As the late, great economist Milton Friedman said “If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand.”

The same applies to housing.

(Bloomberg Quint) — The biggest wave of tenants in U.S. history has arrived, and landlords are responding with the largest-ever rent increases. In the second quarter, the number of occupied units jumped by about half a million, the biggest annual increase in data going back to 1993, according to industry consultant RealPage Inc. Rents on newly signed leases soared 14.6% in June from a year earlier, the most on record, and occupancy reached 96.5%, matching the previous high in 2000.

The rental market is getting flooded with Americans searching for apartments. The economy is revving up, and young people ready to leave their parents’ homes are competing with others who delayed moves because of Covid-19. At the same time, remote work is enabling families to relocate to more-affordable areas, and vaccines have made seniors comfortable again with downsizing.

The end of the federal eviction moratorium last week may provide incentive for some landlords to throw tenants out. Demand is so strong that it won’t be hard to find someone else to move in, at a higher rent.

The Federal government in their Covid relief legislation provided $1,400-per-person stimulus checks and extended unemployment programs through August 29 with a $400/week supplement. Throw in the immigration surge at our southern border and we have Friedman’s shortage of sand metaphor. The Federal government throwing money at a problem (Covid unemployment) and declare a moratorium of rental evictions in the midst of a border surge of immigrants.

We already know that home prices are “k-razy” as Ron Swanson would say. Home prices, thanks in part to The Federal Reserve’s loose monetary policies coupled with supply bottlenecks, are higher today that a the peak of the house price bubble of 2005-2007.

And US home price growth YoY (year-over-year) has a spread over average hourly earnings growth YoY that is even larger than during the house price bubble of 2005-2007.

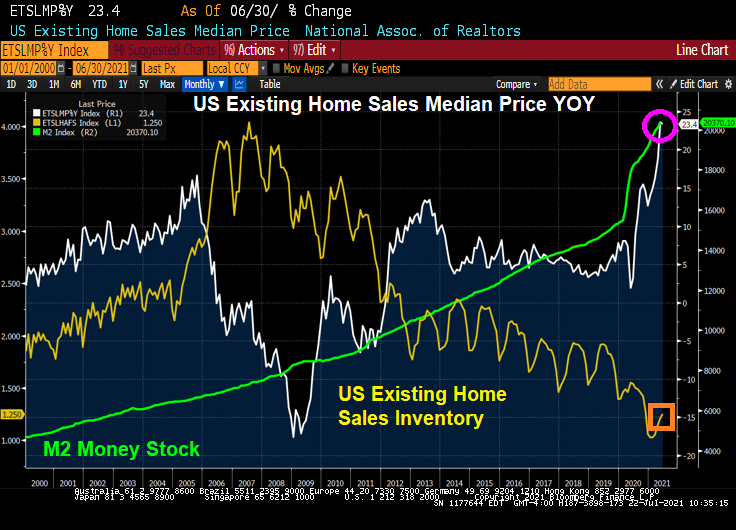

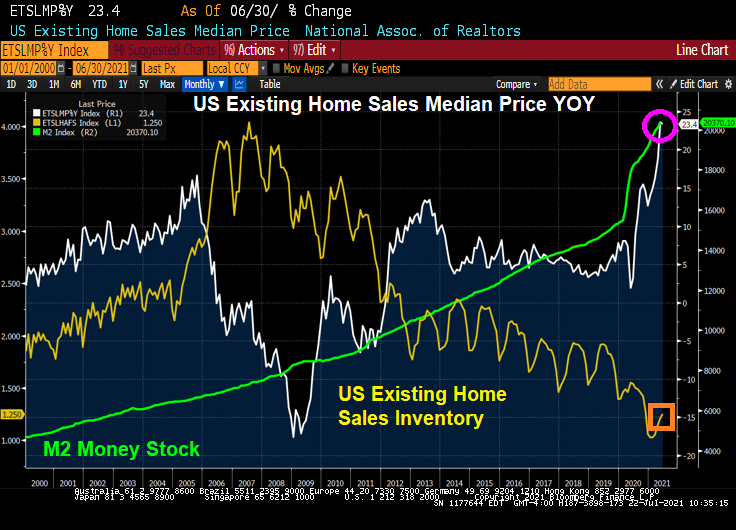

We can see that skyrocketing home prices YoY is being driven by rapidly increasing M2 Money stock and near historic lows in available inventory.

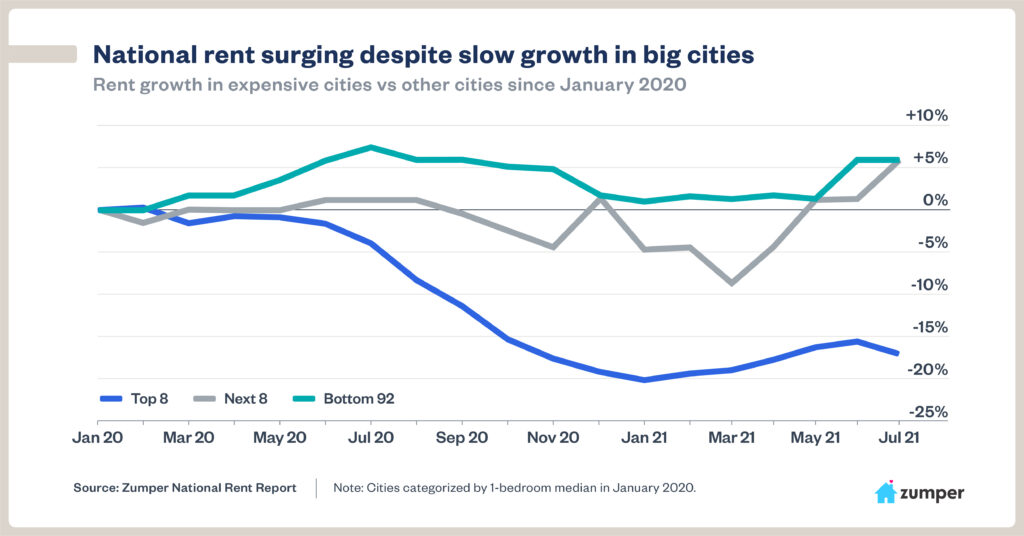

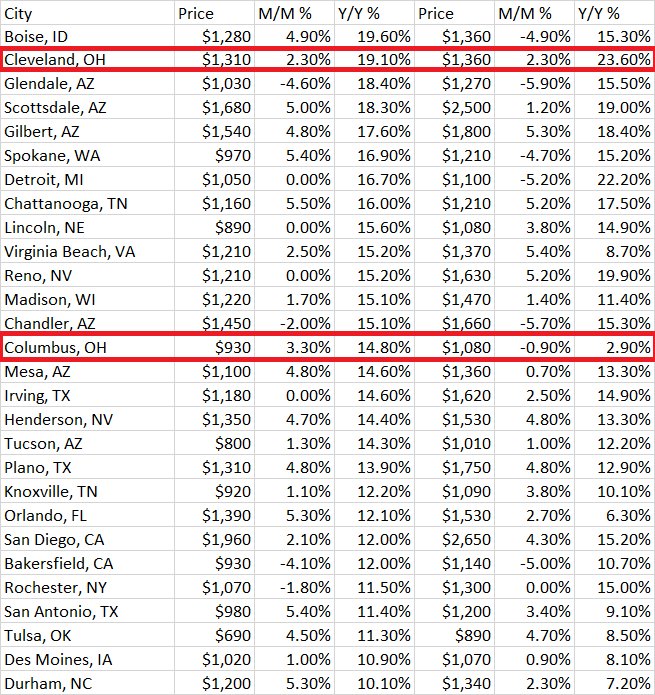

But apartment rents are growing too with Cleveland Ohio rents growing at 20% year-over-year. Here is Zumper’s national rent growth for 2 bedroomsl

But rent growth is slow in big cities and highest in the bottom 92 cities.

Minneapolis, San Francisco, Philadelphia, Oakland and Seattle have seen the largest declines in rent YoY.

The fastest rent growth? Boise Idaho MoM and Cleveland Ohio for 1-unit, both at over 19%. Cleveland has the highest 2 bedroom YoY rate at 23.6%. Columbus Ohio has 1-unit rents growing at 14.80% MoM but 2-unit rents actually declining. There must be a lot of single people moving to Columbus!!

The rental vacancy rate in the US as of Q2 is 6.2%, below the historic average since 1956 of 7.3%.

Getting back to home prices, we can see that skyrocketing home prices YoY is being driven by rapidly increasing M2 Money stock and near historic lows in available inventory.

UPDATE: A group of real estate entities on Wednesday night issued a legal challenge in a D.C. district court to the Centers for Disease Control and Prevention’s (CDC) new eviction moratorium.