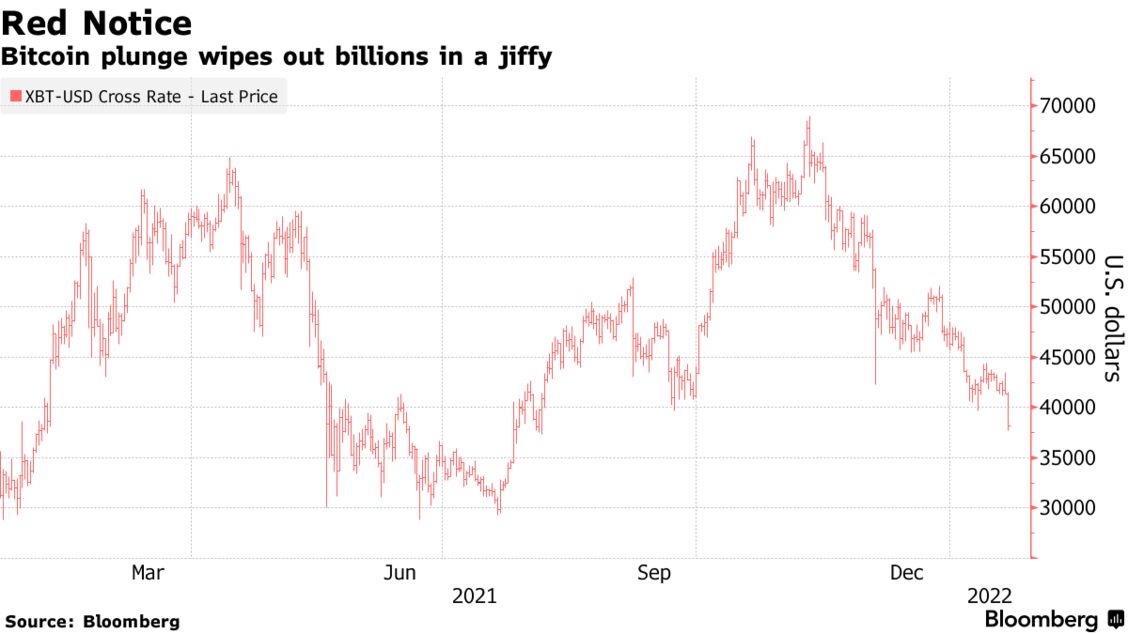

For Bitcoin, there’s only been one constant recently: decline after decline after decline. And the superlatives have piled up really quickly.

With the Federal Reserve intending to withdraw stimulus from the market, riskier assets the world over have suffered. Bitcoin, the largest digital asset, lost as much as 8.7% Friday and dropped below $38,000 to its lowest level in six months. Since its peak in November, it has lost 40% of its value. Other digital currencies have suffered just as much, if not more, with Ether and meme coins mired in similar drawdowns.

Bitcoin’s decline since that November high has wiped out more than $570 billion in market value, and roughly $1.17 trillion has been lost from the aggregate crypto market. While there have been much larger percentage drawdowns for both Bitcoin and the aggregate market, this marks the second-largest ever decline in dollar terms for both, according to Bespoke Investment Group.

“It gives an idea of the scale of value destruction that percentage declines can mask,” wrote Bespoke analysts in a note. “Crypto is, of course, vulnerable to these sorts of selloffs given its naturally higher volatility historically, but given how large market caps have gotten, the volatility is worth thinking about both in raw dollar terms as well as in percentage terms.”

With the Fed’s intentions rocking both cryptocurrencies and stocks, a dominant theme has emerged in the digital-asset space: cryptos have twisted and turned in nearly exactly the same way as equities have.