Source: Investor Junkie

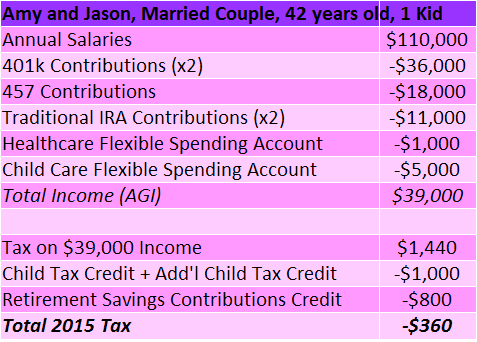

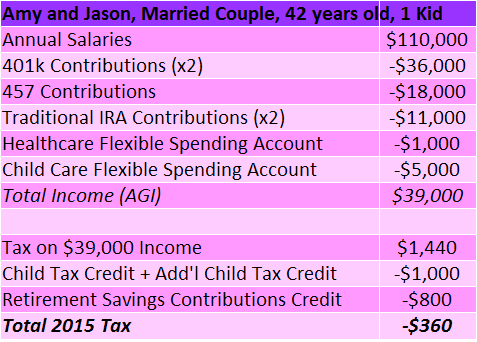

It is worth going through each section individually. Here we are assuming a couple that is both working. Their combined income is $110,000 per year. They max out their 401k contributions of $18,000 per year. Next, one of the above works as a teacher with the access to a 457 account. This essentially is another 401k for public sector workers. They put $18,000 here as well. Next, you are able to stash $5,500 per year in a traditional IRA so you can lower your taxable income.

Next, they utilize their HSA account to the tune of $1,000. They have a child in daycare and spend $5,000 a year here and are able to adjust their income lower here too.

So with all of that, their adjusted gross income drops from $110,000 to $39,000. The tax at this level for a couple with a kid is $1,440. Taking the child tax credit of $1,000 and the retirement credit of $800 they will actually get a refund of $360.

http://www.mybudget360.com/is-it-possible-to-pay-0-in-taxes-on-a-six-figure-income-yes-it-is-and-here-is-how-you-do-it/