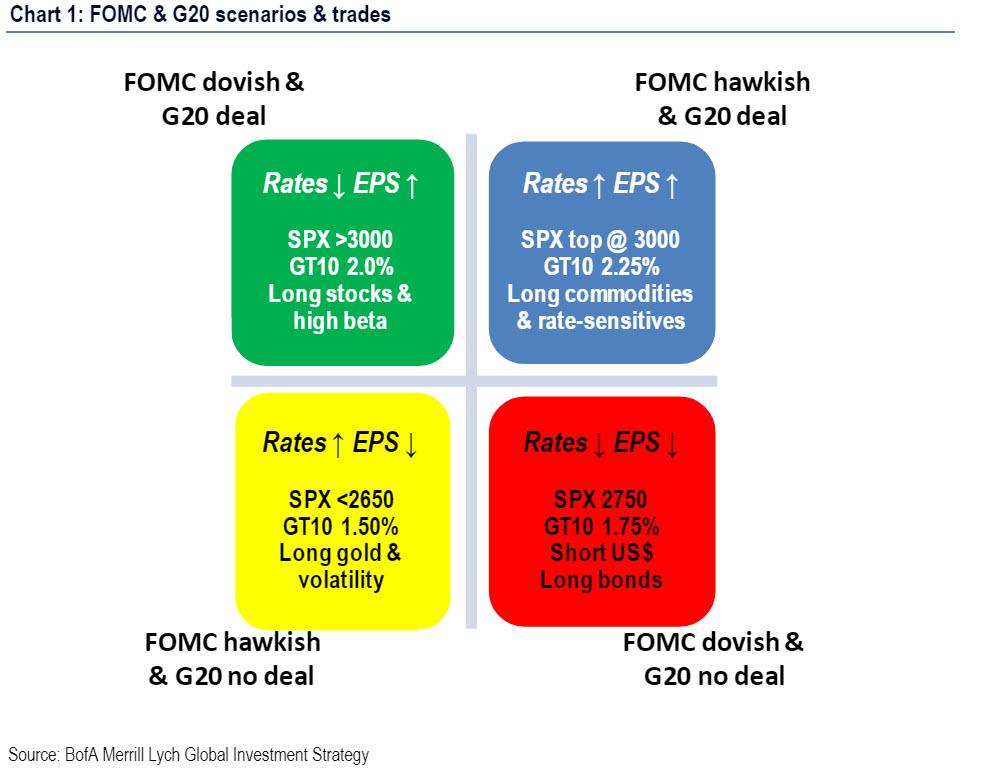

With arguably the most important two weeks of the year looming, on Friday Bank of America’s Chief Investment Officer, Michael Harnett, laid out a 2-by-2 matrix summarizing the four possible scenarios that could result from the Fed’s announcement next week, and the G-20 meeting on June 28-29, where there is a chance (if minuscule) that Trump and Xi will announce the trade war ceasefire, although far more likely, will simple lead to further trade war escalation.

Of these 4 scenarios, two are most remarkable: the best/best and the worst/worst cases. The first one sees a Dovish Fed statement, coupled with a G-20 deal, which according to BofA will send the S&P > 3000, and the 10Y yield to 2.00%, while the worst possible outcome would be if there is a 1) a hawkish Fed surprise and 2) no Deal at the G-20, which would send the S&P below 2,650, or potentially resulting in a 12% drop in the market, while slamming 10Y yields to 1.50% and helping gold rise above its 5 year breakout zone as the VIX surges.

And yet while the market’s reaction to a favorable outcome from the G-20 meeting will undoubtedly be bullish, and vice versa, we disagree that a dovish Fed would necessarily push stocks higher (recall that the Fed cut rates on average 3 months before the last three recessions, effectively telegraphing a start to the economic contraction), because as JPMorgan noted last week, the trajectory for the equity market during Fed rate cut cycles has differed historically depending on whether the Fed was seen as preemptive and cutting rates to provide insurance or seen as simply reacting to weak growth.

"In December liquidity thinner than during worst period of financial crisis…Recent recovery in E-Mini liquidity has been weak, despite calmer mkts…investors surveyed by JPMorgan last month said that 'collapse in mkt liquidity' their biggest fear" https://t.co/VpUlwi4ISq pic.twitter.com/ddVrevCL1I

— Trevor Noren (@trevornoren) June 15, 2019

Equity vol followed the 3-year lead of the US yield curve almost perfectly for the last two decades.

This indicates further pain ahead for stocks.

Kuddos to @OUPEconomics @MacrobondF & @SoberLook for sharing. pic.twitter.com/neODdQ48je

— Otavio (Tavi) Costa (@TaviCosta) June 8, 2019