As I mentioned last week, the bears fumbled miserably in March. The door was there to slam stocks and they weren’t able to get the job done.

With that in mind, stocks roared higher over the weekend breaking through the all-important 4,000 level on the S&P 500.

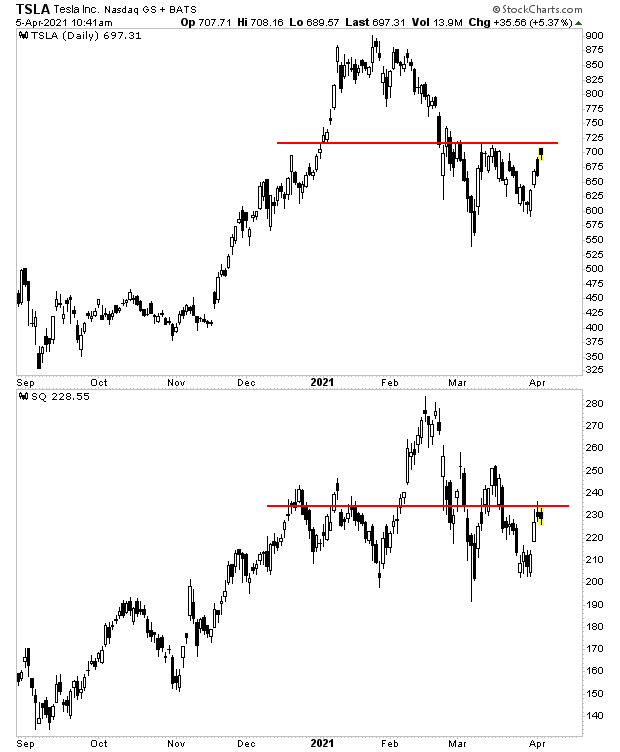

Just as importantly, momentum is catching a bid with the two companies I’ve been monitoring (Tesla and Square) ripping higher to test overhead resistance.

If they can break above these lines, we will have confirmation that the tech massacre is over. At that point, hot money would begin to flow back into tech stocks. And with Tech comprising ~30% of the S&P 500, this would ignite a major rally higher.

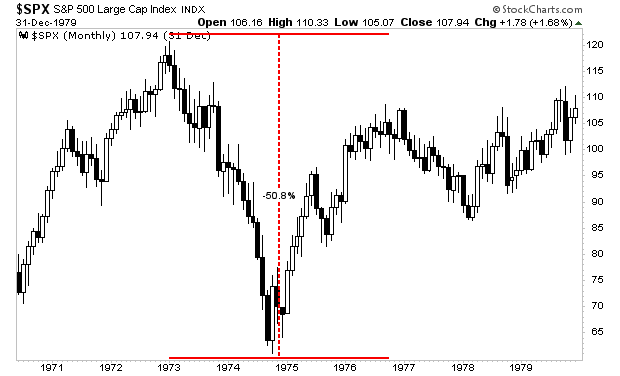

This would lead to the eventual blow off top in inflationary assets I’ve been forecasting for the last few months. Remember, stocks LOVE inflation at first, but that love turns to hate.

During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I keep warning, inflation is going to ANNIHILATE investors’ portfolios.

Those who are properly prepared. however, will make literal fortunes.

On that note, if you’re worried about weathering a potential market crash, we’ve reopened our Stock Market Crash Survival Guide to the general public.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

We are making just 100 copies available to the public.

To pick up your copy of this report, FREE, swing by:

http://phoenixcapitalmarketing.com/stockmarketcrash.html

Best RegardsParagraph

Graham Summers

Chief Market Strategist

Phoenix Capital Research