by Dana Lyons

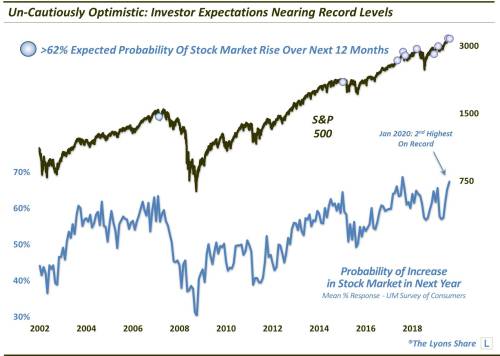

Investor expectations for stocks have almost never been this high.

Markets, it is said, like to climb a “wall of worry”. Of course, the theory is that an abundance of worry on the part of market participants suggests that there is ample money “on the sidelines” available to enter the market and perpetuate a rally. Such a condition was arguably present this past fall as stocks were nearing the end of a months-long consolidation. The prolonged sideways market action seemed to inflict investors with a healthy dose of skepticism and caution towards the prospects for stock. That caution helped fuel the subsequent breakout and extended run to new highs that continues today. That caution, however, does not continue today.

In the monthly University of Michigan Survey of Consumers, one of the questions asked of respondents is their estimation of the “probability of an increase in the stock market in the next year”. In January, the mean response to the question reached 65.6%. That is the 2nd highest level on record since the inception of the survey question in 2002 (only the reading at the intermediate-term top in January 2018 was higher, at 66.7%).

Of course the concern is that once expectations get too high, it may be a sign that most of the potential investable dollars are already in the market. Therefore, there may be relatively little fuel remaining to boost stock prices.

Looking historically at the survey, we see that in addition to elevated reading in early 2018, high readings were also observed in July 2007, June 2015 and late 2018. Obviously, those immediately preceded either cyclical or major intermediate-term tops.

So is the market on the verge of a significant top? Only time will tell. Prior extreme bullish readings in the UM survey certainly have had a consistent record of preceding rough patches in the market. With that being said, sentiment can be an imprecise timing tool. There is no reason why stocks can’t continue to rally in the face of extreme optimism — temporarily. However, such a rally at this point would occur without the benefit of the proverbial wall of worry.