Inflation keeps rising and wage earners continue to suffer.

Today’s inflation print shows headline CPI YoY at 5.4% and core CPI YoY are 4.5%, the highest since 1991.

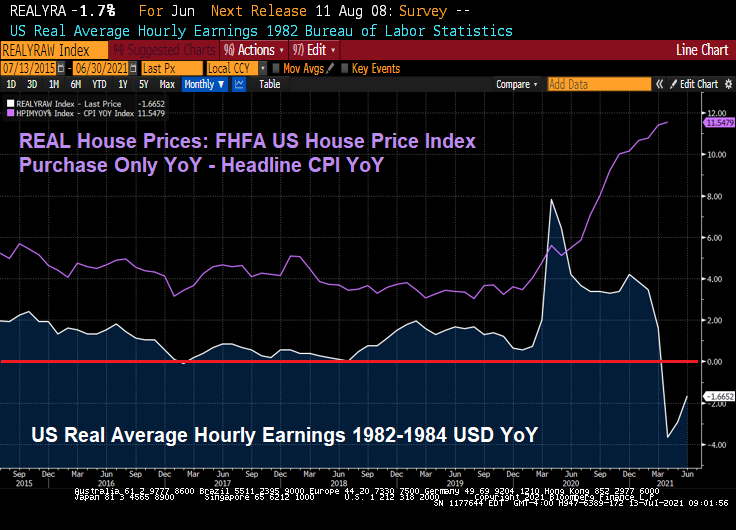

The problem is that real average hourly earnings printed at -1.7% YoY.

0.9% June inflation x 12 months = 10.8% Run Rate Inflation.

If we look at REAL house prices (FHFA HPI Purchase Only YoY – Headline CPI YoY) and REAL US average hourly earnings YoY, we can see a real problem created by excessive Fed money printing and Federal government spending. It is the proverbial “Devil In Disguise.”

Then we have the CPI Owners Equivalent Rent of Residences YoY printing at 2.3%. This compares with home prices growing at 15.7% YoY.

For an alternative inflation measures and better measures of rent inflation, see the Penn State/ACY CPI Index.

Time to cut back on Fed monetary stimulus and/or Federal government spending?