And Now The Hangover: Goldman Sees Sharp Deceleration In US Economic Growth In 2022

It was good while it lasted, but the party is finally ending.

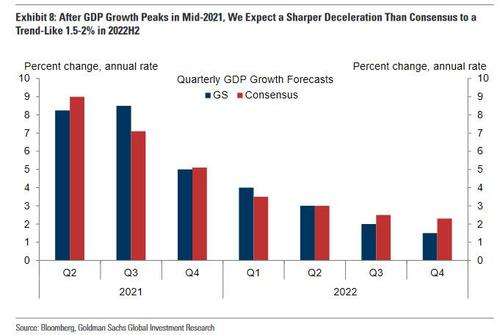

One day after we reported that unemployed households which no longer receive emergency benefits are suddenly spending far less, and on the same day we read about an “unprecedented spike” in evictions as foreclosure moratoriums end, the only thing missing was a sellside downgrade to the US economy. Well, we got just that early this morning, when Goldman – which last year was the first bank to unveil materially above consensus GDP projections – cut its 2021 second half consumption growth forecast, resulting in 1% downgrade to its GDP growth forecasts for Q3 and Q4 to +8.5% and +5.0%, respectively, “as it is becoming apparent that the service sector recovery in the US is unlikely to be as robust as the bank had expected. Which is odd considering the trillions in monetary and fiscal stimulus that have entered into the economy. One wonder how many more trillions would be needed for Goldman to be happy.

But while Goldman’s expected 2021 slowdown is manageable, it gets far worse in 2022, when the sluggishness is expected to truly hammer the growth rate, which Goldman now expected to shrink to a trend-like 1.5% – 2% by the second half of 2022, a far “sharper deceleration than consensus expects.”

Biden’s Broken Economy: Cars and Computers Orders Slump as Shortages Drag Durable Goods

Orders and shipments of computers and autos fell in June as consumers, dealers, and manufacturers continue to struggle with shortages in parts and labor, as well as soaring shipping and materials costs.

New orders for motor vehicles fell 0.3 percent in June, after rising 2.0 percent in May, data from the Commerce Department said Tuesday. Shipments of cars and trucks fell 0.5 percent.

Similarly, orders of computers and related products fell 0.6 percent and shipments declined 1.7 percent.

Orders for appliances were flat for the month while shipments rose one percent.

Longtime market bull Phil Orlando is bracing for a rough stretch because Wall Street has reached a critical “inflection point.”

The Federated Hermes chief equity market strategist is blaming the risk dynamic. Not only does Orlando see hotter-than-expected inflation and the Covid-19 delta variant as glaring issues, he’s also worried about uncertainty surrounding monetary and fiscal policy.

“We’re entering what is historically a seasonally choppy period of time, and we’ve got a bunch of things that are coming together at the same time,” he told CNBC’s “Trading Nation” on Monday. “We’ve got this surging inflation. We’ve got questions about what the Federal Reserve is going to do in terms of policy. We’ve got this debt ceiling issue that’s coming up the end of this week.”