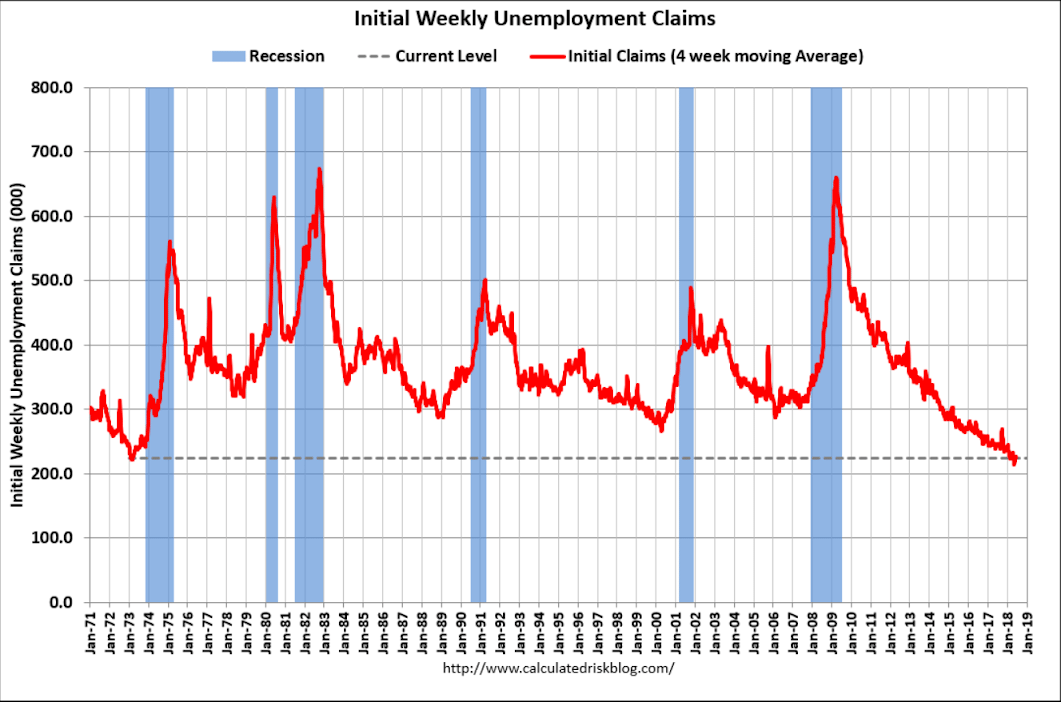

Just a reminder (from 2015) as to why claims are this low:

This is not population adjusted:

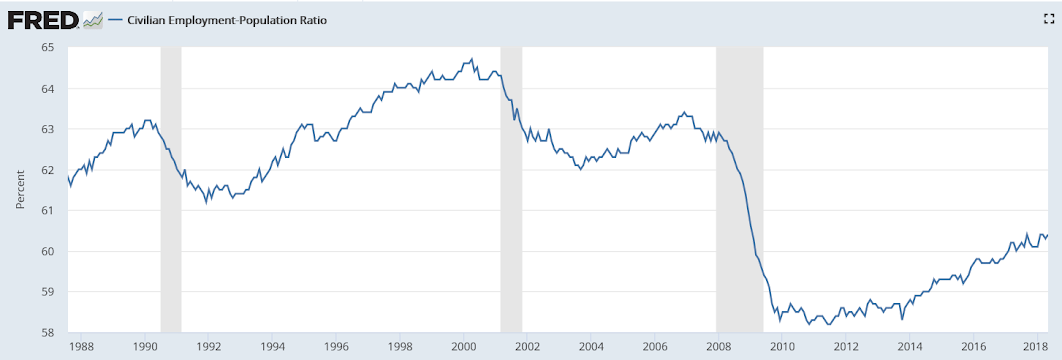

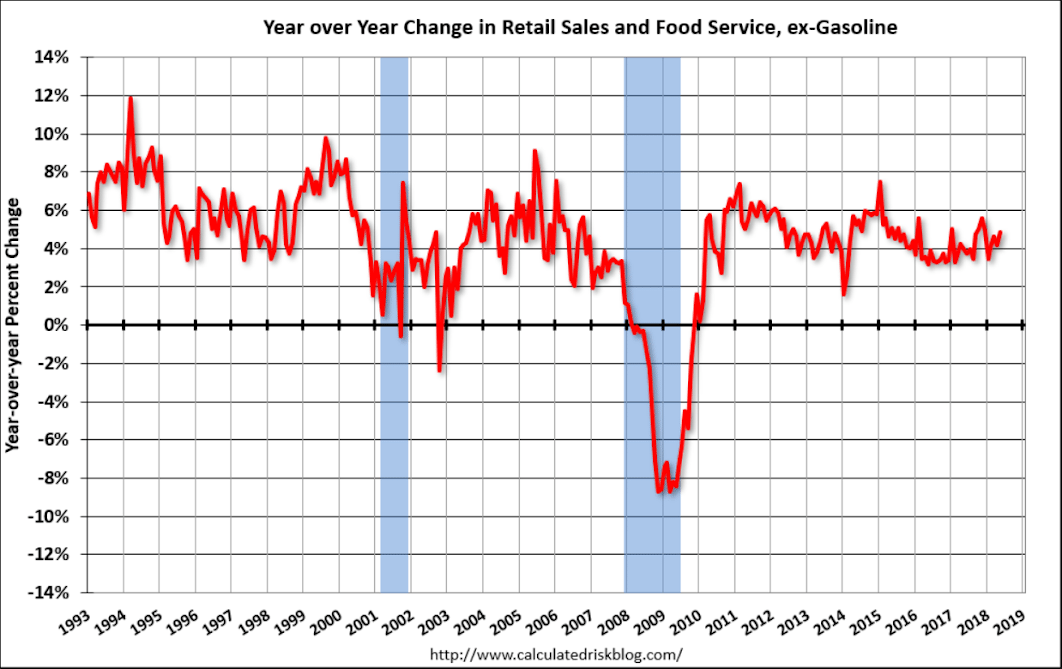

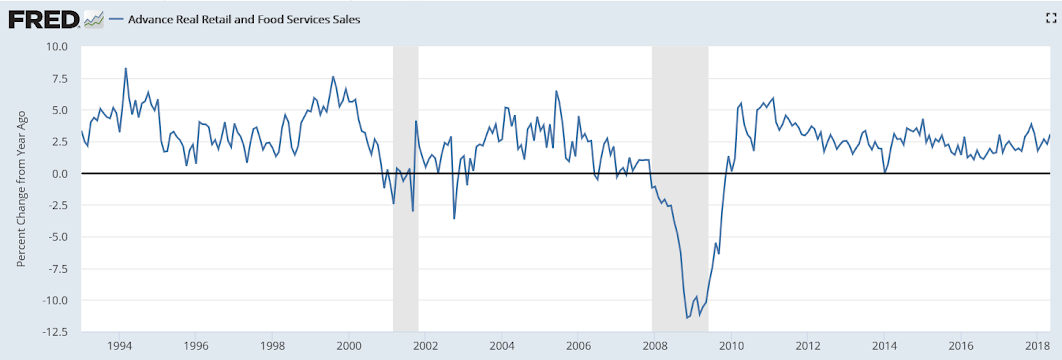

We haven’t yet to recover from the last recession, in my opinion due to an ongoing lack of demand:

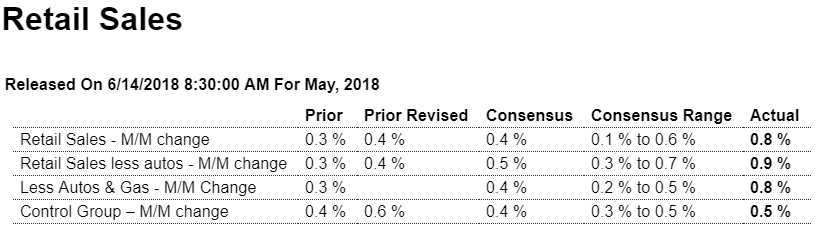

Highlights

The FOMC said yesterday that household spending has picked up and indeed it has. Retail sales jumped 0.8 percent in May which easily tops Econoday’s high estimate. And the results include an upward revision to April which now stands at a 0.4 percent gain.

The report shows balanced gains including a 1.3 percent jump at restaurants and a 0.5 percent increase for motor vehicles, both pointing to rising discretionary demand. Building materials, which have been soft, surged 2.4 percent in what will be a plus for residential investment. Department stores have been very weak but have now put together back-to-back gains of 1.5 percent in May and 0.7 percent in April. Clothing stores, at 1.3 and 1.2 percent, have likewise bounced back with sizable gains the last two months. Gasoline sales have risen 2.0 and 1.0 percent in May and April on higher prices. Disappointments include a decline for furniture in May and only a 0.1 percent rise for nonstore retailers (e-commerce).

It was only a few weeks ago that the Fed’s Beige Book had downgraded consumer spending to “soft” which highlights the importance of today’s report, one that, as far as the Fed at least, marks a pivot upward. Consumer spending so far this year has been mixed but given the strength of the jobs market, improvement should be no surprise.

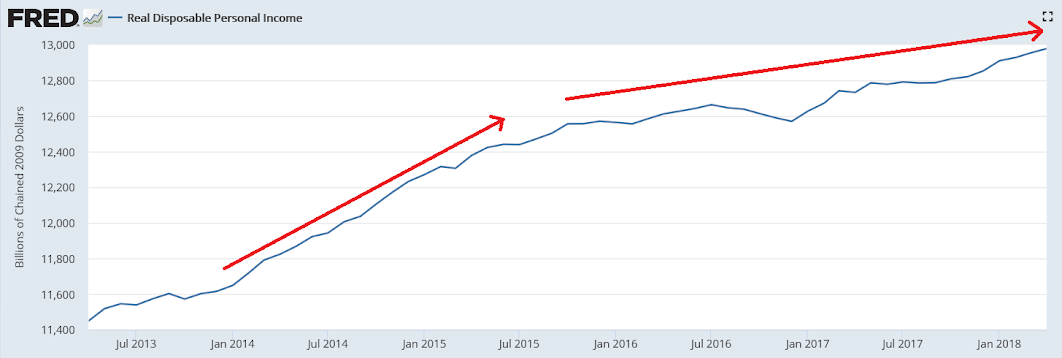

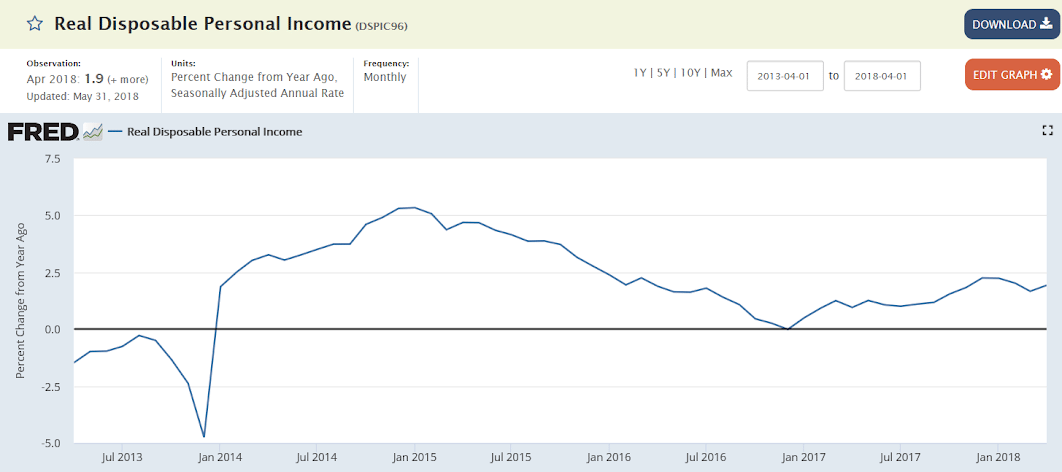

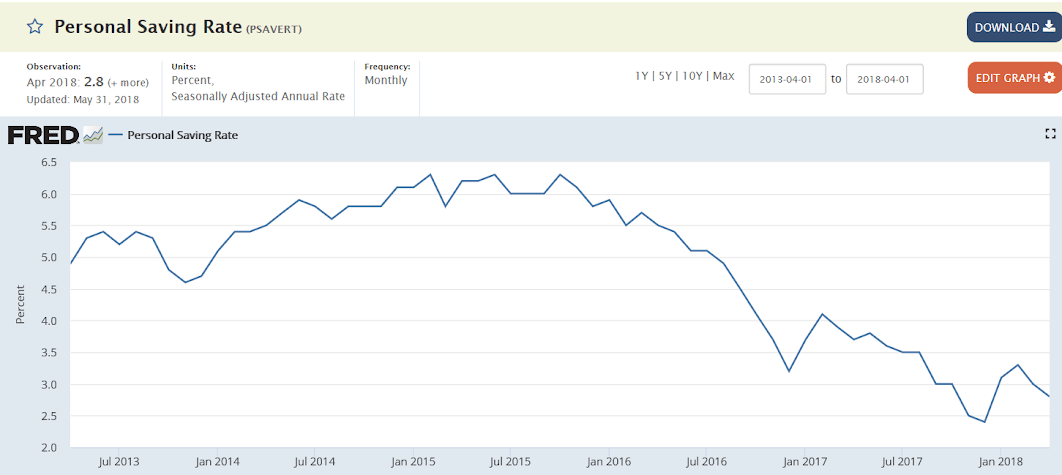

Muddling through at rates of growth that exceed personal income growth, so seems unsustainable:

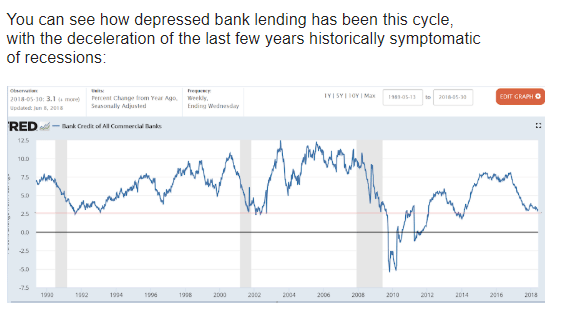

Bank lending:

Like the hair dresser said, ‘no matter how much I cut off, it’s still too short.’ Raising rates supports the economy via the interest income channels, and the higher the debt to gdp ratio the larger the effect. (Paying interest is like basic income for people who already have $…) That is, the Fed has it backwards. They think they are stepping on the brakes when they are stepping on the accelerator with regards to the economy and inflation:

Fed Raises Interest Rates, Sets Stage for Two More Increases in 2018

(WSJ) Eight of 15 officials now expect at least four rate increases will be needed this year, up from seven in March and four in December. Most officials expect the Fed would need to raise rates at least three more times next year and at least once more in 2020, leaving rates in a range between 3.25% and 3.5% by the end of 2020, the same end point officials projected in March. The statement dropped language added four years ago that said officials expected to hold their benchmark rate “for some time” below a neutral setting. Nine of 14 officials putting neutral at either 2.75% or 3%.