by UPFINA

Given the rise in stocks, the steepening of the yield curve, and the rise in long term treasury yields, it’s no surprise fund managers see less of a threat of the US entering a recession in the next year. As you can see from the Bank of America survey below, credit investors see a 21% chance of a recession in the next year which is down from 25% two months prior.

Merrill Lynch gauges probability of a recession. Chart by @ISABELNET_SA.

In my opinion, this chart is all wrong. The probability of a recession was highest in late 2017 / early 2018.

When everyone thinks the recession is coming, either it’s already happened or it won’t happen. pic.twitter.com/AP5P7FwaAW

— Tiho Brkan (@TihoBrkan) November 11, 2019

The more surprising aspect of the Bank of America surveys than the recent increase in optimism was the level of bearishness earlier in the year in relation to the mostly consistent rally in stocks.

It’s also notable how most indicators weren’t indicating a recession outside of the yield curve, yet the media has played up the recession risk substantially to get more interest. The media is biased towards generating views/clicks; recognize that before investing based on any information you read in the financial press. Be skeptical of the predictive value of a metric that is extremely prevalent in the media and investor circles. Be even more skeptical of reports that an indicator has never been wrong. The yield curve hasn’t been wrong recently in the US, but saying it has never been wrong is a mischaracterization since it has been wrong in the more distant past and in other countries.

Consumers Are In Great Shape

Consumers are in very good shape heading into the holiday shopping season as stocks are rallying, gas prices are relatively low, and the labor market is near full employment. Obviously, not everyone owns stocks, but those who do have higher spending power. As you can see from the chart below, 55% of Americans stated their financial situation is better than it was 1 year ago. That percentage has been topped three other times this cycle and one time in the late 1990s. Those are the only other times it was higher since 1978 and those readings were only slightly better.

Hmm, just escapes me when the right time to buy stocks would be… pic.twitter.com/oIpY6WXN81

— Fundamental Investor (@fundiescapital) November 11, 2019

To be fair, consumers were positive about their finances last year and it turned out poorly. They became more negative early in 2019. However, the negative catalysts were obvious last year. The stock market declined and the government was getting ready to shut down. Adding to the current positivity, in a recent Gallup poll, only 11% of Americans mentioned economic issues as the country’s most important problem. Besides a slightly lower reading earlier this year this is the lowest percentage since at least 2001. The trough was 16% last cycle.

Bearish investors love charts that show consumers are very confident in their finances and aren’t worried about the economy because after this confidence comes recessions. However, that’s the wrong way to view this situation. The consumer being confident doesn’t cause recessions. In fact, the strong consumer has helped the economy stay afloat in 2019 as we’ve recently seen business investment hurt GDP. There needs to be a catalyst for a recession to occur. If you went bearish when consumers were very confident earlier in the cycle, you would have lost money. A recession is closer now than it was 5 years ago, but that’s obvious and not information you can use to make money. Consumers are confident, but they aren’t overly leveraged like last cycle.

Homeownership Rates

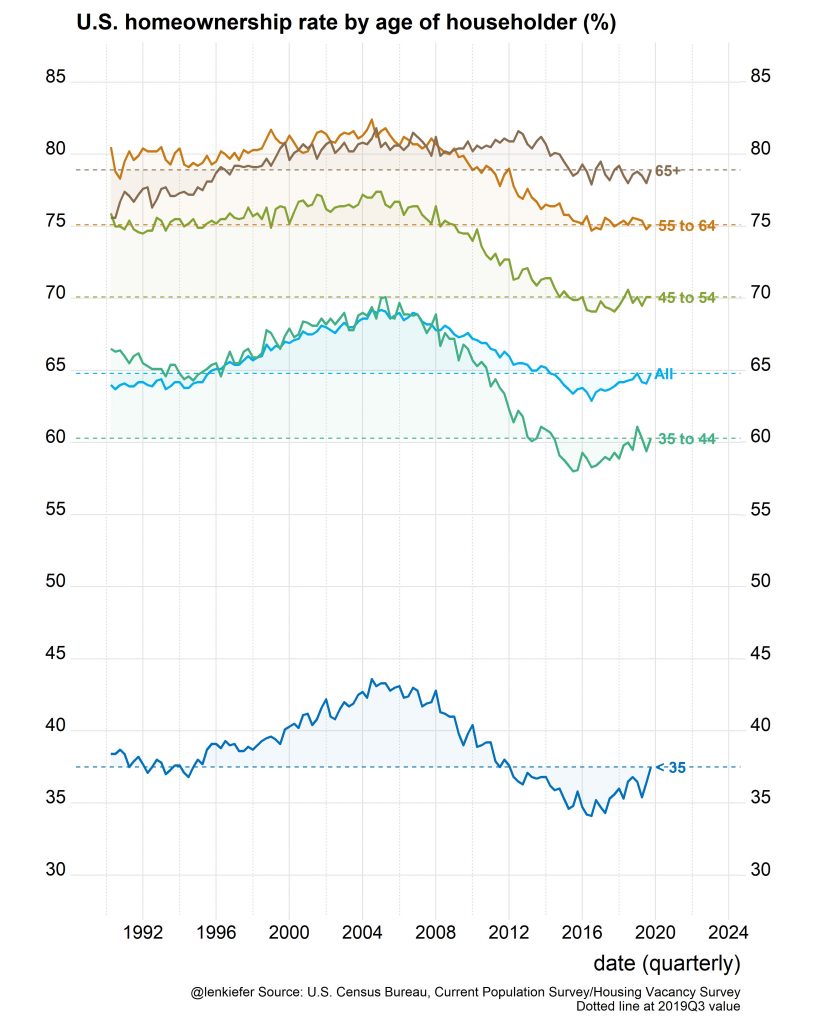

In Q3, the homeownership rate increased 0.4% to 64.7% which is the highest rate since Q2 2014. Even though the housing market peaked before the 2007-2009 recession, the homeownership rate kept declining after it ended as it bottomed in Q2 2016. The chart below breaks down the homeownership rate by age range.

There has been very little recovery for those 45 years and older as once they lost out on owning a home, they couldn’t regain their financial footing. That’s hard to do near and after retirement. Younger people have shown a greater ability to recover, but those just starting out were hit the hardest because they bought into a housing bubble where predatory loans were given out.

Weak Business Confidence

We’ve seen the Conference Board survey of CEO confidence which shows CEOs aren’t confident at all. Therefore, it’s no surprise the Markit business confidence report was also negative. As you can see from the chart below, in October 10% more firms expect an increase in business activity in the next year than expect a decrease. That’s the weakest reading in 3 years. It’s the 3rd weakest reading of this expansion. There were 2 lower readings in the prior slowdown. Sequentially, this percentage fell 6 points. This reading is below that of global markets (+14%) and developed markets (+12%).

U.S. business activity expectations – @SoberLook @IHSMarkit pic.twitter.com/ZL1MotKjcO

— Rob Hager (@Rob_Hager) November 11, 2019

Sentiment in manufacturing and services weakened. It’s possible that this reading will increase after phase one of the trade deal with China is announced because this weakness was caused by trade policy uncertainty. Other negative factors were the 2020 election and difficulty in finding skilled workers. This brings us to the weakness in employment. The net percentage seeing an increase in hiring in the next year fell to 5% which is the lowest reading since February 2016. The net percentage seeing an increase in investment fell 4 points to 6%. On inflation, the net percentage who see an increase in non-labor costs fell to 4% which was the lowest since February 2017. On prices received, a net 17% of manufacturers see higher selling prices (up 3 points) and a net 3% of services firms see themselves raising prices in the next year. A net 8% expect an increase in profits in the next year which is down from 31% last October.