via Zerohedge:

The ECB’s imposition of negative interest rates have created an “absurd situation” in which banks don’t want to hold deposits, rages UBS CEO Sergio Ermotti, arguing that this policy is hurting social systems and savings rates.

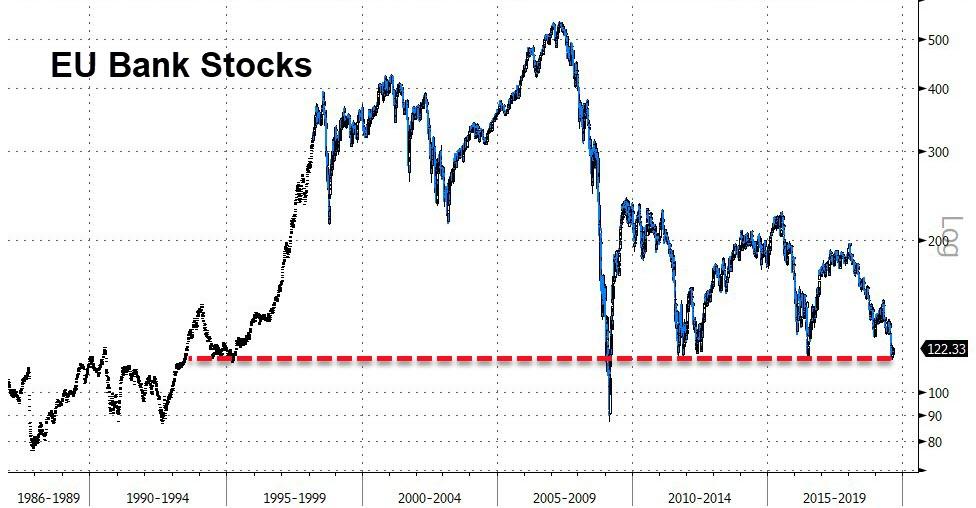

Ermotti is not alone. As European bank bosses cast their eyes at their share prices, they are fighting back, some have said – biting the hand that feeds, in their attack on ECB policies, warning of severe consequences to asset prices and the broader economy.

Source: Bloomberg

As Bloomberg reports, Deutsche Bank CEO Christian Sewing warned that more monetary easing by the ECB, as widely expected next week, will have “grave side effects” for a region that has already lived with negative interest rates for half a decade.

“In the long run, negative rates ruin the financial system,” Sewing said at the event, organized by the Handelsblatt newspaper.

Another cut “may make refinancing cheaper for states, but has grave side effects.”

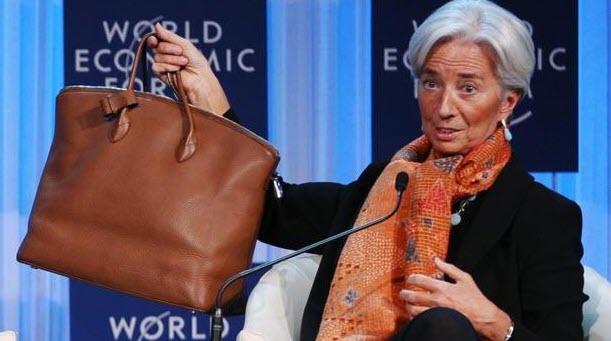

While incoming ECB head Christine Lagarde has claimed that the benefits of deeply negative rates outweigh the costs (stating just this week that “a highly accommodative policy is warranted for a prolonged period of time;” few economists believe another cut at this level would actually help the economy. According to Sewing, all it would achieve is to further divide society by lifting asset prices while punishing Europe’s savers who are already paying 160 billion euros ($176 billion) a year because of negative interest rates.

“What’s really worrisome: central banks have hardly any tools left to effectively mitigate a real economic crisis,” Sewing said.

“They have already cranked open the money tap – most of all the European Central Bank.”

Who can blame Sewing, as the EU yield curve has collapsed, so has his share price…

Source: Bloomberg

“Banks’ interest margins are under pressure in this environment and that’s not going to change,” Commerzbank CEO Martin Zielke said at the same conference.

“I don’t think it is a particularly sustainable or responsible policy. But we have to recognize the facts and the facts are that winning clients in this environment helps work against that pressure.

Bloomberg also notes that Yngve Slyngstad, the chief executive officer of Norges Bank Investment Management, Norway’s $1 trillion wealth fund, has separately said that negative rates are the main worry at the world’s largest wealth fund right now.

So, with Draghi facing push back from an increasingly hawkish group of ECB members, the question is, will he just push off the decision? Starting October 31, how the Eurozone will be destroyed – whether with hyperinflation fire and deflationary ice – will no longer be Draghi’s decision, but instead the final destruction of the Eurozone will be delegated to arguably the most clueless person (see Argentina) in the room.