Foreign purchases of American homes plunge 36% as Chinese buyers flee the market

- The dollar volume of homes purchased by foreigners from April 2018 through March 2019 dropped 36% from the previous year, according to the National Association of Realtors.

- Foreigners bought 183,100 properties with a total value of about $77.9 billion, down from 266,800 properties valued at $121 billion a year earlier.

- “The magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.,” the Realtors’ chief economist says.

Challenging conditions in the U.S. housing market, along with tighter currency controls by the Chinese government, caused a stunning drop in foreign demand for American homes.

The dollar volume of homes purchased by foreign buyers from April 2018 through March 2019 dropped 36% from the previous year, according to the National Association of Realtors. The decline was due to a drop in the number and average price of purchases. Foreigners bought 183,100 properties with a total value of about $77.9 billion, down from 266,800 valued at $121 billion in the previous period.

They paid a median price of $280,600, which is higher than the median for all existing homebuyers ($259,600), but it was down from $290,400 the previous year.

“A confluence of many factors — slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale — contributed to the pullback of foreign buyers,” said Lawrence Yun, NAR’s chief economist. “However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.”

The Chinese were the leading buyers for the seventh consecutive year, purchasing an estimated $13.4 billion worth of residential property. Yet that was a 56% decline from the previous 12 months and comparatively the biggest percentage drop of all foreign buyers. Chinese economic growth slowed to 6.3% in 2019 compared with 6.9% in 2017, when the previous buyer survey began. The Chinese government also tightened its grip on the outflow of cash to purchase foreign property.

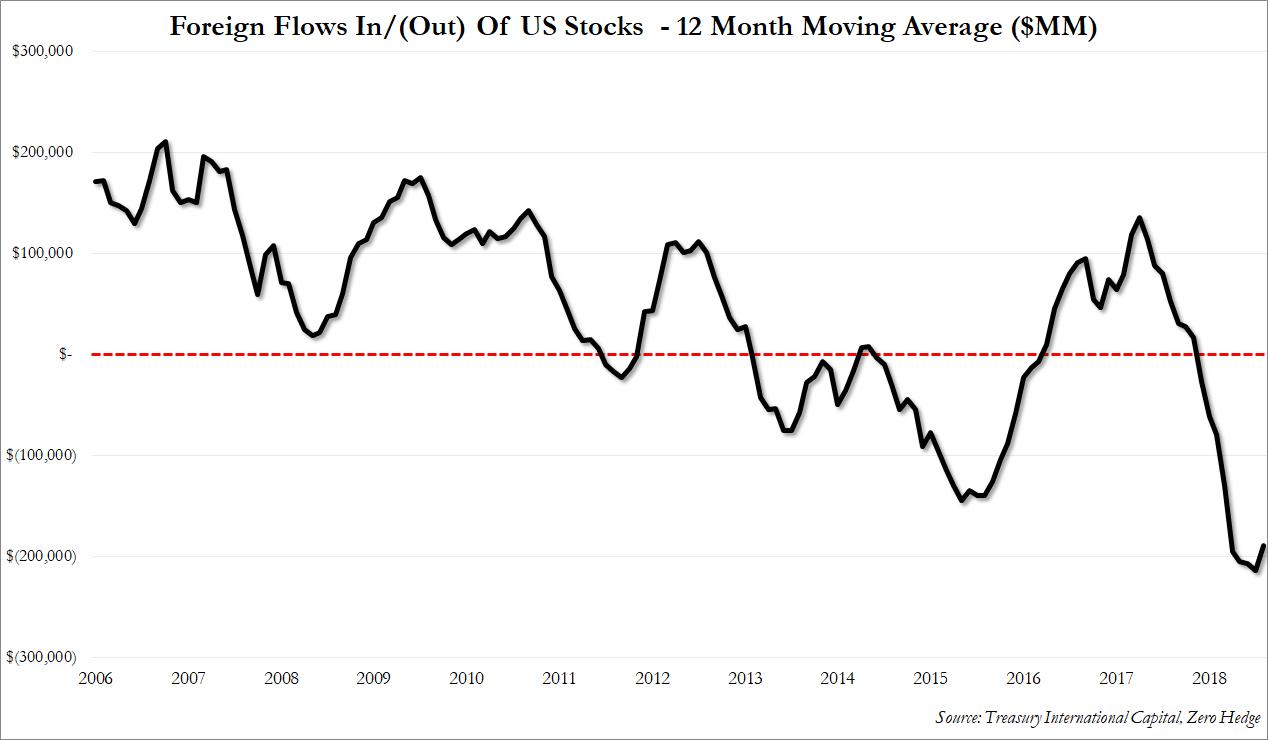

Foreigners Dump US Treasurys, Liquidate A Record $216 Billion In US Stocks In 13 Consecutive Months

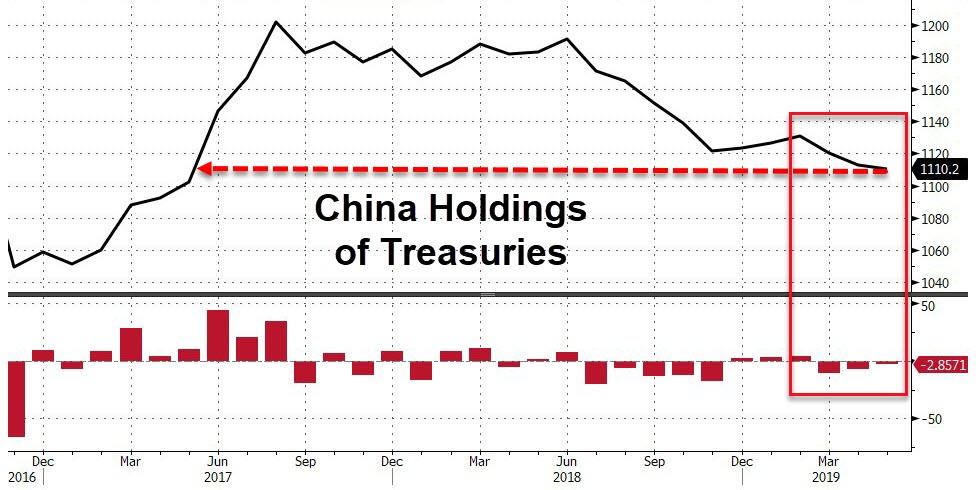

The latest TIC data for the month of May, released just after the close, showed that China continued to sell US Treasurys for the third straight month, bringing its total to just $1.11 trillion, down another $3 billion, and the lowest since May 2017…

… Even as Japan bought a whopping $37 billion in US paper in May, its largest monthly purchase since August 2013, and bringing its total to $1.101 trillion, just $9BN shy of China’s $1.110 trillion.

Meanwhile, in a surprising development, the UK – which has been aggressively buying US paper either for itself, or in proxy for other purchasers – saw its holdings jump once again, rising to $323.1 billion, an increase of $22.3 billion in the month.

Similar to Belgium and Euroclear, it is far more likely that this surge is simply the result of some offshore fund serving a sovereign, but based in the UK, is doing the buying. Whether it’s China or someone else, will be revealed in due course.

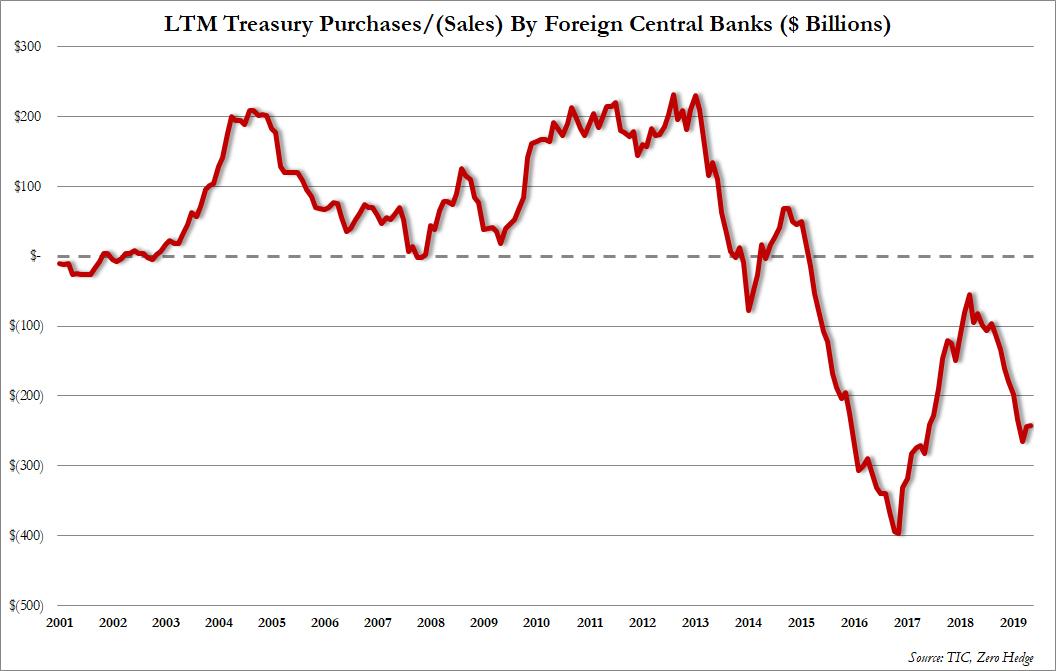

Yet despite the occasional purchaser, foreign official institutions (central banks, reserve managers, sov wealth funds) have seen their holdings of US TSYs slide by another $22 billion, the 9th consecutive drop in the holdings of foreign official institutions, and yet because the decline this May was smaller than the drop in May of 2018, the LTM net sales posted a modest drop.

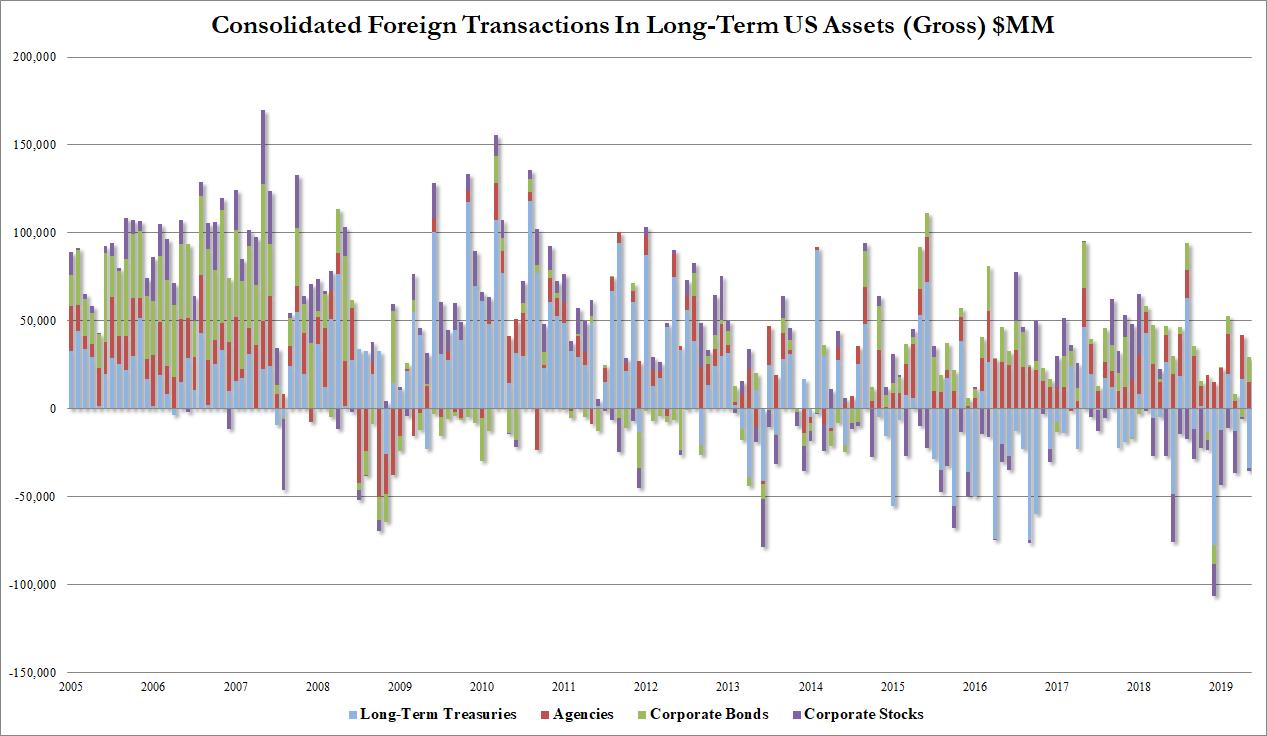

Overall, May – and the past 12 months in general – were not good for US Treasurys, as foreigners, both public and private sold a total of $33.8 billion in US Treasurys and $1.4 billion in corporate stocks, offset by purchases of $15.1 billion in Agencies and $14.9 billion in Corporate bonds.

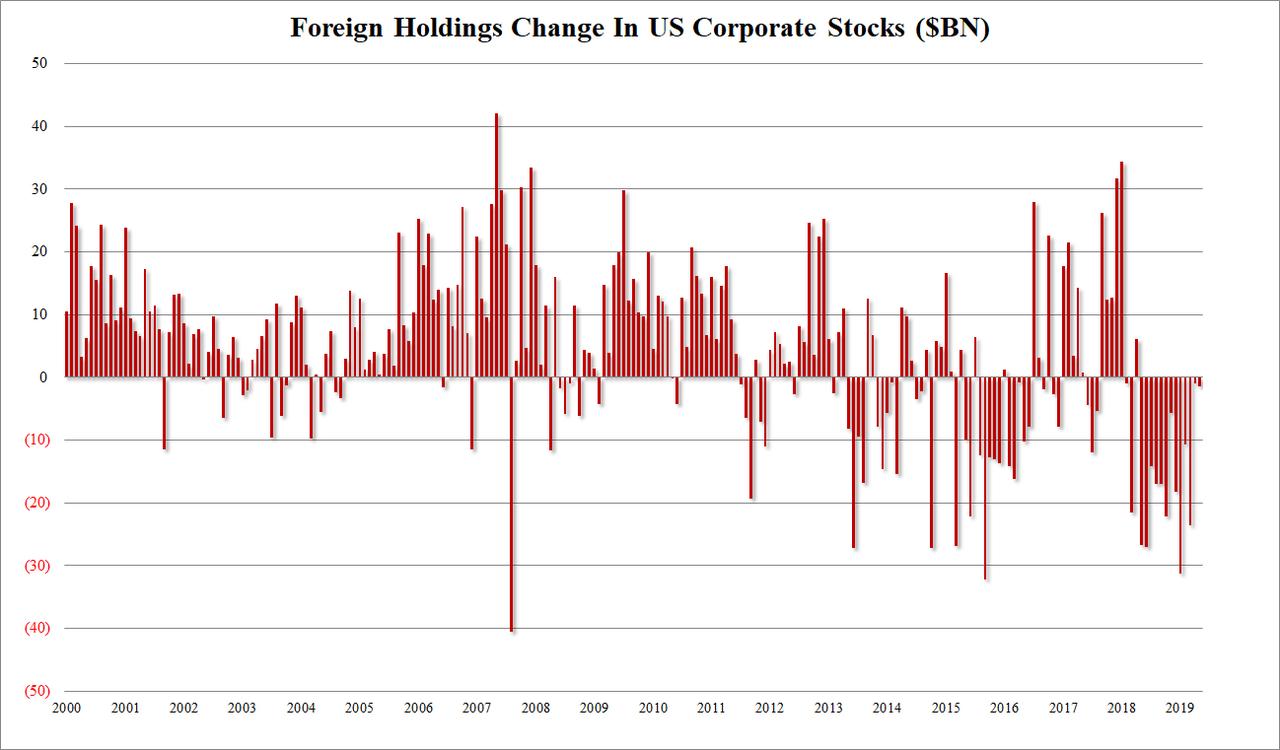

However, for yet another month, the real action was away from the bond market, and in US stocks, where TIC data showed that foreigners sold US stocks for a record 13th consecutive month and 153 of the past 16:

The aggregate $215 billion in sales in the past 13 months, is the largest liquidation of US equities by foreigners on record.

And while it is perhaps not surprising that in May foreigners dumped US stocks – after all it was the worst month for the S&P in 2019 – what is odd, is that in June and July, US stocks barely noticed the ongoing liquidation, and after several attempts at taking out 3,000 in the S&P, finally pushed right through in July, despite what we showed just this weekend continues to be relentless selling by both individual and institutional investors, and – now – also by foreigners.

So with the S&P at all time highs, are we going to find out in two months that foreigners continued to dump anything that wasn’t nailed down?