Source: www.federalreserve.gov/releases/h8/20230519/

fred.stlouisfed.org/series/DPSACBW027SBOG

EDIT: I was originally using the not seasonally adjusted data instead of seasonally adjusted data. Have edited all the numbers to reflect (outside of the title). Apologies for the mix up–what I get for trying to do more than 1 thing at a time -.-

Domestically chartered commercial banks divested $87 billion in assets to nonbank institutions in the week ending March 29, 2023. The major asset item affected was the following: securities, $87 billion.

Domestically chartered commercial banks divested $87 billion in assets to nonbank institutions in the week ending March 22, 2023. The major asset items affected were the following: securities, $27 billion; and loans, $60 billion.

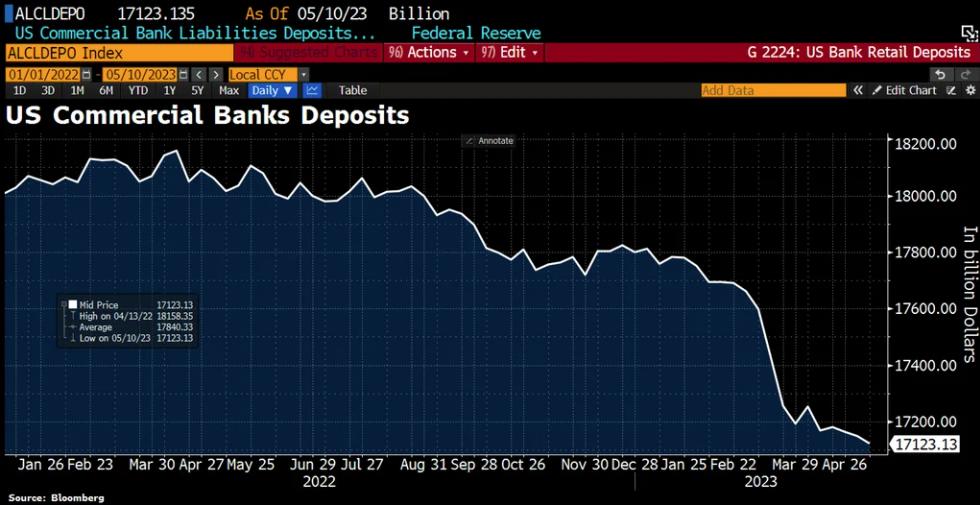

A little over a year ago (4/13/2022) the high was hit at $18,158.3536 billion

| Date | Deposits, All Commercial Banks (billions) | Down from all time high (billions) |

|---|---|---|

| 4/13/2022 | $18,158 | 0 |

| 2/22/2023 (Run picks up speed) | $17,690 | -$468 billion |

| 3/1/2023 | $17,662 | -$496 billion |

| 3/8/2023 | $17,599 | -$559 billion |

| 3/15/2023 | $17,428 | -$730 billion |

| 3/22/2023 | $17,256 | -$902 billion |

| 3/29/2023 | $17,192 | -$966 billion |

| 4/5/2023 | $17,253 | -$905 billion |

| 4/12/2023 | $17,168 | -$990 billion |

| 4/19/2023 | $17,180 | -$978 billion |

| 4/26/2023 | $17,164 | -$994 billion |

| 5/3/2023 | $17,149 | -$1,009 billion |

| 5/10/2023 | $17,123 | -$1,035 billion |

TLDRS:

- Folks have pulled $1,035 billion in deposits since 4/13/2022

- Folks have pulled $567 billion in deposits since 2/22/2023

- Folks have pulled $45 billion in deposits since 4/12/2023

- Folks have pulled $26 billion in deposits 5/3-5/10

- The bank run continues and picks up more speed!

EDIT: I was originally using the not seasonally adjusted data instead of seasonally adjusted data. Have edited all the numbers to reflect (outside of the title). Apologies for the mix up–what I get for trying to do more than 1 thing at a time -.-

Bank stocks dip as Janet Yellen calls for more mergers – report