by laflammaster

Wall Street on Parade recently reported that “The Next Bomb to Go Off in the Banking Crisis Will Be Derivatives”

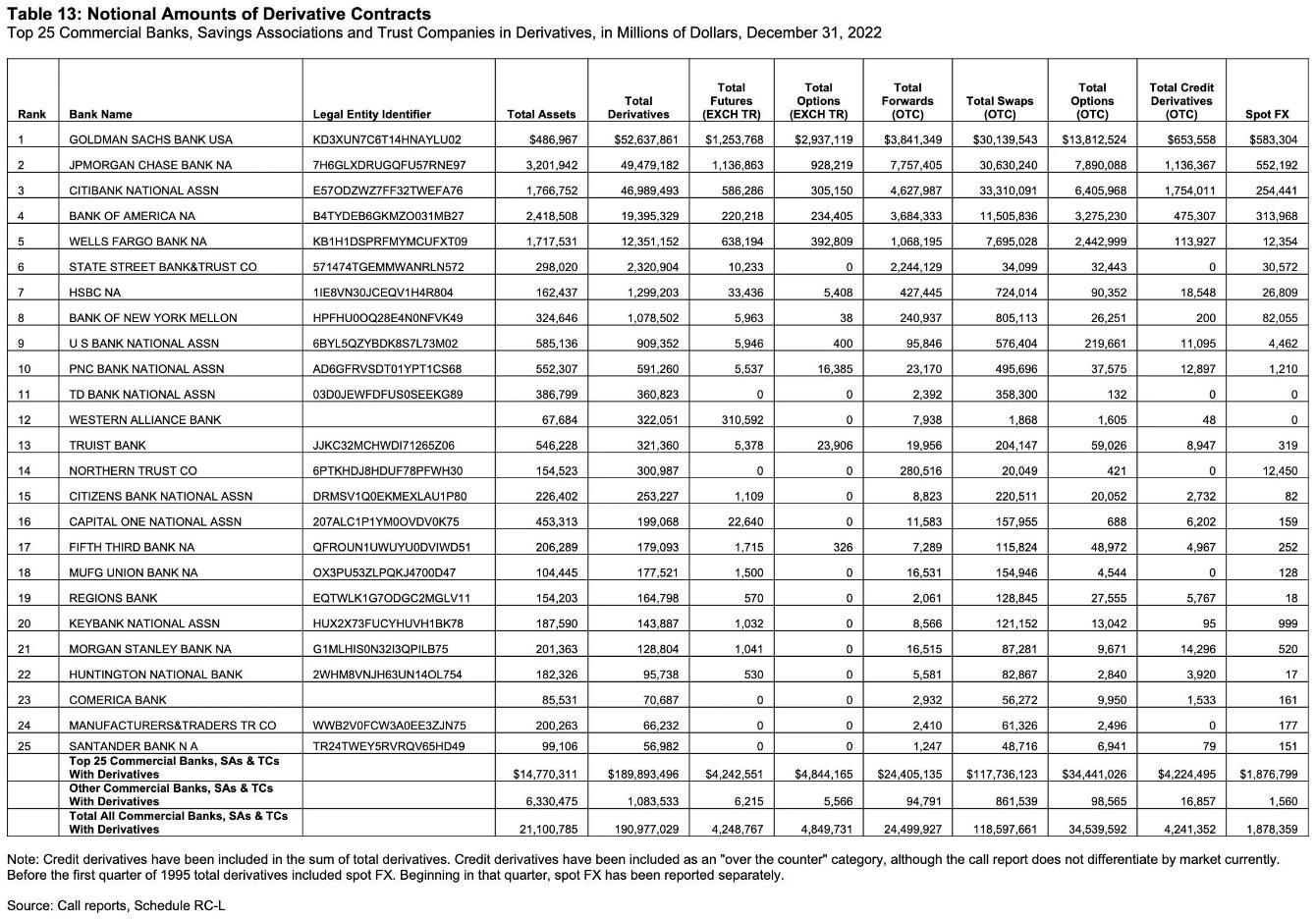

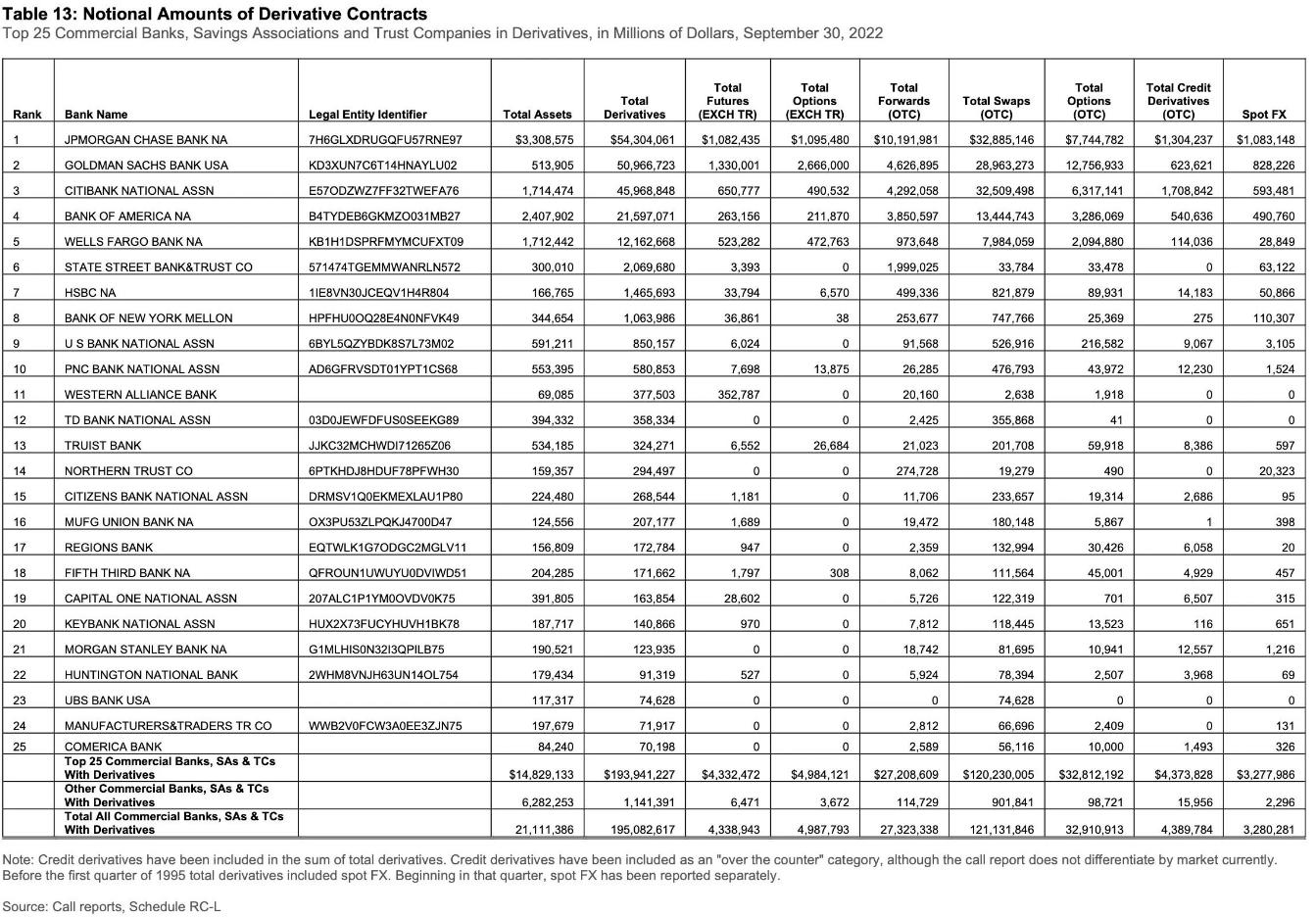

One quote: “The most recent quarterly derivatives report from the U.S. regulator of national banks, the Office of the Comptroller of the Currency (OCC), found that as of September 30, 2022 four U.S. mega banks held 88.6 percent of all notional amounts of derivatives in the U.S. banking system. The total notional amount for all banks was $195 trillion… Even though the Dodd-Frank legislation required that most of these derivative trades move to central clearing, as of September 30, 2022 the OCC report found that 58.3 percent of these derivatives were not being centrally-cleared, meaning they were over-the-counter (OTC) private contracts between counterparties, thus adding another layer of opacity to an unaccountable system.”

Source with more good stuff:

wallstreetonparade.com/2023/03/the-next-bomb-to-go-off-in-the-banking-crisis-will-be-derivatives/