https://www.nytimes.com/interactive/2018/08/25/opinion/sunday/student-debt-loan-default-college.html

Millions of students will arrive on college campuses soon, and they will share a similar burden: college debt. The typical student borrower will take out $6,600 in a single year, averaging $22,000 in debt by graduation, according to the National Center for Education Statistics.

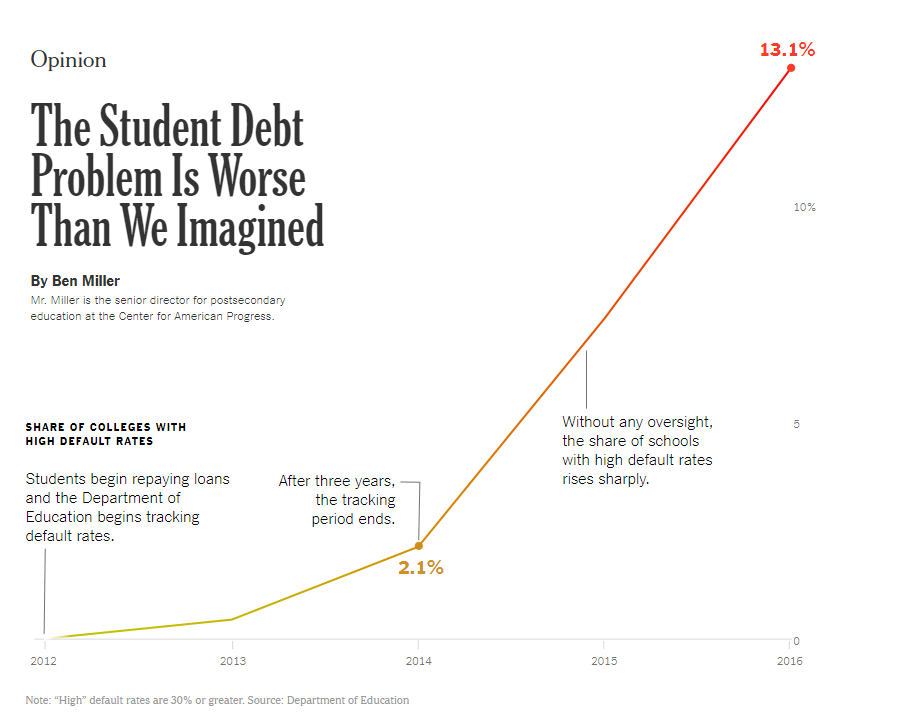

There are two ways to measure whether borrowers can repay those loans: There’s what the federal government looks at to judge colleges, and then there’s the real story. The latter is coming to light, and it’s not pretty.

Consider the official statistics: Of borrowers who started repaying in 2012, just over 10 percent had defaulted three years later. That’s not too bad — but it’s not the whole story. Federal data never before released shows that the default rate continued climbing to 16 percent over the next two years, after official tracking ended, meaning more than 841,000 borrowers were in default. Nearly as many were severely delinquent or not repaying their loans (for reasons besides going back to school or being in the military). The share of students facing serious struggles rose to 30 percent over all.

If these default rates stay with current trends, then by 2020 it could be close to 40% default.

Yearly progression:

10 13 16 20 25 31 39

h/t matt2001