Disclaimer: I am not a licensed financial advisor and this is not financial advice. This information provided is just the opinion of an old mountain man.

TLDR: “my people perish for lack of knowledge” “the easy things in life make you fat, sick and dumb.”

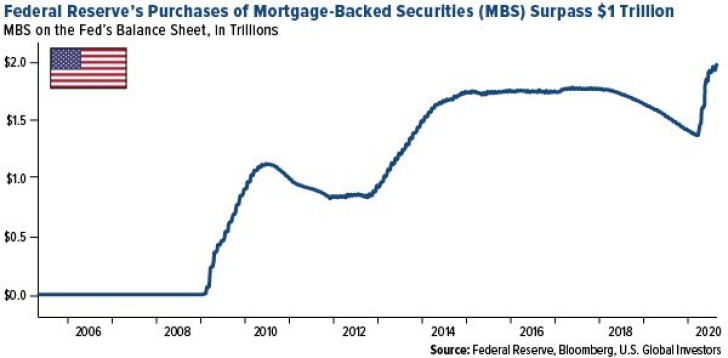

I’m going to start at the bottom floor because unfortunately too many people are completely unaware of how the housing market works. See the below picture:

When you buy a house with a mortgage, most likely that mortgage is not just a debt sitting on a ledger at the bank. Your mortgage, along with the mortgages of thousands, or even tens of thousands of other people, have been bundled together into a financial instrument called a Mortgage Backed Security (MBS). The theory behind these securities is that if you have 1,000 mortgages bundled and then sliced into 1,000 parts if one mortgage defaults, it is only a .1% loss over the entire security.

https://en.wikipedia.org/wiki/Mortgage-backed_security

These security instruments gained a lot of press in the 2007 financial crisis when it was discovered that “toxic” mortgages were rolled within these complex securities and spread around the financial industry.

Many people are unaware of how this systemic problem was “solved.” One of the primary ways was through the Federal Reserve, who began to buy up these toxic MBS in order to restore confidence in the MBS industry.

https://www.federalreserve.gov/newsevents/pressreleases/monetary20081230b.htm

“Well what the heck is this post about Bob? The housing market recovered, so what’s the big deal?”

Well, here is the dirty little secret, they never stopped buying them. Even after the supposed “recovery” the Federal Reserve just kept buying and buying and buying…

https://www.federalreserve.gov/releases/h41/current/

As of last month the Fed held $2,184,684,000,000 in mortgage backed securities.

Step back and ask yourself, if the economy recovered from the financial crisis, why didn’t the fed accelerate their purchasing of MBS’ dramatically in the last 10 years?

This is the black pill: These actions by the Fed aren’t going to stop or reverse in the foreseeable future, in fact it’s not so much a “won’t” as it a “can’t”. Their actions have injected $2 TRILLION dollars into the housing market, and made housing a GOVERNMENT GUARANTEED asset.

https://www.theatlantic.com/technology/archive/2019/02/single-family-landlords-wall-street/582394/

https://www.nytimes.com/2020/03/04/magazine/wall-street-landlords.html

This direct intervention into the market (not to mention their $4 trillion dollars in t-bills) is fast-tracking us back to a serfdom economic model where the wealthy lords own all the property and the non-elite class “own nothing and love it.”

But I fear that we’ll have a full scale revolution on our hands before this happens. The looting that we have been witnessing on the streets has also been happening in our government and wall street, the only difference is the media reports the $200 shoe thief, but not the $100 million hedge fund robber baron.

“Prepare ye the way of the LORD.”

h/t russianbot2020