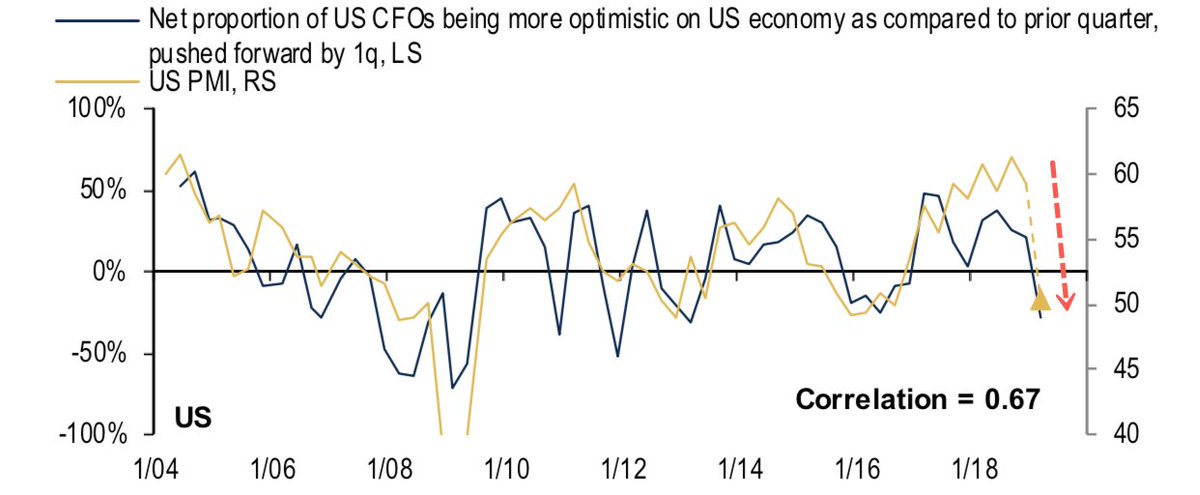

Crashing US CFO Confidence implies PMI of 50.3 in Feb 2019, from 59.3 in Nov 2018. The economy is rapidly slowing, and stock market bulls hope policymakers can reflate assets like ’16 – might be much harder this time.

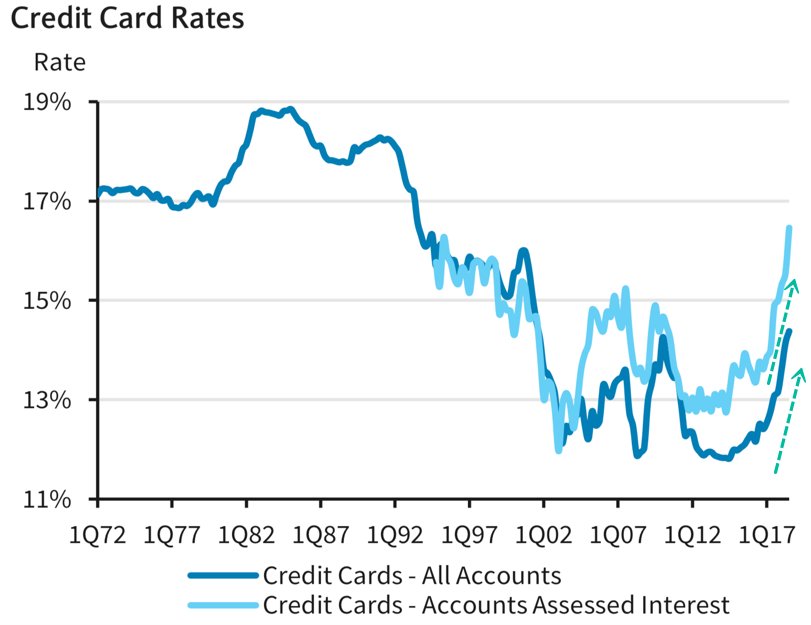

this could be the most bearish chart outlining the US consumer is headed for trouble

Flattening yield curve suggests higher volatility through 2021

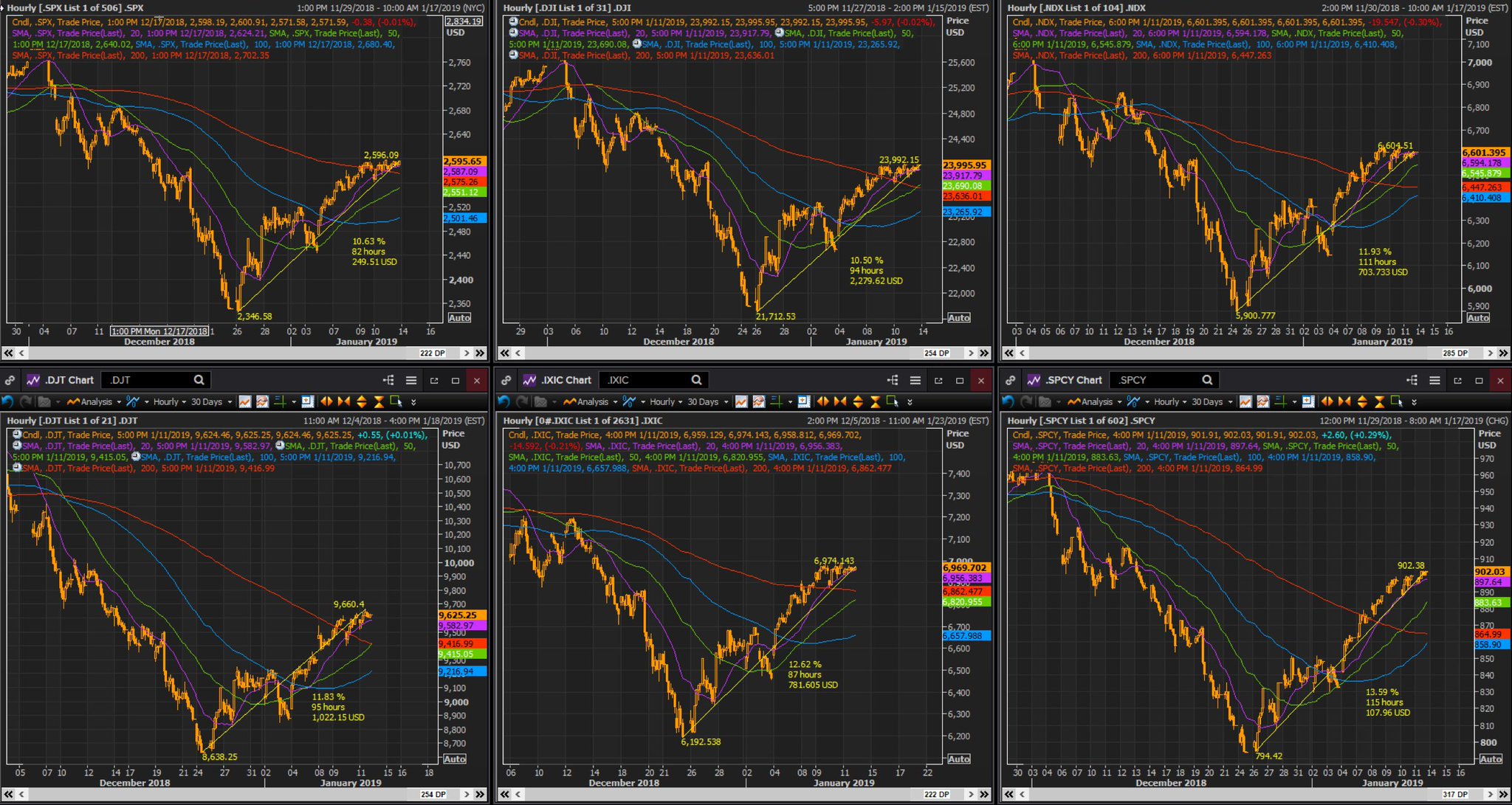

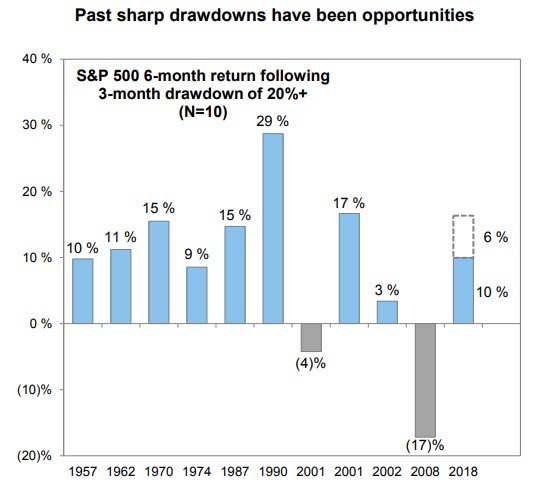

Major US equity indexes have already risen +10% to +13.5% in about 90 or so hours, a powerful move in this bear market.

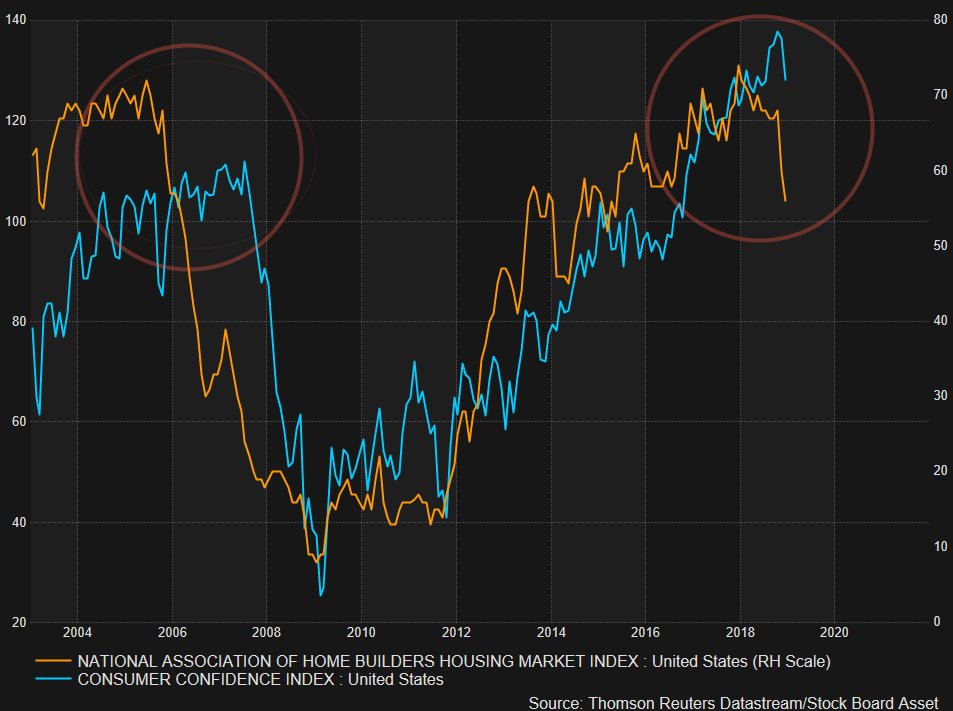

The mechanics of consumer animal spirits could be the result of the housing industry. With that being said, when housing rolls over, so does confidence in the economy.

via @zerohedge:

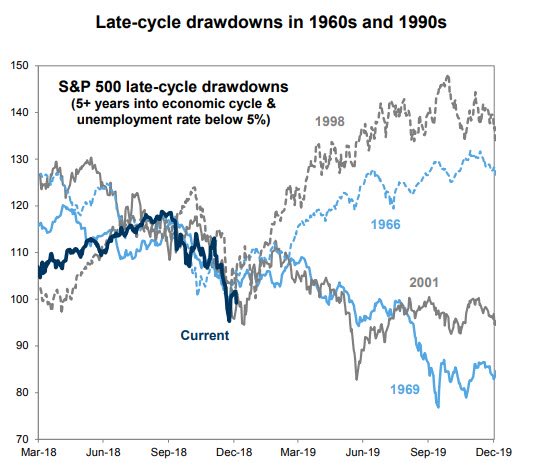

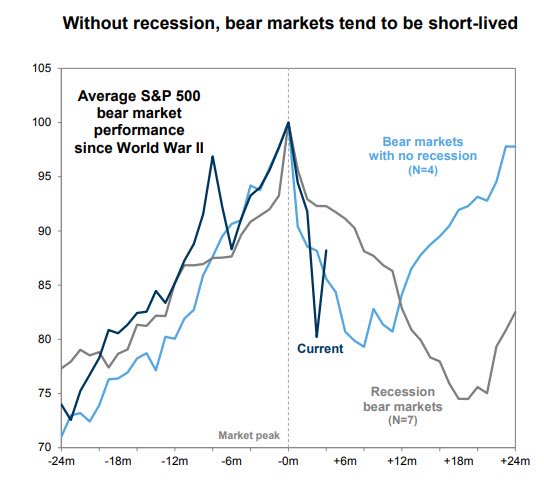

Will stocks rebound or continue sliding? Only one thing matters: is the economy in a recession or not.

via @TeddyVallee:

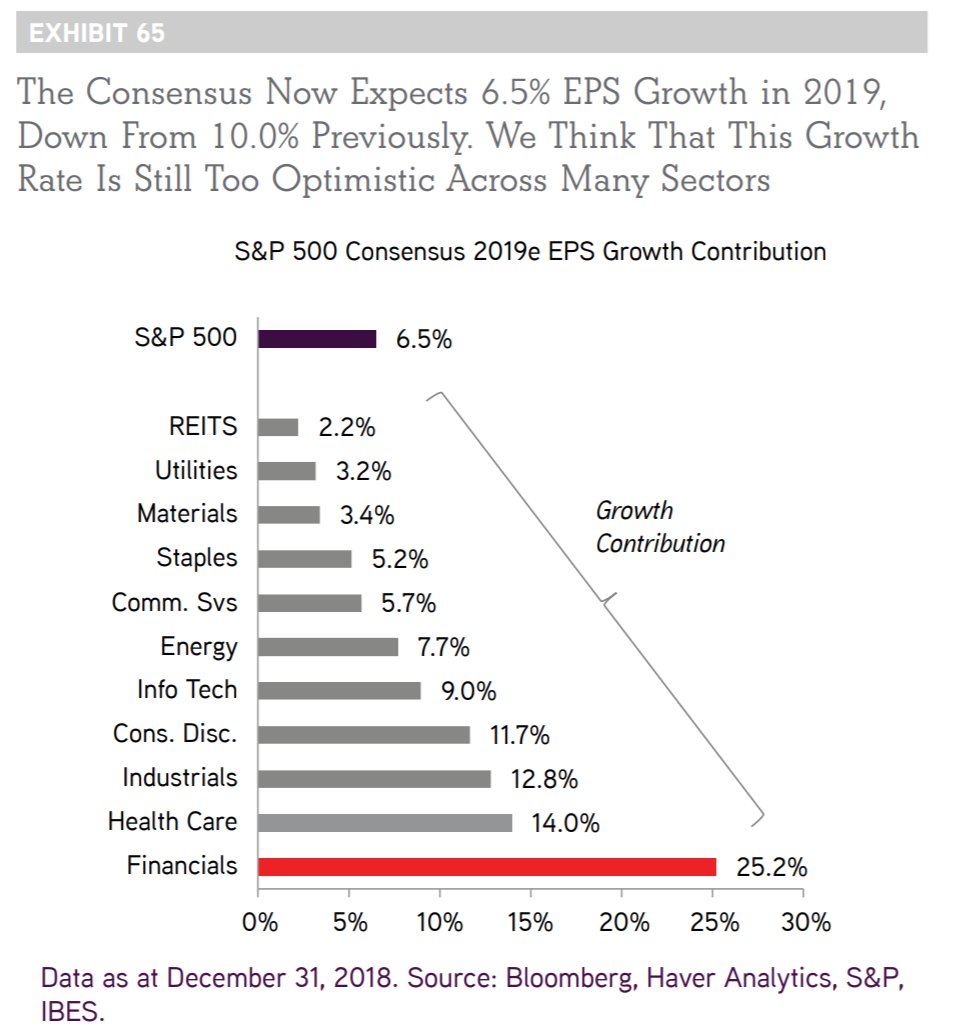

$SPX EPS sector growth composition