via Zerohedge:

While some are ignoring the looming economic crunch and instead blame mortgage convexity hedgers for the sharp move lower in yields in the past week which led to the first inversion in the recession signalling 3M-10Y curve since 2007, even as others do their best to talk down the risk of a recession following yield curve inversion, the slide in yields has continued overnight, with the 10Y yield tumbling as low as 2.35% overnight – the lowest since Dec. 2017 – and the curve inversion hitting a new cycle low of 11bps earlier this morning.

The reason for the latest flush in rates and the associated “crazy, panicky” rates action according to Nomura’s Charlie McElligott, was due to comments from a NYT interview released last night from President Trump’s new Fed nominee Stephen Moore, who said that the Fed should immediately cut rates 50bps, while ECB’s Draghi and Praet again reiterated dovish guidance on both 1) TLTRO (making it more attractive by “tiering”) and 2) potential for deeper NIRP. As a result, global rates are again “foaming at the mouth” with another leg of “panicky grab,” while risk-assets have been “spooked” by the instability seen in the Rates-trade, with Spooz off 16 handles at their lows from earlier best levels, while FX vol saw some “risk off” flow as well as the Swiss Franc trading at the strongest vs EUR since Jul 2017.

For those who missed it, Moore’s interview with the NYT was “full of fireworks”, with McElligott’s summary below:

- Moore stated that the Fed should immediately cut rates 50bps

- “I was really angry” about the Fed’s December hike, Moore told the paper…”I was furious, and Trump was furious too. I just thought that the December rate increase was inexplicable. Commodity prices were already falling dramatically.”

- Moore believes that the Fed should use an index of commodity price changes to drive interest rate policy decisions, a move which would have seemingly meant Rate hikes in the middle of the 2008 recession, as well as at the beginning of the very nascent 2010 / 2011 expansion

- Moore is sorry he called for Fed Chair Powell to step-down after the FOMC raised interest rates in December—now instead saying “…hopefully I could work with Powell to get him shifted over to a more pro-growth” policy, LOL

- Moore too acknowledged that his hyperinflation predictions / criticisms of QE policy during the Obama years were incorrect

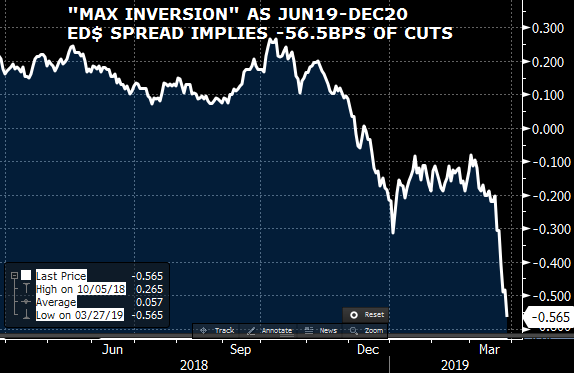

Whether or not following Moore’s “guidance”, or just due to rising economic pessimism, the Eurodollar market now sees over 2 full rate cuts by December 2020.

“WE WERE…INVERTED”:

The move in Rates, which are now pricing-in multiple Fed cuts, has been so profound that the Nomura strategist suggests the Fed’s Kaplan was “rolled-out” to counter the market behavior via comments to the WSJ in an interview piece released at 5:32am EST this morning, stating that it is “too soon” for the Fed to consider cutting rates.

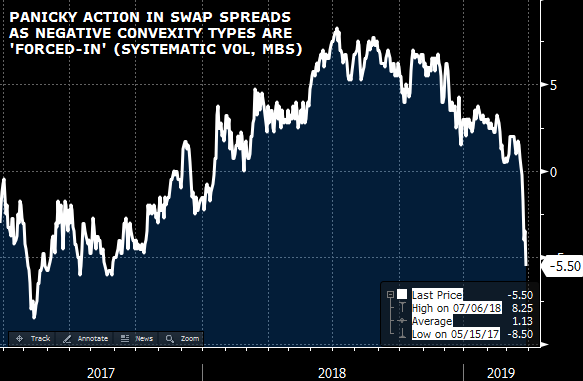

So far it has not helped, with the overnight action exacerbated by further “forced-in” moves by the abovementioned MBS convexity hedgers, as swap spreads continue to collapse.

“SCARY HOURS” IN 10Y SWAP SPREADS:

Meanwhile, as attention is squarely focused on the curve inversion, recall that the time to panic – as Goldman reminded readers yesterday – is when the curve proceeds to re-steepen next, something it has been doing in the 5s30s interval for now. Commenting on the latest steepening in the 5s30s, which earlier touched fresh highs last seen in Nov17, McElligott ascribes this to Fed’s Rosengren stating that he favors shortening the WAM (weighted avg maturity) of the Fed’s UST portfolio

This again speaks to the rationale provided behind our recent advocacy of a “Reverse Operation Twist” where the Fed would increase the share of US T-Bills via reinvestment proceeds, which too then later allows flexibility for the Fed to then take the policy step of lengthening the maturing of its B-S the next time a significant economic downturn occurs

This public debate on the composition of the B-S is picking-up steam as they follow comments on the topic Monday from both Fed’s Harker and Evans, indicating policy tweaks to the SOMA WAM are increasingly likely in my eyes

Summarizing the violent action, here is McElligott’s conclusion: “Rates raging” again with an extension of UST- / swap spread- / front-end- / front-end flattener- “stop-ins” again “going off” overnight, with likely “exacerbation” culprits again being “negative convexity” types from MBS- and systematic “short vol” strategies.”