via Zerohedge:

Amid the celebrations that the impromptu US trade war with Mexico may be canceled, or at least postponed, one may be excused to forget that relations between Washington and Beijing are deteriorating by the hour. Luckily, Goldman – which initially was wrong about the outcome of the nascent trade feud and expected a relatively smooth resolution – is there to remind us, and in a Sunday note by the bank’s EM FX strategists, writes that “given the recent developments in the US-China trade tensions, we have revised our base-case scenario and now expect a 10% US tariff rate by July on the final USD 300bn of Chinese imports.”

While the bank still think an eventual deal could lead to a removal of the tariffs, “it is likely only in late 2019 or early 2020”, a view which differs from the bank’s previous view, in which it expected no deal at G20 but a pause on new tariffs with the 25% tariff on USD 250bn of imports gradually phased out by late 2019-2020.

The implications of this bear case scenario in the trade dispute manifesting itself are extensive, and have directly affected the FX market resulting in substantial dollar strength, although as the FX strategists note, “the pillars of US dollar support are starting to give way”, for the following reasons:

- First, the US-China trade conflict risks damaging US growth, primarily through tighter financial conditions.

- Second, US cyclical outperformance has diminished.

- Third, while the Fed was raising rates last year, Goldman economists now see an increasing risk of cuts.

So in terms of the dollar, Goldman’s latest forecast revisions now see the trade-weighted index falling by 1% over the next 3 months and 4% over the next year (and the DXY index by 1% and 5% over the same periods).

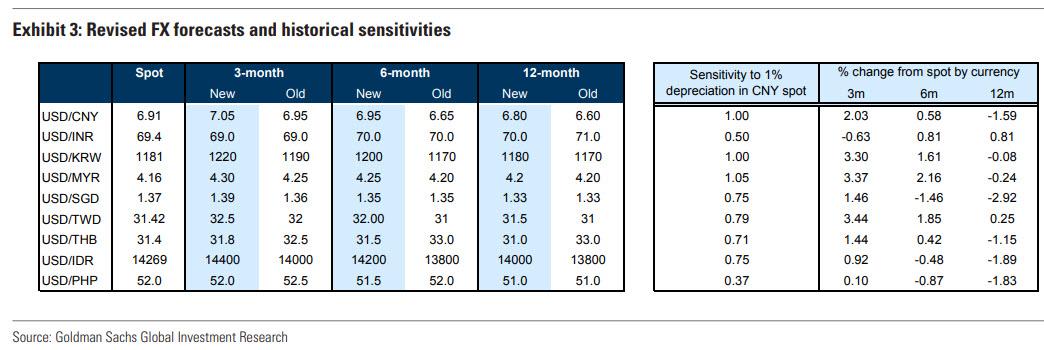

Yet any global dollar weakness would be offset by even greater weakness in the Yuan, according to Goldman. Specifically, the bank now sees “scope for further US dollar appreciation” against the Yuan, and as a result it has revised its USD/CNY forecasts higher to 7.05, 6.95, and 6.80 on a 3M, 6M and 12M outlook (from 6.95, 6.65 and 6.60 previously). This is remarkable, because if Goldman is right, not only will the yuan breach what many have said is the PBOC’s “redline” level of 7.00 vs the USD, which to many is also the catalyst for a resumption in aggressive capital flight from China, but would also mean the lowest level of the yuan since the financial crisis – the last time the USDCNY traded above 7.00 was in March 2008, just after Bear Stears collapsed. This, in turn, was shortly after China began strengthening the yuan after a decade of “fixing” the currency at almost exactly 8.28 as shown in the chart below.

That said, Goldman caveats that the case for further CNY depreciation is “not clear-cut”. To be sure, as discussed here last week, the PBOC last Friday said that there is “tremendous” room to ease monetary policy, sending the yuan tumbling to the lowest level since November 2018. In this vein, as Goldman explains, “given our base-case assumption for tariffs to go up further, one possible policy response by Chinese authorities could be to allow currency depreciation to naturally offset the impact of tariffs. However, we note that a move from 6.70 to 6.90 is not the same as a move from 6.90 to 7.10, given the associated costs and risks of breaking above the key psychological level of 7.0, as the latter could potentially re-ignite capital outflow pressures” (and also send cryptocurrencies soaring as Chinese residents seek to bypass China’s capital account firewall using bitcoin).

Instead of using just FX to offset rising tariffs, Goldman does not think that “China will use just currency depreciation to offset the impact of tariffs but rather a combination of FX depreciation, more domestic stimulus and allowing for slightly lower growth than otherwise, should trade tensions linger as we expect.”

Then there is the political fallout: a significant depreciation in the yuan will be interpreted by the Trump admin as further escalation, which could aggravate trade tensions even further. Notably, US Treasury Secretary Mnuchin has already commented on June 8 that China was allowing the value of its currency to slide in a bid to offset tariffs.

Finally, according to Goldman’s FX team, a sharp CNY depreciation is not in China’s interest either as it may affect international equity and bond investors, while China is being phased into various bond and equity indices. As such, Goldman forecasts “just the tip”, as it thinks “the USD/CNY will break above 7.0 just modestly before coming back down below 7.0″ with the following amusing footnote: “assuming a deal is eventually reached.”

And another consideration highlighted by Goldman is similar to the comments made by PBOC governor Yi Gang last week, namely that while there are costs and risks associated with allowing USD/CNY to breach 7.0, “we would not overemphasize them” for three reasons:

- First, the capital controls put in place after the capital outflows in 2015 have been and should continue to prove effective.

- Second, just as the US perceives an advantage in negotiating with tariffs in place, Chinese policymakers may determine that compromises are more forthcoming following a sizable CNY depreciation in the bag.

- Third, authorities should and will manage the pace of depreciation so that it is gradual and such that it is not seen as a one-way move, by managing the currency back and forth around the 7.0 mark.

As a result, while Goldman expects the dollar to slide alongside the yuan, it sees the dollar actually rising against most Asian currencies, all of which are exposed in some part to future yuan weakness:

In short, among the AEJ currencies, Malaysia, South Korea, Taiwan and Indonesia are most sensitive to a move in USD/CNY, while Philippines, India and Thailand are relatively less sensitive. This pattern can be explained by trade linkages with China, and narrowing it down, “KRW, TWD, MYR and IDR should be most sensitive to a move higher in USD/CNY”, while PHP, INR and THB should outperform on a move higher in USD/CNY .

Putting it all together, here are Goldman’s latest trade recos:

- Long INR vs short CNH (CNH/INR entry spot reference 9.99; entry indexed at 100, target 106, stop 97)

- Long PHP vs short KRW (PHP/KRW entry spot reference 22.78, entry indexed at 100, target 106, stop 97)

- Hold onto short SGD vs top-8 currencies in GS SGD NEER index (entry 100, current 100.35, target 98, stop 101).

- Hold onto long INR 5Y bond / swap trade (entry 125bp, current 123bp, target 70bp, stop 155bp)

- Hold onto CNY 2Y receivers vs KRW 2Y payers (entry 120bp, current 124bp, target 90bp, stop 135bp)

One final point: considering the accuracy of Goldman’s recent, and not so recent, predictions (the bank expected 4 Fed rate hikes last December), a cynical take of today’s forecast revision would be terrible news for yuan bears as it would guarantee that the Chinese currency will never dip below 7.

And now cue China Daily articles that slam Goldman with the same fury that China lashed out at George Soros back in early 2016, just months after China’s yuan devaluation went terribly wrong and cost Beijing $1 trillion in reserves to reverse the massive outflows that resulted.