QUESTION: Dear Marty,

Thanks for the continuous enlightening blogs about increasing interest rates and its effects on EM’s and others.

Today on Bloomberg , they were discussing that the earlier 60:40 Equity bond correlation is breaking down and now it’s 100:0 i.e. both go up and down together.

If I understand your view correctly , the increasing interest rates is a death knell for the Bond trade/Sovereign Debt but totally opposite for the Equity mkt which might surge as capital flees to Private assets i.e Equity.

Would you care to comment please ?

Thanks again for all that you do and the fresh perspective you provide.

Best Regards,

US

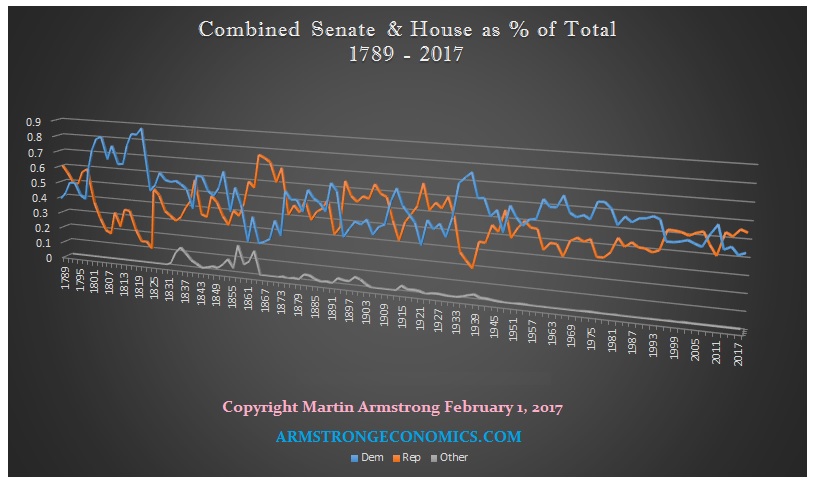

ANSWER: They are misreading the impact of interest rates. It is really a political impact at this time and as we head into the week of 11/05, there is a rising concern because the Gallup Poll shows that the Democrats may take back the House and then everyone assumed they will do everything in their power to overturn everything Trump has ever done. So international capital is deeply concerned about the Democrats right now. They are seen as a major threat to the world economy for they also advocate war with Russia as retribution for Hillary. This is the perception out there I get back particularly from overseas.

We are still in this consolidation transition period. Capital is trying to figure out the future and it is very confusing. This analysis you refer to is myopic at best. They ignore worldwide concerns and focus only on domestic issues. Interest rates have been rising since the 4th quarter of 2015. They act as if the markets suddenly took notice 3 years later. The equity decline has NOTHING to do with interest rates. They see the entire world only through domestic eyes and just have to blame something.