by BoatSurfer600

via kingworldnews:

Here is a look at what is happening behind the scenes in the gold and silver markets.

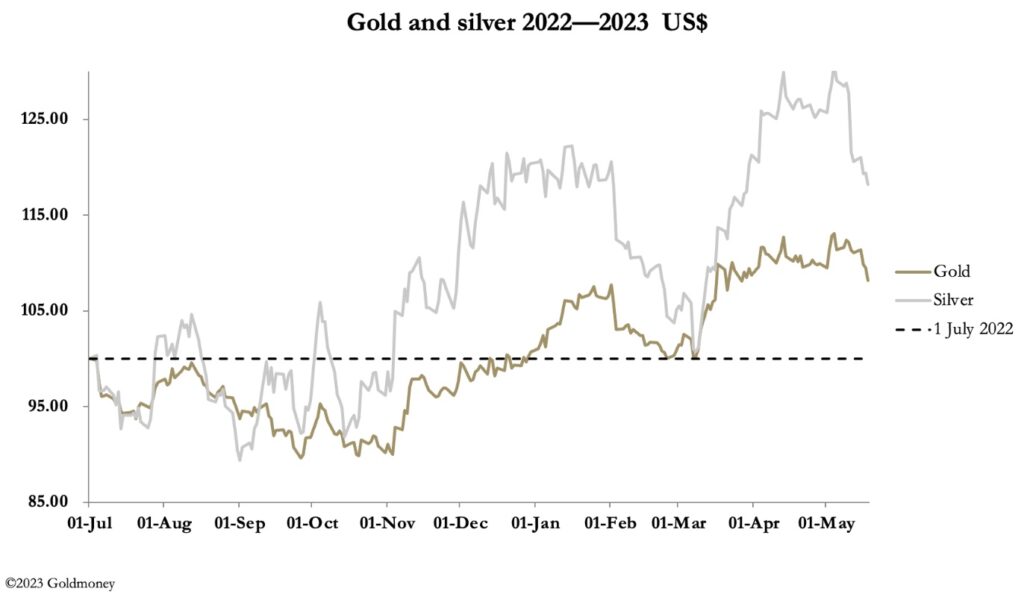

May 19 (King World News) – Alasdair Macleod:Gold and silver prices declined this week, as the shorts mounted an attack on speculating longs. In Europe this morning, gold was trading at $1965, down $46 from last Friday’s close, and silver was at $23.69, down 25 cents on the week.

Gold Demand ‘Will Increase Fourfold’ as Inflation, Qe, Debt and Deficits Impact U.S. – Rick Rule

Gold Gets Lifeline From Renewed Banking Jitters, Powell Comments

Gold rallied 1% on Friday, recouping some losses from earlier this week, on renewed worries about the stability of the banking sector, while traders slashed bets for another interest rate hike following remarks from the U.S. Federal Reserve chairman.

UBS Sees Three Reasons to Buy Gold

Gold fell on Thursday. If you like it UBS Global Wealth Management outline three reasons to buy. 1. Central bank demand should remain robust…