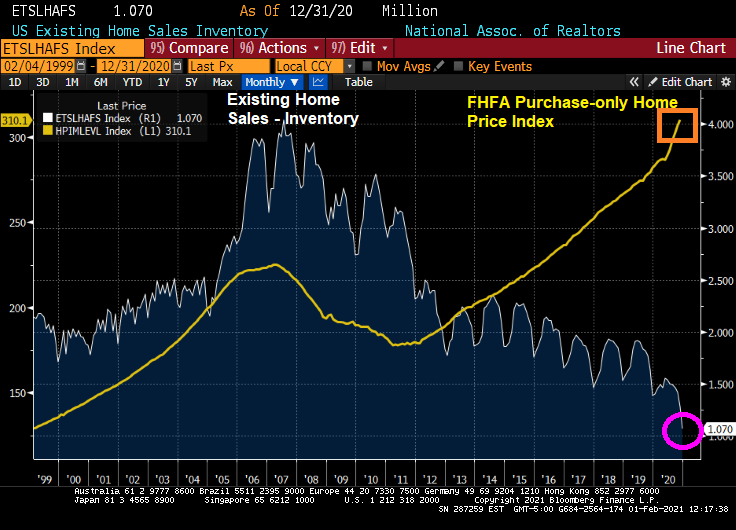

The FHFA Purchase-only home price index rose at an 11% YoY pace in November 2020, even a faster pace than the dreaded house price bubble of 2005.

Oddly, the GSEs Fannie Mae and Freddie Mac have been raising the average credit score (FICO) on loan purchases since Q1 2019.

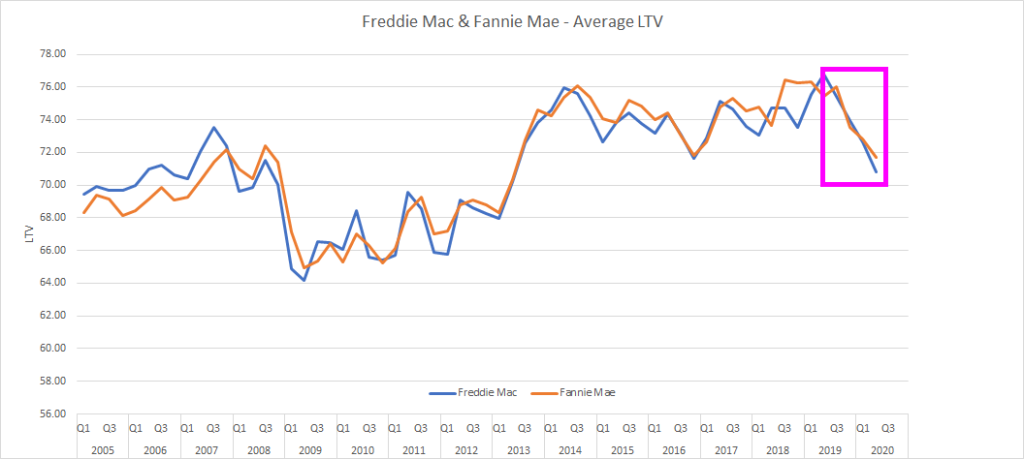

Over the same time period, Fannie Mae and Freddie Mac have been lowering the loan-to-value (LTV) on purchased loans.

Debt-to-income (DTI) ratio? The average DTI has been falling since the end of 2018. This means TIGHTENING of credit standards.

Were Fannie Mae and Freddie Mac tightening loan standards ahead of possibly being taken private and out of conservatorship with their regulator, FHFA? If it is an attempt to slow down home price growth, it hasn’t worked so far.

Of course, there are regional migration patterns that move home prices around.

So, when Congress and the Biden Administration try to figure out what to do with Fannie Mae and Freddie Mac, they should try to figure out 1) why home prices are accelerating so fast when Fannie and Freddie at tightening underwriting standards and 2) why is housing inventory so low?

- This analysis was done with the capable Python assistance of Hakeem Azoor.