via upfina:

Even though in the few days leading up to the September Fed meeting, the CME Group FedWatch tool showed a declining chance of a rate cut (it fell to near 50%), the Fed did exactly what was expected by cutting rates on Wednesday. The CME Group tool was impacted by the selloff in the repo market. Because of this selloff in the repo market and the spike in the effective Fed funds rate, the Fed took a few additional actions unrelated to monetary policies that have an economic objective.

The effective Fed funds rate spiked from 2.13% on September 12th to 2.3% on the 17th. Therefore, the Fed lowered the IOER (interest rate on excess reserves) by 30 basis points, authorized temporary Open Market Operations, and allowed organic balance sheet expansion. Whenever the Fed does anything new it gets criticized. It’s easy to claim such action is a negative signal and that this organic balance sheet expansion is another round of QE, but it’s not, at least not yet.

Notable Dissent

The stock market didn’t react much to the Fed’s statement because it didn’t change much. It reacted to Powell’s testimony which we will review in the next section. The most interesting aspect of the Fed’s announcement was the vote. There were 3 dissents which is the highest since 2013. It’s no surprise there is dissent because economic policy i.e. the trade war, is highly unpredictable. Bullard favored a 50 basis point cut. That could be problematic because the Fed funds rate would be close to the zero bound without a recession. There would be less ammo to deal with a recession. Plus, in the event of a trade deal and cyclical upturn, the Fed could quickly have an inflation problem (even core PCE) in early 2020.

Dots show no FOMC member thinks we'll need more than ONE additional cut https://t.co/kStPX386aJ pic.twitter.com/4wMKKH3gWl

— Myles Udland (@MylesUdland) September 18, 2019

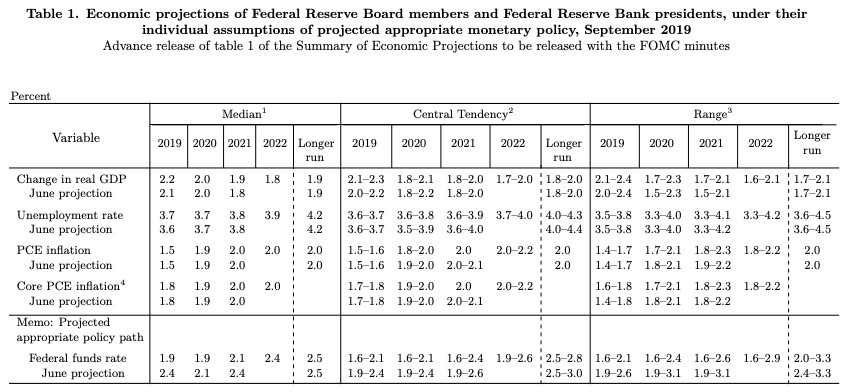

On the other hand, Rosengren and George voted for no cut. As you can see from the Fed’s dot plot above, the median estimate sees no cuts for the rest of the year and next year and then a hike in 2021. You probably shouldn’t take 2021 policy estimates very seriously since the Fed didn’t guide for any cuts this year back in June. Also, in the presser, Powell essentially stated he’s going meeting by meeting and if the data changes, policy will change. There’s not much visibility into December 2019 let alone 2021. To be clear, the CME Group FedWatch tool shows there is a 49.2% chance of a cut by the end of this year.

Powell’s Hawkish Presser

The stock market reacted mostly to Powell’s presser as it fell and then rose. You can tell this was a hawkish presser because the yield curve flattened as you can see from the chart below.

US 2/10 yield curve flattens to 3 bps after Fed's 'hawkish' rate cut. pic.twitter.com/NfTpZW2aLn

— Jamie McGeever (@ReutersJamie) September 18, 2019

If you think a steepening after an inversion signals a recession like it has in recent cycles, flattening is actually good news.

The key reason this was a hawkish presser is that Powell didn’t support further easing. He left it open when he stated, “If the economy does turn down, then a more extensive sequence of rate cuts will be appropriate. We don’t see that. It’s not what we expect. We made one decision today, and that decision was to lower the funds rate by a quarter percentage point. We believe that action is appropriate to promote our objectives. We’re going to be highly data dependent. I would also say as we often do that we’re not on a preset course.” The Fed really didn’t make one decision on Wednesday. It cut rates and gave guidance. Saying the Fed didn’t make a decision is actually a hawkish decision in itself.

No Negative Rates

The other interesting statement in the presser was on the possibility of negative rates. He stated, “I do not think we’d be looking at using negative rates, I just don’t think those will be at the top of our list. If we were to find ourselves at some future date again at the effective lower bound, again not something we are expecting, then I think we would look at using large scale asset purchases and forward guidance.” We’ve seen the Fed question the effectiveness of QE, but it’s no surprise Powell would suggest it over negative rates because the latter is much more extreme policy. If the Fed isn’t planning on cutting rates below zero, it shouldn’t cut them that much during this slowdown. In a Twitter poll, 57% of our followers stated negative rates are possible and 43% said rates would never go negative.

Fed’s Confusing Guidance

The Fed’s guidance doesn’t make much sense because, as the table below shows, in June the Fed saw 2.1% real GDP growth in 2019 and 2% growth in 2020. Now it sees 2.2% growth in 2019 and 2% in 2020.

Somehow, slightly improved growth was in tune with 2 cuts, which the Fed didn’t see coming as late as June. Nothing in this table made investors believe cuts were coming. The best response here is the Fed is reacting to slowing global growth and the trade war, not the US economy.

Great August Housing Starts

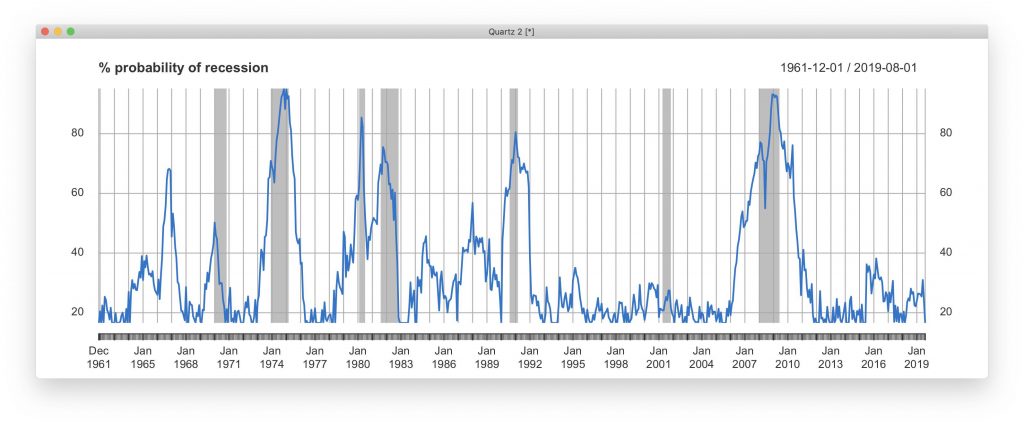

The August housing starts report signals the economy isn’t close to a recession. As you can see from the chart below, just based on permits, the 2 year cumulative recession probability is near 0%.

This model uses the distance from the two year rolling average max in permits. Permits are at a 12 year high. The 3 month average of yearly permits growth is 2.1%. It averaged -6% in the 12 months prior to the past seven recessions. It averaged -13.6% prior to the past five. The 3 month average of housing starts is up 4.6%. The averages prior to the past seven and five recessions were -5.3% and -13%.

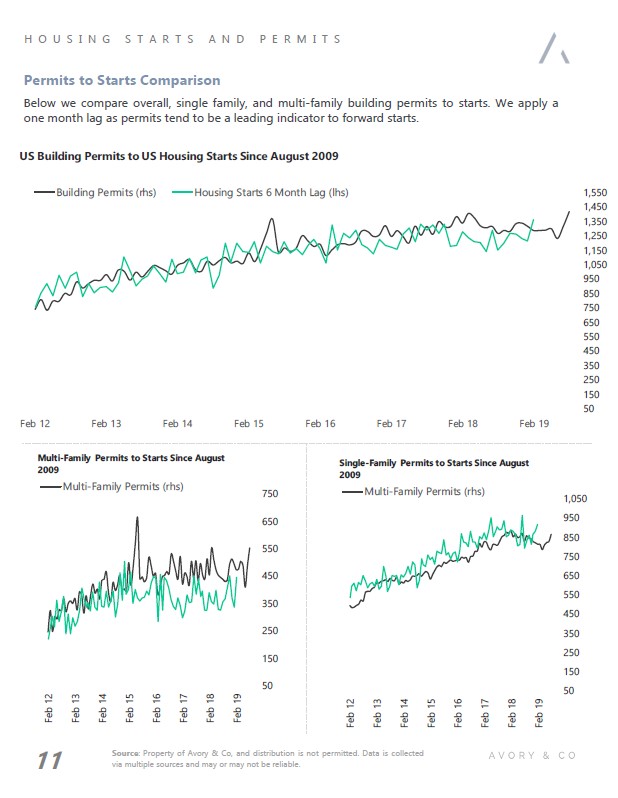

August housing starts were 1.364 million which beat estimates for 1.251 million. It increased from a positively revised 1.215 million (from 1.191 million). This is great news for real residential investment growth. As you can see from the chart below, the permits data signals starts will improve in the next 6 months. Permits increased from 1.317 million to 1.419 million. That beat estimates for just 1.3 million.

Conclusion

The Fed cut rates in July and September. It could cut them again this year. That’s despite there barely being any changes to the Fed’s economic projections. The Fed is cutting rates because of the trade war and global weakness. Housing starts and permits were amazing in August. There is little reason to expect a recession in 2019 based on this data.