Due to my recent findings from researching the empirical data of prior market crashes since 1901, investors in the future will be able to distinguish a crash from a correction. All crashes and corrections can now be measured and categorized.

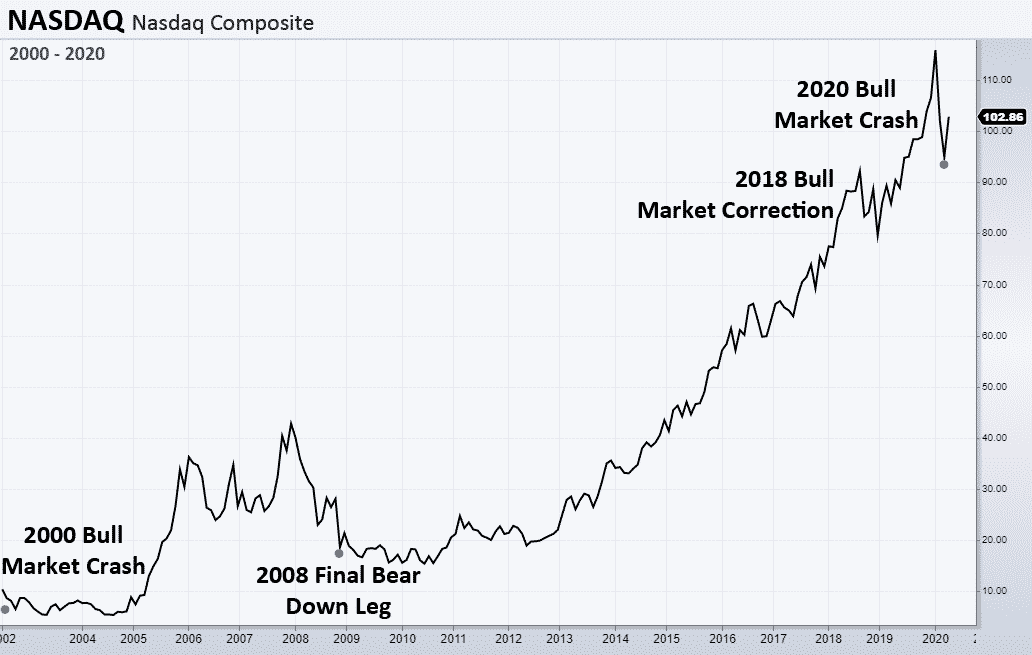

The chart below for the NASDAQ from 2000 to 2020 depicts:

- 2000 & 2020-bull market crashes: Sharp declines of 10% or greater from all-time bull market highs as measured their both having an initial correction velocity of greater than 10% are crashes.

- 2008-final leg down for bear market: From the 2007 high through September 2008, the NASDAQ had already declined by 20%. The September through March 2009 decline was 44%. The decline for the NASDAQ 2000’s final leg down from January 2002 to October 2002 was 47%.

- 2018-bull market correction: The initial correction velocity of less than 10% from an all-time bull market high is a bull market correction.

According to the SCPA (Statistical Crash Probability Analyses) algorithm, the probability is 100% for:

- The relief rally high to occur anytime from April 3, 2020, to April 14, 2020.

- After the indices reach their highs they reverse and decline to within 41% to 44% of their highs by late April or early May 2020.

Since March 23rd when the indices were 34% below their 2020 highs, they have climbed back to within 20% of their highs.

Take advantage of the powerful relief rally. Liquidate everything except for stocks under $5 per share by Tuesday, April 14th. Suggest that 20% of portfolio holdings be sold per day for the next five days. Do not procrastinate. The market can stop on a dime and turn downward.

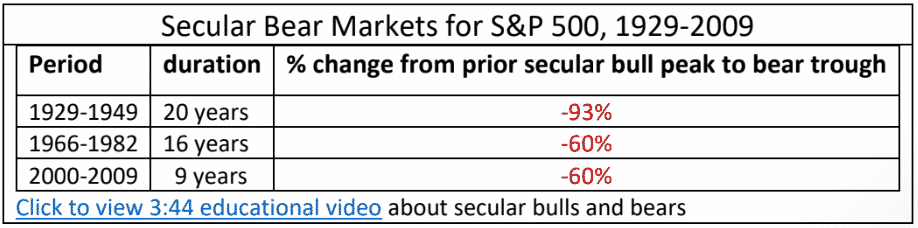

My prediction is that the S&P 500’s secular bull market which began in March 2009 ended on February 19, 2020. The ninth secular bear since 1802 began on February 20th. Based on the peaks of the last three secular bull markets as compared to the troughs of the three most recent secular bears, the S&P 500 could decline by an additional 47% to 80% from its March 6, 2020 close.

Read my March 31, 2020, article entitled “Embrace the Bear” to learn about:

- investing strategies that are best utilized during bear markets

- investing in ETFs which go up when the market goes down

- algorithms including the Bull & Bear Tracker and SCPA ’s which are being utilized by investors

The video of my “Secular Bulls & Bears: Each requires different investing strategies” workshop at the February 2020 Orlando Money Show is highly recommended. The educational video explains secular bulls and bears and includes strategies to protect assets during secular bear markets and recessions, etc.

BullsNBears.com which covers all of the emerging and declining economic and market trends is a one-stop-shop for bear market strategies and products. Click here to view a one-minute video about the site.

To understand why diversification does not work and why penny and low-priced stocks should be held watch MoneyShow workshop video.