by GoldCore

-

Gold bullion tends to rise January and February before Chinese New Year (see table)

-

Gold is nearly 8% and $100 higher since Fed raised rates one month ago

- Options traders are bullish and suggest gold has room to run (see chart)

- Nervous in short term, positive in medium term – gold at $1,500 in 2018

From Bloomberg:

Gold’s breakneck rally eased this week, but tailwinds in both physical and paper markets suggest it’s got room to run.

Chinese New Year buying and option prices suggest the stars are aligning for the metal to extend its 6 percent gain over the past month.

“I’m always a bit nervous when gold prices rise this much, this fast,” said Mark O’Byrne, director of bullion dealer GoldCore Ltd. “But there certainly is healthy demand from China and the futures market — I think we should break highs above $1,400 later in the year.”

Options traders are betting on at least another month of rising prices. They’re charging more for benchmark call contracts than for similar puts, and by the biggest premium since November. The bias, measured in implied volatility, has increased to about 0.6 percentage points.

Gold tends to do well in January and February. That’s when demand spikes in the biggest consuming nation, China. Over the past decade, the metal advanced by about 6 percent on average in the first two months combined. The Lunar New Year, which is often celebrated with gifts of gold in much of Asia, falls on Feb. 16 in 2018.

January has historically been gold’s strongest Still, a technical indicator points to a rally that may have grown tired.

Still, a technical indicator points to a rally that may have grown tired.

The metal, which reached a four-month high this week, crossed into 2018 with an eight-day rally, the longest string of increases since 2011. Now, it’s considered overbought, according to the relative-strength index, a gauge of momentum.

As gold futures are quoted in the U.S. currency, its upswing somewhat depends on whether the greenback’s losing streak continues.

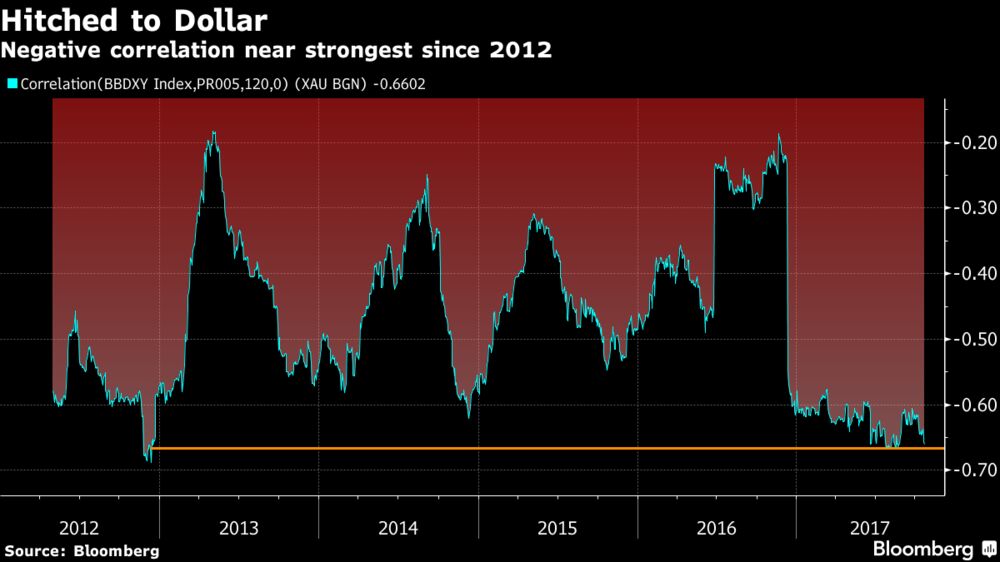

Option prices signal that traders foresee the dollar falling over the next month against the euro, yen and pound. That’s good news for bullion: The 120-day price pattern is close to its strongest negative correlation since late 2012.

GoldCore Note

Gold is due a correction after its $100 rally since the Fed raised rates. A near 8% gain in a month is quite a move up in a short period of time and ordinarily one would expect a correction. Frequently a 50% retracement of the gains takes place. This could take us back to the $1,300 level which acted as resistance before. Previous resistance frequently becomes support.

We are a little cautious in the very short term but very positive in the medium term and see gold over $1,500 in 2018.

Fed Increases Rates 0.25% – Rising Interest Rates Positive For Gold

Gold’s Positives – Rising Interest Rates and Negative Rates

News and Commentary

Gold flat as U.S. Treasury yields rise (Reuters.com)

Gold inches up, but heads for first weekly loss in six (Reuters.com)

Asian Stocks Rise, Even in Face of Climb in Yields (Bloomberg.com)

Gold suffers biggest one-day decline in more than a month | January 18, 2018 (MorningStar.com)

U.S. Stocks Mixed Following Wednesday’s Records (Bloomberg.com)

U.S. Stocks Mixed Following Wednesday’s Records (Bloomberg.com)

Source: Bloomberg

Gold ETF Holdings Surge as Cryptocurrencies Collapse (Bloomberg.com)

Don’t pile into property in 2018 (MoneyWeek.com)

Global housing markets are warning that the cheap money is running out (MoneyWeek.com)

Investors Turning To Gold As Inflation Risks Resurface: Rhind (Bloomberg.com)

2018 to be Good Year For Gold And Precious Metals (Bloomberg.com)

Weak Dollar Poses a $3.4 Trillion Question for U.S. Credit Markets (Bloomberg.com)

Gold Prices (LBMA AM)

18 Jan: USD 1,329.75, GBP 961.14 & EUR 1,088.40 per ounce

17 Jan: USD 1,337.35, GBP 969.45 & EUR 1,092.48 per ounce

16 Jan: USD 1,334.95, GBP 970.38 & EUR 1,091.32 per ounce

15 Jan: USD 1,343.00, GBP 971.93 & EUR 1,092.93 per ounce

12 Jan: USD 1,332.90, GBP 978.75 & EUR 1,099.78 per ounce

11 Jan: USD 1,319.85, GBP 978.14 & EUR 1,104.45 per ounce

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

Silver Prices (LBMA)

18 Jan: USD 17.09, GBP 12.31 & EUR 13.96 per ounce

17 Jan: USD 17.21, GBP 12.49 & EUR 14.10 per ounce

16 Jan: USD 17.10, GBP 12.43 & EUR 13.99 per ounce

15 Jan: USD 17.12, GBP 12.58 & EUR 14.14 per ounce

12 Jan: USD 17.12, GBP 12.56 & EUR 14.12 per ounce

11 Jan: USD 17.01, GBP 12.64 & EUR 14.24 per ounce

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

Recent Market Updates

– Digital Gold Flight To Physical Gold Coins and Bars

– Gold and Silver Bullion Are Only “Safe Investments Left” – Stockman

– Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

– London Property Crash Looms As Prices Drop To 2 1/2 Year Low

– Gold Bullion Up 1% In Week, Heads For 5th Weekly Gain As Bonds Sell Off

– Gold Prices Rise To $1,326/oz as China U.S. Treasury Buying Report Creates Volatility

– Gold Hits All-Time Highs Priced In Emerging Market Currencies

– World is $233 Trillion In Debt: UK Personal Debt At New Record

– 10 Reasons Why You Should Add To Your Gold Holdings

– Spectre, Meltdown Highlight Online Banking and Digital Gold Risks

– Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

– Gold Has Best Year Since 2010 With Near 14% Gain In 2017

– Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift