In investments, when you buy is often a bigger determiner of profitability than when you sell. That’s why traditional investment wisdom advocates a “buy low, sell high” strategy. Buying a stock when it’s trading at a low price guarantees your profit when it starts trading high – buying a stock that is already trading high might result in losses if the stock is unable to go higher.

Interestingly, Jim Rogers notes that “Buy low and sell high, It’s pretty simple. The problem is knowing what’s low and what’s high”. Warren Buffet however advises that the best way spot the lows and the highs is to be greedy when others are fearful and be fearful when others are greedy. This piece provides insights for getting ahead of Wall Street by investing in pre-IPO companies by leveraging cryptocurrency tokens.

Image Source: fatpossum

Buying Pre-IPO stocks is a great way to buy low and sell high

People who invest in private companies are probably the most practical with the buy low sell high advice – investors in high-profile private companies often make a great deal of money even before the news about such companies hit the newsstands. Investors who bought ReWalk Robotitcs at IPO booked 116% gains, but its pre-IPO investors made as much as 381% gains. When Facebook had its IPO, investors lost money on the first day but private investors such as U2 lead singer Bono, went home with more than $43M from his pre-IPO shares.

The problem however is that the stock of private companies are not readily available to all investors. Even when you are willing to invest in a revolutionary idea such as Uber or AirBnB, SEC regulations might disqualify you from being able to make such investments.

To start with, you might need to be an accredited investor earning $200,000 per annum or having a net worth of $1M before you can qualify to buy into private companies. Secondly, some private companies have minimum investment amounts that might not be easy for many retail investors to put down. Hence, VCs, celebrities, and high-net worth individuals are usually the only people that can access those kinds of deals. For the most part, retail investors will only seat on the sidelines to read about how the VCs are booking 10X, 20X, or 100X returns.

Elephant unleashes an opportunity to buy pre-IPO stocks with crypto

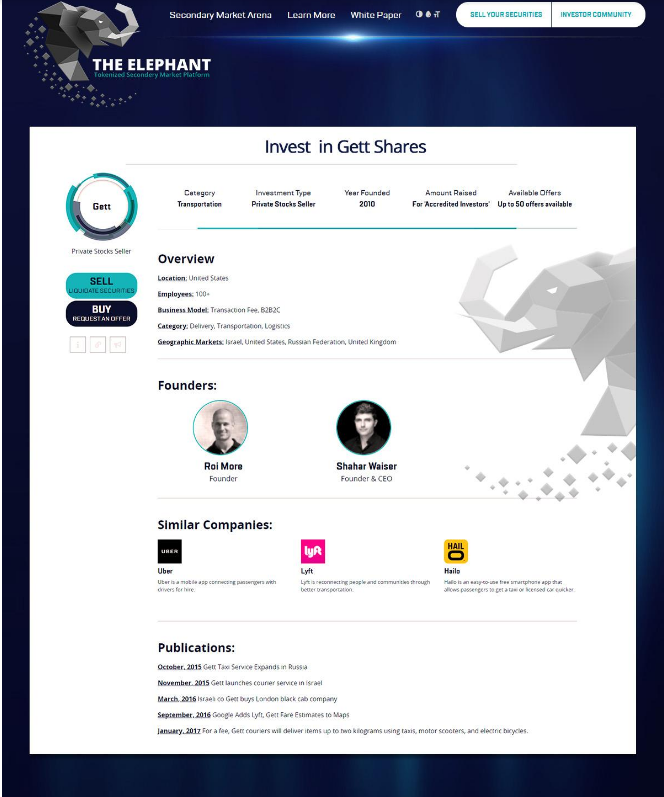

The Elephant is out to change the accessibility of pre-IPO investments by leveraging the decentralized nature of blockchain technology and cryptocurrencies. The company’s vision is to tokenize equity rights in the promising private companies globally, make such dedicated tokens available to investors, and to activate a measure of stability in cryptocurrencies.

-

Solving liquidity challenge for early backers

The Elephant is currently the only blockchain-based platform focused on solving the liquidity challenge that buyers and sellers of the share of private companies face. Founders, early-employers, and seed-stage investors usually find it strenuous to wait until an IPO before they can sell a part (or all) of their stakes in the private company. Waiting until an IPO means that they are rich on paper, but such riches might not have a practical effect on their finances if they are unable to sell their stakes.

The Elephant solves the liquidity issue by creating a dedicated partnership that will purchase the equity tokens from these original owners. By purchasing the equity with a dedicated partnership (instead of directly to multiple retail investors), sellers would find it easier to exit without flouting requirements that a private company can’t have more than 500 shareholders. Hence, early backers that want to exit don’t have to wait until they find another institutional investor willing to take the shares off their hands at fair prices.

-

Opening private equity to a broad base of investors

The use of dedicated partnerships allows sellers to sell as low as $100,000 worth of shares instead of being forced to sell all their stake to attract hedge funds. After buying up the equity rights with dedicated partnerships, The Elephant tokenizes the equity rights and makes them available to retail investors in the form of Dedicated Tokens, which represent participation units and are equal to equity stakes in the pre-IPO company.

Now, investors can spend as low as $20,000 buying the participation tokens without meeting the minimums predefined in Rule 501 of Regulation D of the Securities Act. Many retail investors who have low entrance thresholds will be empowered to become active in the secondary markets.

-

Providing a measure of stability in cryptocurrencies

The cryptocurrency market has skyrocketed and there are now more than 1500 different cryptocurrencies in the market. Some of them such as Bitcoin, Ethereum, Ripple, and Litecoin have built a cult-like following. Others such as Qtum, Neo, Steem, IOTA are coming up fast. However, many cryptocurrencies trading under $0.10 are probably built on nothing more than a landing page and a whitepaper.

Now, cryptocurrencies don’t have to be expressions of ideas, prototypes, and futuristic plans again. The Elephant is providing a unique opportunity to have cryptocurrencies backed by shares in existing high-profile companies. Of course, demand and supply will still drive the value of cryptocurrencies but the fact that these dedicated tokens have their fundamentals rooted in real-life businesses will tone down the speculations that drives much of the volatility in cryptocurrencies.

Disclaimer: This content does not necessarily represent the views of IWB.