The cold truth is homelessness and soaring rents are the only possible outputs of central bank policies that inflate asset bubbles.

It’s been a long, strange economic boom since the nadir of the Global Financial Meltdown in 2009. A 10-year long boom that saw the S&P 500 rise from 666 in early 2009 to 2,780 and GDP rise by 43% has been slightly more uneven for most participants.

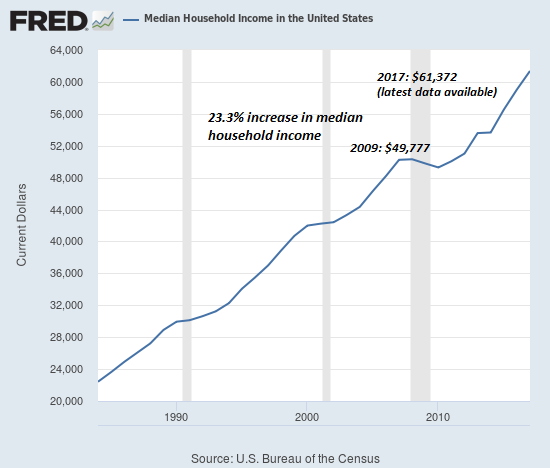

First and most importantly, household income hasn’t risen by the same percentages as assets, GDP or costs of big-ticket expenses such as rent, healthcare and college tuition. The broadest measure of income, median household income, has registered a 23% increase in the past decade, roughly half of GDP gains and a mere fraction of stock market and housing gains.

It’s well known income gains have skewed to the top, as revealed by Census Bureau data: Historical Income Tables: Household (US Census Bureau).

The bottom quintile (20%) registered income gains of 20% from 2009 to 2017, while the middle quintile (roughly speaking, the middle class) gained 25.5% and the top 5% enjoyed a 31.6% gain.

The raw numbers tell the story in a slightly more visceral fashion:

Upper limit of bottom quintile: $24,638 up 20% since 2009

Upper limit of middle quintile: $77,552 up 25.5% since 2009

Lower limit of top 5%: $237,034 up 31.6% since 2009

(the median household income is much higher–around $350,000 according to Household Income Quintiles the Tax Policy Center.)

So the top 5% earn at a minimum 10 times the lowest quintile income and around 4 or 5 times the middle quintile income.

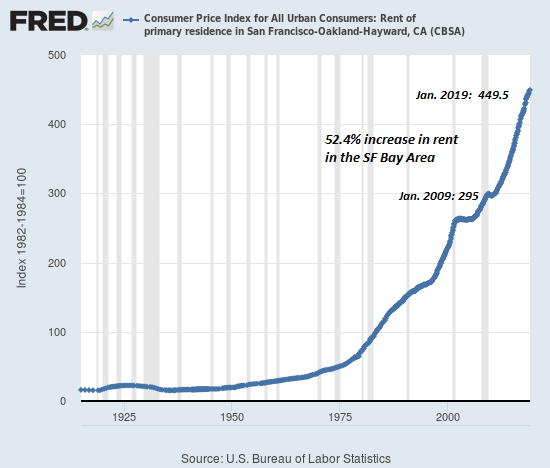

Here in Northern California, this has manifested in rapidly expanding homeless encampments a stone’s throw away from new luxury rental apartmentscharging $3,000 and up for one-bedroom flats and $4,000 and up for two-bedroom flats.

Meanwhile, the streets are filled with potholes and cracks. Maintaining streets–presumably one of the core missions of local government–is simply not being done in a timely manner. Major streets are in such disrepair that local businesses have taken to raising banners demanding “pave our street now.”

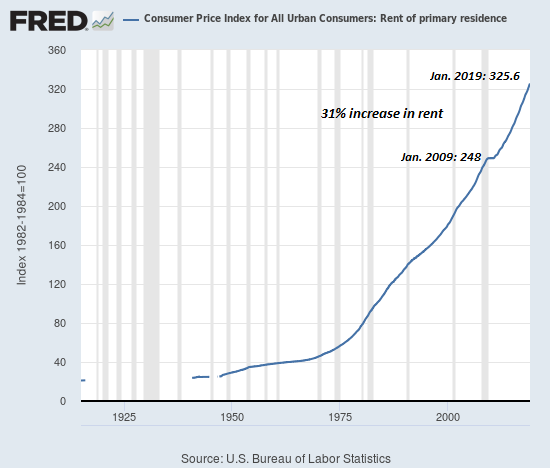

Let’s look at three charts of the long, strange boom from 2009: median household income (up 23%), national rents (up 31%) and rent in the San Francisco Bay Area (up 52.4%). Rents are double the gains in median household income in many cities.

The tens of thousands of pricey rentals being built in the region assume an endless expansion of well-paid techie jobs filled by young techies who are happy to sacrifice all hope of ever owning a home in the region ($900,000 for a 100-year old bungalow on a 5,000 square foot lot) or having a family unless they cash in on an IPO or marry a techie who already cashed in.

Sadly, the affordable housing fees collected by cities (up to $10 million per project) are not enough to address the unprecedented need for affordable housing and low-cost housing solutions for the homeless and near-homeless.

What’s behind the soaring cost of housing? It’s really pretty simple: the extended near-zero interest rates and unlimited liquidity pushed by the Federal Reserve as the “solution” for recession have impoverished the bottom 80% and put ownership of capital out of reach for all but the top 5%.

Though the mainstream media punditry and the political class will deny this, the cold truth is homelessness and soaring rents are the only possible outputs of central bank policies that inflate asset bubbles that inevitably outpace the wages needed to pay the soaring cost of rent and housing.