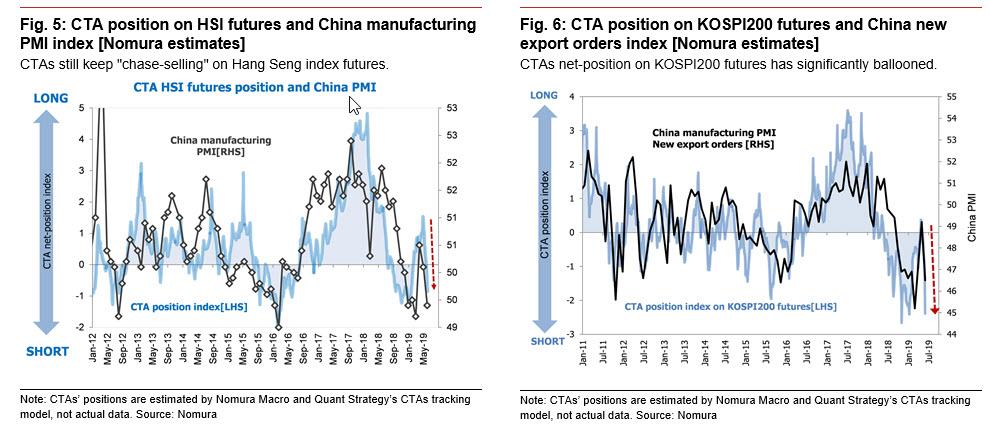

But wait, it gets worse, because as the Japanese bank notes, shifting its focus to Asian equity markets, speculators are also selling stocks at a rapid clip premised on a recession in China as well. Bear trades appear to have also been catalyzed by the Chinese manufacturing PMI falling below 50. As a result, shorting by CTAs was particularly pronounced for Hang Seng futures in Hong Kong, KOSPI 200 futures in South Korea, and TAIEX futures in Taiwan, with shorts expanding in all cases to the levels seen in January 2018.

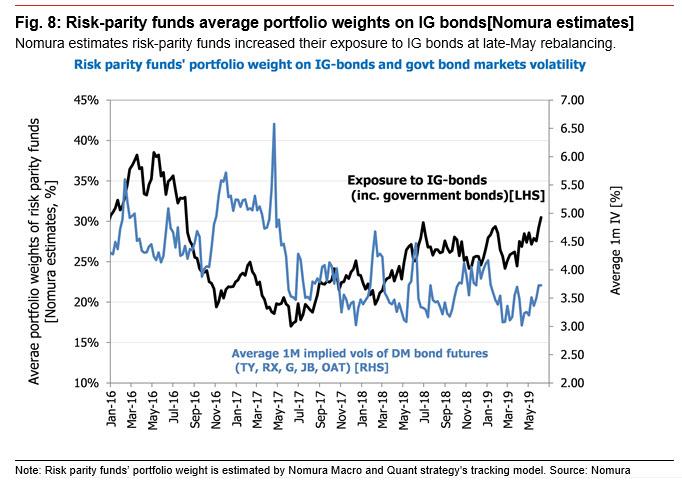

Meanwhile, the exact opposite picture emerges in bonds, where “something akin to panic-buying of USTs and other DM government bonds.” Specifically, with 10yr UST yields now at multi-year lows around 2.07%, the end of last week and the start of this one was marked by something close to panic-buying in US and other DM bond markets, especially after FOMC voting member James Bullard suggested that the time for a rate hike is coming . As caution builds in the market regarding global economic conditions, the market also seems to be moving in ways that could force the Fed toward a precautionary rate cut.

Among short-term market participants, macro hedge funds have been buying bonds in a wide range of regions, including the US, Germany and Japan. At the same time, while bond (yield) volatility is rising, the volatility of risk assets (equity, commodities, high-yield bonds) was higher than that of investment-grade bonds throughout May. For this reason, risk-parity funds prioritized bond buying in their May rebalance. Of course, if bond volatility remains high in June, we believe risk-parity funds would likely sell some of these accumulated long bond positions