Know your client

Finance is a high-risk sphere, where knowing your customer is extremely important. To avoid sanctions, and protect themselves and their clients, financial organizations have to take a risk-based approach and perform enhanced due diligence, including:

- client identity verification,

- risk assessment,

- user activity monitoring.

With the current rise of a decentralized economy, the stakes rise even higher. Blockchain is revolutionizing the world of finance. The distributed ledger technology was originally developed for this industry and gives many new opportunities for its development. The main reasons for its wide distribution were anonymity, immutability, and lack of intermediaries. Automated smart contracts would play the part the third party would have played, eliminating prejudice and the chance of human mistake. In the world of thriving data trading and scams, blockchain was a long-awaited breakthrough.

Anonymity versus safety

However, besides honest individuals tired of privacy breaches and corruption, the anonymity of blockchain transactions and high volatility of cryptocurrencies attracted criminals – leading to increasing global and local regulatory demands to combat money laundering, financial terrorism, and fraud. This issue raises an important question about the need for a balance in the fintech industry – to ensure transparency and, at the same time, proper protection of personal user data. Today there is high demand for a reliable, professional KYC solution that would provide high level of service:

- compliance with local legal frameworks and global regulators,

- enhanced verification: both automatic and human review checks,

- ongoing monitoring of user profiles,

- complete technical and physical security of user data.

Genesis Vision: due diligence in practice

Genesis Vision is the first trust management platform to utilize blockchain and smart contracts. It unites asset managers, exchanges, brokers, and investors in a legal, trustworthy space. Recently the project has announced the new level system designed to distinguish and award managers with the top performance and to create a field of trust for all platform users. The KYC procedure became an important element of the system.

Performing KYC is not obligatory to start trading or investing within the Genesis Vision platform. However, without the verification, the managers have access only to the 1st level, where they can attract up to 70 GVT tokens (230$ roughly at the time of this writing). After the KYC procedure, they will have an opportunity to attract up to 70,000 GVT tokens (on the 7th level). Same goes for the GV investors: without personal data verification, they cannot invest more than 100 GVT tokens per month.

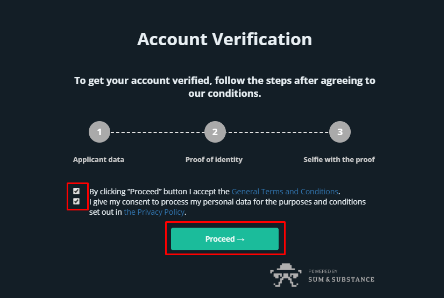

Going through verification is easy: open profile menu, click on “Personal details” and choose “Verify”. The system will ask you to fill in the personal information, upload an ID photo and a selfie. The electronic images of physical documents are inspected with the help of deep learning technology.

Genesis Vision’s KYC verification page

The KYC solution used by Genesis Vision platform is provided by Sum &Substance, a new generation KYC/AML service which meets all the above requirements. Among the clients of the service, there are such well-known companies as Philip Bank, Uber, and Gett. All the user data is stored safely and used with customer consent, which can be withdrawn at any time.

In the fintech industry, KYC is not an option – it is a must, a valuable instrument that provides reliable protection: from ensuring information safety to mitigating risks.

Disclaimer: This content does not necessarily represent the views of IWB.