It’s the beginning of an accelerating wage price spiral, and could continue on for several decades.

Most people alive today never experienced the 1970’s period of runaway inflation. They are quickly coming to terms with their massive loss of their purchasing power. Like a runaway train, once governments lose control, it’s nearly impossible to stop. In an effort to put the genie back in the bottle, they will be forced resort to wage and price controls. As with Nixon’s failed experiment 51 years ago, these efforts are doomed to failure. Here’s 8 reasons why.

1. No one really wants to stop it. Jerome Powell no longer claims that inflation is transitory and his efforts at containment are half-hearted. Besides a feint move towards tapering and a gradual increase in interest rates, little is being done. As we’ve quoted in the past, the late Nobel Laureate economist Milton Friedman said repeatedly, “Inflation is first and foremost always a monetary phenomenon.” The world is about to get a refresher course in monetary theory.

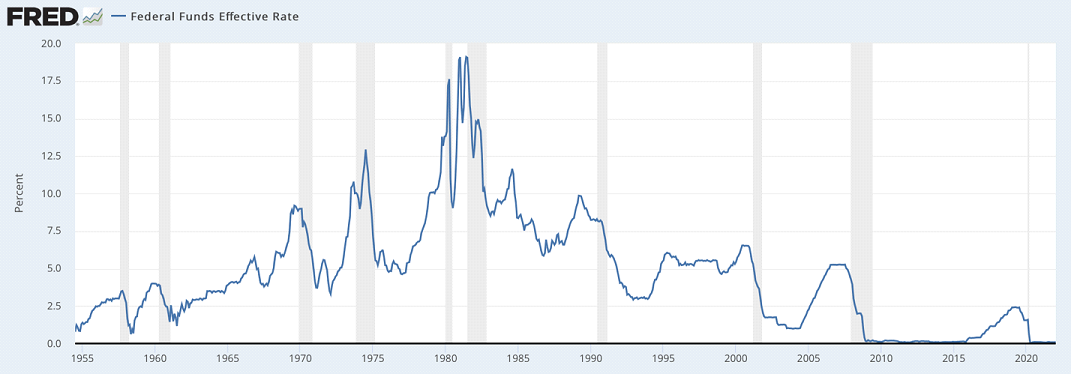

2. Central Banks are powerless. In the past, central banks’ increased interest rates to control inflation, or as Alan Greenspan said, removing the punch bowl when things got too frothy. The dramatic increase in interest rates required to control the current inflationary spiral is economically and politically unacceptable. While attempting to crush inflation 40 years ago, Paul Volker nearly threw the economy into a major depression.

Global debt today is many times higher than in 1980. 20 percent plus interest rates would trigger a global economic meltdown, along with the uncontrolled political demolition of our world’s governing structure. Cascading defaults and global systemic financial implosion are far too great a risk for this prescription to be applied. Therefore, world leaders’ only choice is to blame the greedy capitalists and act to rein them in.

3. It’s the speculator’s fault. Politicians are hanging rising prices on speculators yet again. The current administration blames high oil prices on excessive speculation and industry profiteering. To get to the bottom of it, the matter has been referred to the Federal Trade Commission. That should work out well. Certainly, reckless speculation is abundant, but it’s largely compliments of the Fed’s artificial ultra-low interest rate policy that encourages hedge funds to bet the house in pursuit of extreme profits. While these actions can have short-term effects on prices, they are clearly not the underlying cause of inflation.

4. Ignorance of inflation’s true causes. Our leaders and the public refuse to accept or understand inflation’s actual origins, leaving the real causes to go unaddressed. As with Nixon, the current admin will look for the easy fixes. In a world of unbridled government power, where the system of checks and balances has been thrown out the window, price freezes have a logical, almost irresistible appeal. Of course, they’re just trying to flatten the price curve; it will be a 90-day freeze. Sound familiar? Like what we’ve been living through for the past two years.

5. Authoritarianism is in the air. Recent events in Canada, Australia, New Zealand and many other countries have greatly reduced freedom. While once-free nations have quickly embraced authoritarian steps to fight the pandemic; they have been extremely slow in relaxing them. Makes one wonder if they have any intention of ending these emergency measures. If governments can shut businesses down, make people virtual slaves in their own homes and lock people up for exercising their protected rights, can wage and price controls be far off? And of course, governments will only be doing it to keep prices affordable for their populations.

6. Shortages inevitably lead to higher prices. It’s one thing when people can’t buy cars or stock up on Charmin, but It’s quite another matter when shortages make food unaffordable for the middle class. No politician can sit idly by when widespread civil unrest becomes prevalent. The public will demand a solution.

7. Something has to be done. Politicians can never just sit back and let the market implement its solutions. Government intervention is so ingrained in the populace’s psyche that the average person has no idea what a free market is, let alone its superior effects of managing supply demand and price. Therefore, we can expect the worst possible solution at the worst possible time.

8. The War Drums are Beating. With Russia’s attack on Ukraine and the resulting financial chaos, there are a number of places where war could break out at any moment. A major war will result in higher inflation and mandatory wage and price controls. It worked that way in WWI, WWII and many other wars throughout history.

Lock in your price increases and wage hikes now, before it’s too late. If you can get a low interest mortgage on your home or investment properties, now’s a great time. If you can finance income producing assets at these ridiculous rates, go for it. If you own a business, you’re in even better shape. During the inflationary 1970’s, price increases above the rate of inflation were the norm. Customers stopped resisting higher prices and instead sped up their purchases to avoid holding rapidly depreciating dollars. Companies were able to increase profits faster than the rate of inflation. You must be aware of the signs that wage and price controls are coming and act accordingly.

Regards,

Kerry Lutz

Other recent links:

8 More Shortages About to Worsen

10 Shortages That Are Getting Worse

Six Lessons I Learned From Working with Billionaire Hedge Funds

Get Ready for Non-Transitory Inflation: Ten Things About to Shoot Up in Price

Back by Popular Demand – Prices of 7 More Things Ready to Go Way Higher

In the US and around the world, record wage and price increases are becoming the norm.

In the US and around the world, record wage and price increases are becoming the norm.