Calling the US stock market “expensive” is like calling the sun “warm.” It really doesn’t do it justice.

“Insanely overvalued” is more accurate, as the following charts illustrate:

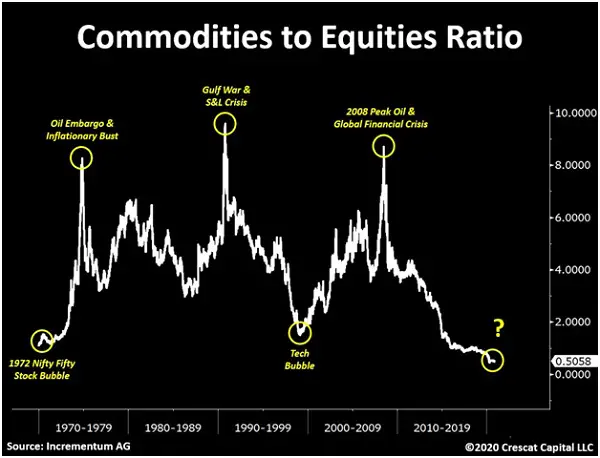

Stocks are now more expensive than ever versus commodities…

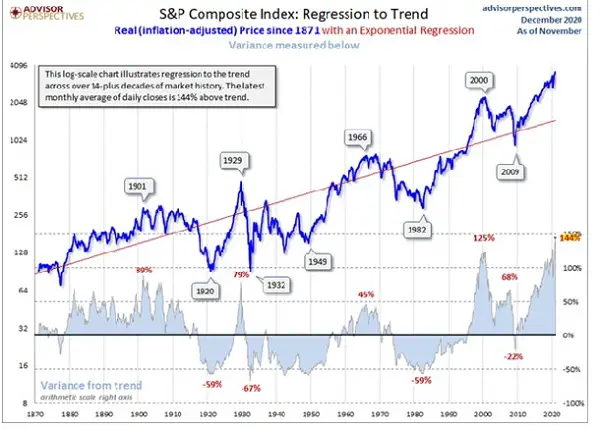

… and versus their own long-term price trend …

… and versus GDP …

Meanwhile, short sellers – people who bet on stocks going down — are having their worst year ever:

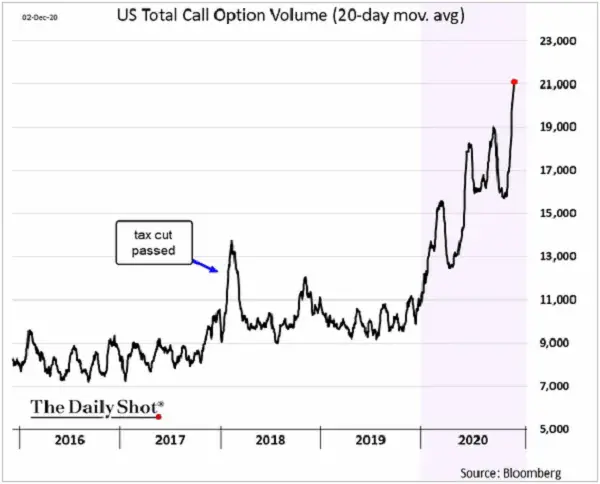

Call option (i.e., leveraged bets on stocks going up) volume is spiking …

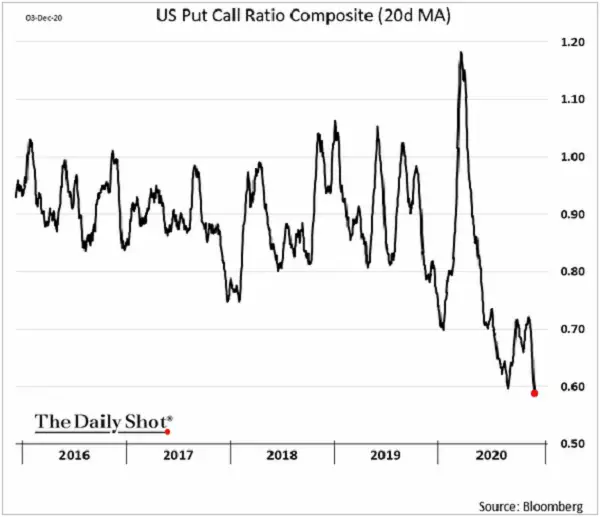

… while the ratio of put options (bets on stocks declining) to call options is plunging:

What does all this mean? One of two mutually exclusive things:

1) In the past, when stocks have gotten anywhere near their current valuation levels they have subsequently crashed. So if history still matters, look out below in 2021.

2) If we’ve entered a new, hyperinflationary world where governments and central banks try to inflate their way out of their past mistakes without regard for the impact on price levels or currency values, then stocks might continue to rise in nominal terms while falling in inflation-adjusted terms. In other words, we become a banana republic. Gold, in this scenario, will rise faster than equities so it’s still possible to make money shorting, but only in a pair trade coupled with long gold positions.