In Illinois is a State that should just commit suicide and be emerged into surrounding states. It is following the EXACT pattern as the fall of the city of Rome itself. Constantine the Great moved the Roman capital from Rome to Constantinople around 330AD. Rome lost its status as corruption and taxes rose. More and more people just walked away from their property for there was NO BID.

Property values are already collapsing in Illinois. The Pension Crisis is worldwide, but Illinois is leading the charge. The words of Edward Gibbon from his Decline & Fall of the Roman Empire are very applicable to Chicago. This is how empires, nations, and city-states die. It is always the abuse of taxation that drives people from their homes. Illinois is the NUMBER ONE state that now has a NETloss of citizens and people are fleeing that state. Bureaucrats cannot see the trend any more than they can see their own nose. They only see raising taxes. To them there is just no other way. They come first. Gibbon wrote:

“Her primeval state, such as she -might–appear in a remote age, when Evander entertained the stranger of Troy, has been delineated by the fancy of Virgil. This Tarpeian rock was then a savage and solitary thicket; in the time of the poet, it was crowned with the golden roofs of a temple, the temple is overthrown, the gold has been pillaged, the wheel of Fortune has accomplished her revolution, and the sacred ground is again disfigured with thorns and brambles. The hill of the Capitol, on which we sit, was formerly the head of the Roman Empire, the citadel of the earth, the terror of kings; illustrated by the footsteps of so many triumphs, enriched with the spoils and tributes of so many nations. This spectacle of the world, how is it fallen! how changed! how defaced! The path of victory is obliterated by vines, and the benches of the senators are concealed by a dunghill. Cast your eyes on the Palatine hill, and seek among the shapeless and enormous fragments the marble theatre, the obelisks, the colossal statues, the porticos of Nero’s palace: survey the other hills of the city, the vacant space is interrupted only by ruins and gardens. The forum of the Roman people where they assembled to enact their laws and elect their magistrates, is now enclosed for the cultivation of pot-herbs, or thrown open for the reception of swine and buffaloes. The public and private edifices that were founded for eternity lie prostrate, naked, and broken, like the limbs of a mighty giant, and the ruin is the more visible from the stupendous relics that have survived the injuries of time and fortune.”

There is absolutely no hope whatsoever of fixing this problem of a pension crisis in Illinois and every solution, like the current one from the Chicago Federal Reserve and its proposed 1% on property annually for the next 30 years, will fail in the end. The state has COLAs which insanely increase state employees’ yearly pensions by an automatic 3% annually, regardless of the inflation rate. Because Illinois does not have its own currency, it is then bound by the national value and international value of the dollar. Like Greece, as the dollar rises, Illinois is thrown into deflation. Its institutions are broken, and they will be remembered only by history.

These annual increases of state employees pensions negotiated with other state employees to line their pockets forever are simply driving up the costs of pensions every year. Illinois’ COLAs are killing the state and the future is ABSOLUTELY hopeless. Any reader in that state or who has family in that state had better put your property up for sale NOW and get out of town while you still can. Hopefully, a fool has just entered the housing market and its time to get out if you can get a bid.

The Chicago Fed published its proposal formally. As always, it assumes that we the people are an endless supply of revenue with no end. We are the economic slaves to serve the people who are supposed to be serving us. The Fed is proposing a 1% annual tax be imposed already on top of the highest property taxes in the country. They propose that will stay in place for the next 30 years. What they fail to recognize is that property taxes are a net loser for they are never considered as a cost when you sell your home. If you paid $100,000 in 1968 and sell it for $200,000 today and paid $2,500 on average per year for the past 50 years, you paid $125,000 in property taxes. Then the State and the Feds want their tax on the $100,000 profit since they do not count the taxes paid. This is not a very good deal.

The Chicago Fed published its proposal formally. As always, it assumes that we the people are an endless supply of revenue with no end. We are the economic slaves to serve the people who are supposed to be serving us. The Fed is proposing a 1% annual tax be imposed already on top of the highest property taxes in the country. They propose that will stay in place for the next 30 years. What they fail to recognize is that property taxes are a net loser for they are never considered as a cost when you sell your home. If you paid $100,000 in 1968 and sell it for $200,000 today and paid $2,500 on average per year for the past 50 years, you paid $125,000 in property taxes. Then the State and the Feds want their tax on the $100,000 profit since they do not count the taxes paid. This is not a very good deal.

For now, the Fed’s proposal is that homeowners with houses worth $250,000 would pay an additional $2,500 per year in property taxes. Illinois already has a net migration out of the state. That means property values will DECLINE and the tax burden will increase on those left behind. Property taxes in the 3.5-5% level will devastate home values. The average person cannot afford those types of taxes on top of sales taxes, incomes taxes (state & federal) and expect to have any kind of reasonable life.

If you can’t pay the property tax, then they confiscate your home and sell it for taxes at whatever price it brings. Just have a friend who bought two houses that were valued at $70,000 each for tax records for $7,000 for BOTH! They do not care what property brings as long as they get their tax.

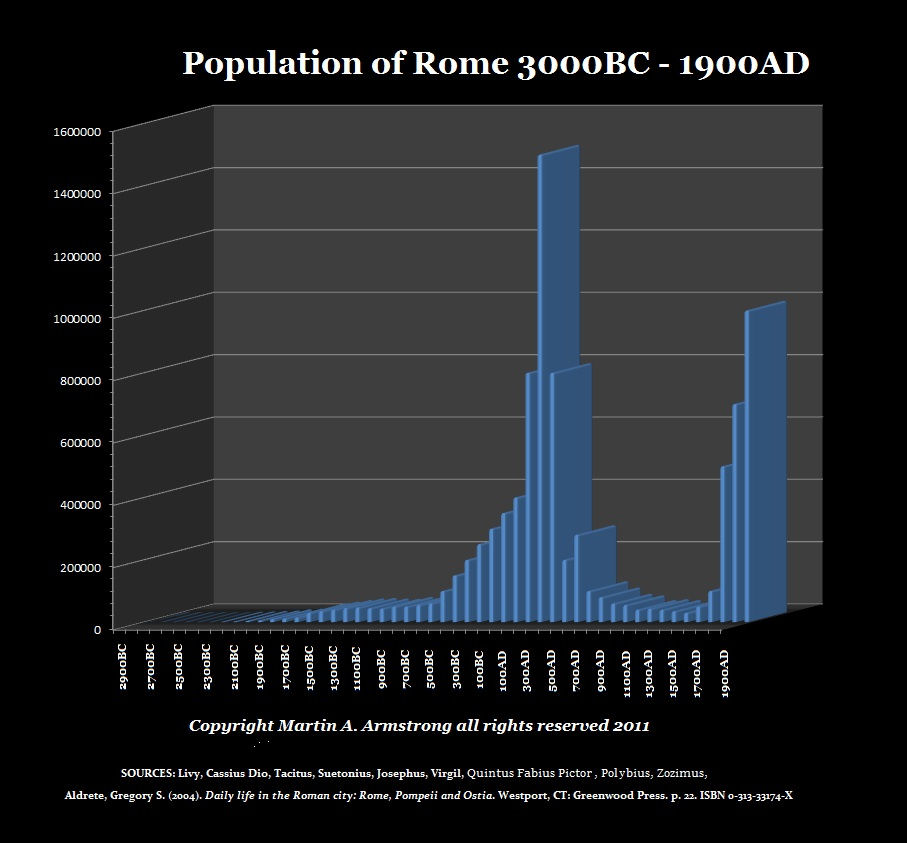

History repeats because human nature never changes. Rome fell, we all know that. However, when you plot the actual population of Rome, what emerges is a very interesting and a stark reality that applies to Illinois. As taxes and corruption expanded, people could no longer afford to live there and they were forced to just walk away from their homes.

The value of real estate went to ZERO!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Beware!!!!!!!!!!!!!!!!!!!! History repeats!!!!!!!!!!!!!!!!!!