by Saad Ullah

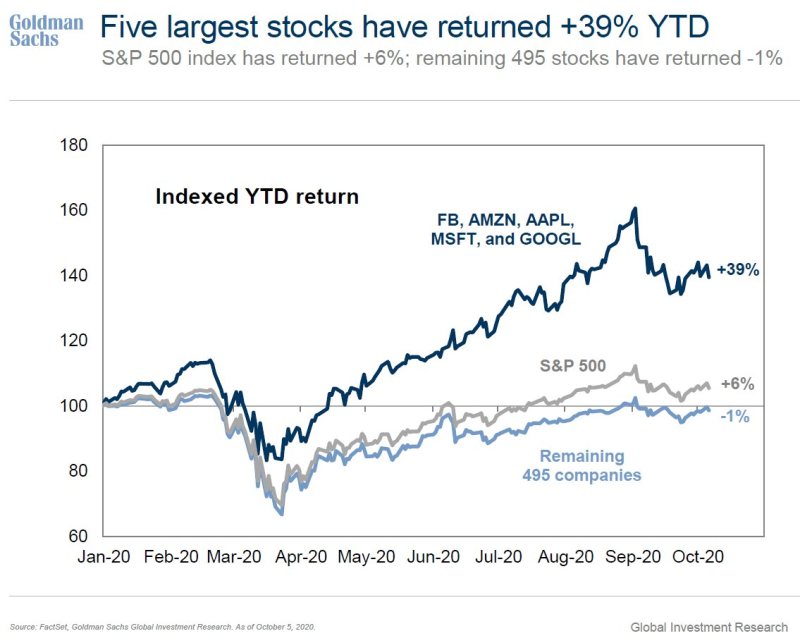

The stocks of FAAMG has grown by 39 percent since the beginning of the year compared to an additional 495 stocks just up 6 percent.

Image source: Twitter @tracyalloway

FAAMG’s Performance

Facebook, Amazon, Apple, Microsoft, and Google (Alphabet), collectively called as FAAMG, are five leading corporations by market size in the S&P 500. The index is re-equilibrated annually, adjusting the weights of firms and manufacturing. FAAMG’s inventories reflect approximately 25% of the index’s market cap at the time of publication. Since at least the 1980s, five businesses did not get the S&P 500.

The FAAMG’s stocks do not only have a large weight in the index, but also surpass the larger index since the beginning of the year. The implications of the pandemic have forced some investors to opt for large companies which generate revenue from online companies that have gained from the FAAMG ‘s stocks.

The FAAMG’ stocks rose by 39 percent, compared with another 495 stocks rose only by 6 percent from the beginning of the year up to October 2020.

Don’t Be so Optimistic

While this momentum is optimistic, an important detail needs to be noted. The S&P 500 uses a weighted methodology to determine market capitalization in free float.

Bloomberg reported that after mid-February, only about a third of S&P 500 companies were in the green zone. During the pandemic, the largest components of the index were quite strong and were the driving force behind the reversal of the S&P 500 index.