New trends and ventures often need acceptance from traditional institutions for them to get a semblance of legitimacy. Take Bitcoin and cryptocurrencies, for example. It was only when institutional investors entered the market and exchanges such as Cboe and CME started trading Bitcoin futures that many showed a more favorable attitude towards cryptocurrencies.

Today, blockchain and crypto activities are starting to prove that they are more than just fads. Cryptocurrencies have become accepted investment vehicles that investors could use to diversify their portfolios. Even established trading platforms are now acknowledging blockchain’s impact. eToro, for instance, now supports trading of top cryptocurrencies including Bitcoin, Ether, and Ripple.

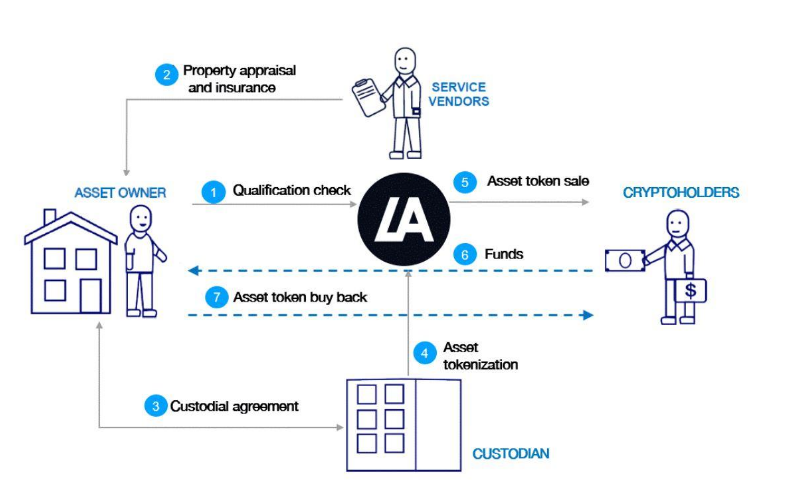

But crypto’s impact on investing doesn’t stop there. Several blockchain ventures have also been working on enabling the trade of various assets over blockchain. LAToken, for instance, allows the tokenization and trade of real estate and even fine art pieces. Populous tokenizes business invoices to allow blockchain-based invoice financing. Premium online brokerage firm ThinkMarkets has also built a blockchain-based trading platform that supports a variety of assets including forex, commodities, and even precious metals called TradeConnect.

With the availability of such platforms, blockchain seems positioned to be applied to the trading of a wide array of traditional assets.

Tokenizing Assets

What essentially enables all of this to happen is tokenization. Using blockchain, things like real-world assets can be represented by cryptographic tokens through uniquely identifiable digital signatures. It’s similar to a piece of paper that defines and identifies ownership of an asset like a land title or a stock certificate. For example, a platform like LAToken takes all the pertinent details of the asset to be traded like an artwork or a parcel of land which are then used to create the corresponding token.

Image Source: LAToken

Tokenization provides a variety of advantages. Since blockchains are distributed, copies of the record are found on nodes across the globe. This offers better security for any record unlike paper records which can be stolen, lost, or destroyed. Digital records are also subject to similar vulnerabilities especially if they are stored in single centralized location. Since blockchain data is also immutable and serves as an accurate and reliable record, owning a token can now be considered proof of ownership.

Tokens are also tradable over the blockchain so transferring ownership is as simple as sending tokens to other parties. Tokens can also be traded in fractional values, which, in effect, allows for fractional trading and ownership of assets. Potential buyers or investors need not have substantial resources to acquire the whole token in order to participate. This effectively lowers the barriers to investing in a wide variety of assets.

No More Intermediaries

Another advantage of using blockchain to trade assets is that it allows direct peer-to-peer (P2P) transactions. It helps do away with intermediaries or middlemen that only make transactions slow and costly. With blockchain, transactions don’t have to rely on trusting a centralized authority for processes like payments or escrow. This not only speeds things up but it also saves users on costly transaction fees imposed by traditional platforms.

Another problem in trading the traditional way is that financial institutions are not exactly transparent. They are able to influence the prices of assets and fees to the disadvantage of ordinary investors. Blockchain’s transparency encourage fair market pricing since the investors could readily check and verify details such as pricing and payments for all transactions being done.

This said, it is quite refreshing to see established players embrace blockchain. ThinkMarket’s upcoming TradeConnect platform maximizes blockchain’s capabilities to enable the trade of various financial products. Powering the TradeConnect platform is the ThinkCoin token which will be used to facilitate trade of assets and financial products including stocks, CFDs, and even precious metals.

Image Source: Thinkcoin

The platform seeks to provide investors with best pricing scenarios using its own artificial intelligence-driven digital persona matching protocol. The protocol models an investor’s trades and helps match the investor to relevant products that are available on the platform. Instead of being charged commissions typical of traditional trading platforms, TradeConnect users are only charged with a “connect” fee which is split among all the participants to ensure the platform’s liquidity.

Making Traditional Trading Better

Blockchain is quite capable of handling the trade of traditional assets. In fact, these blockchain trading platforms seem to offer more convenient experiences to investors. To start, these platforms are allowing ordinary investors to participate in what might be previously costly endeavors. In the case of invoice trading, the activity has previously been inaccessible to many. So, platforms like Populous have actually opened the activity up to a wider audience even to investors who may usually have little business being involved in invoice financing.

Through blockchain, transactions are also made to be speedy and affordable. Without the need for middlemen, even high-value transactions can be concluded in just seconds. Investors could also enjoy better returns for their money since blockchain platforms often forgo sizable commissions. In addition, they also have token economies that reward all their participants.

At the seller’s side, these platforms are also helping asset holders and owners enjoy better liquidity since they now have quicker and easier means to fractionally trade their assets away. Certain enhancements such as the use of artificial intelligence to cleverly match traders and products like what TradeConnect offers, create a more fulfilling trading experience.

Perhaps best of all, blockchain encourages all participants to act on good faith. A fair market offers less risks and better returns for investors.

Disclaimer: This is a guest post and it doesn’t represent the views of IWB.