Fed Chair Jerome Powell is singing “Take it easy.’

The Federal Reserve risks stoking the same sort of asset bubbles that Chairman Jerome Powell has linked to the last two recessions with its new-found eagerness to fan inflation.

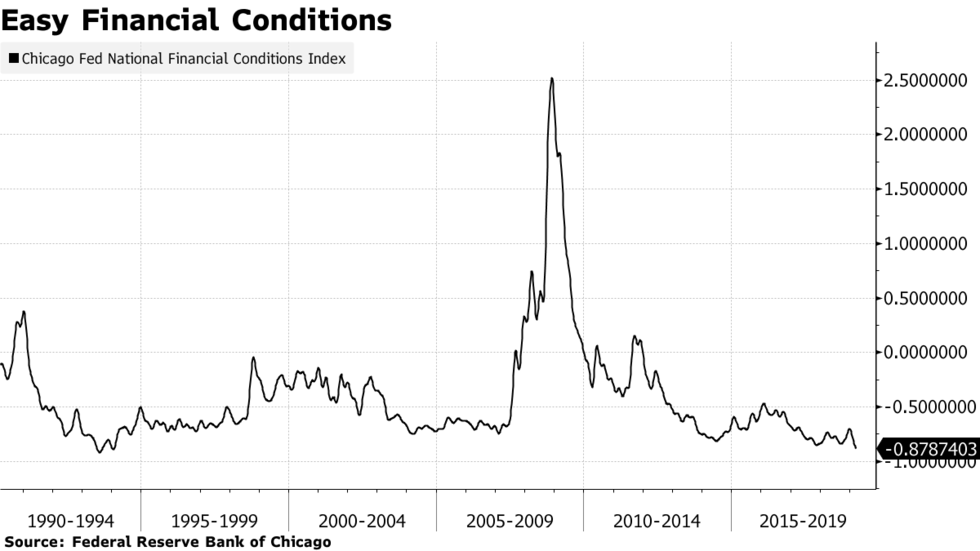

The Fed’s surprise pivot away from any interest rate increases this year has boosted prices of stocks, high yield bonds and other risky assets in spite of nagging investor concerns about slowing global economic growth. Financial conditions, at least as measured by the Chicago Fed, are at their easiest since 1994. And they could well get looser.

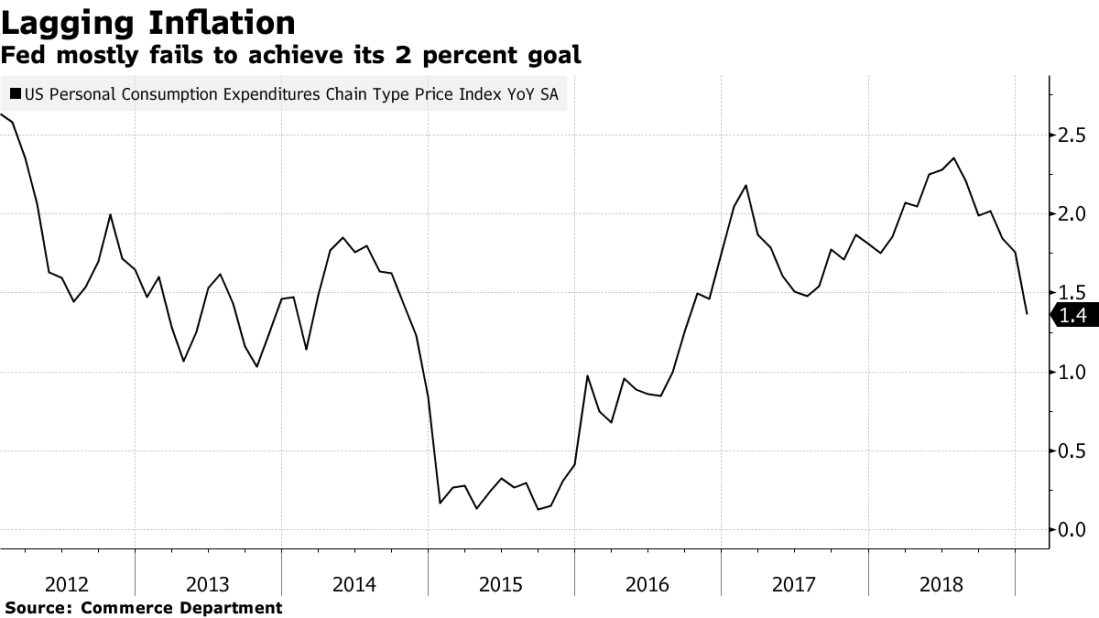

That would put policy makers in a pickle. In unveiling the Fed’s U-turn last month, Powell highlighted the central bank’s determination to promote price pressures by declaring that low inflation was “one of the major challenges of our time.’’ And he left open the possibility that the Fed’s next rate move might be a cut after four increases last year.

But a drive to boost inflation through low interest rates could end up threatening financial stability by encouraging supercharged risk-taking, according to Allianz SE chief economic adviser Mohamed El-Erian.

And it’s just such “destabilizing excesses” that Powell has pinpointed as leading to the last two economic downturns. First it was the dot-com stock market boom of the late 1990s that crash landed and led to the 2001 recession. Then it was the housing boom and bust of the 2000s that preceded the biggest economic contraction since the Great Depression.

Easy Policy

The quandary for the Fed is that easy monetary policy seems more effective in spurring asset values than it does in boosting prices of goods and services.

The S&P 500 Index rose by an average 8.5 percent from 2014 through 2018, while the personal consumption expenditures price index increased 1.3 percent, well below the Fed’s 2 inflation target. In January, the most recent month for which data is available, it stood at just 1.4 percent.

Well, bank lending YoY for all but Commercial and Industrial (C&I) loan are slowing.