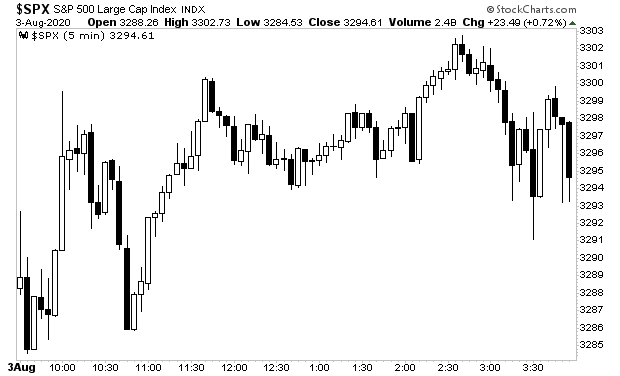

Stocks ripped higher early yesterday. However, there was NO follow through. The market effectively traded sideways after the early morning ramp.

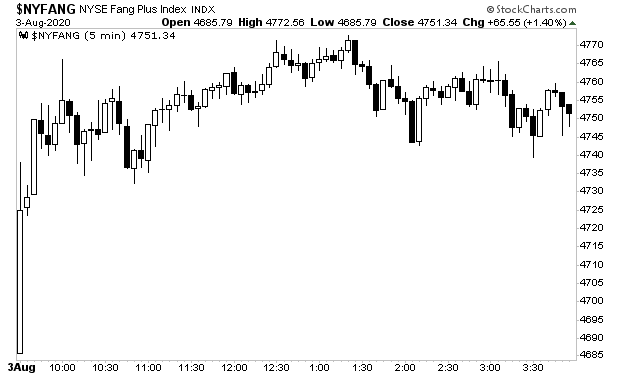

What’s really interesting is the fact that this happened EVERYWHERE in the market, not just the S&P 500. Even the super popular FANG stocks went nowhere after the first 15 minutes.

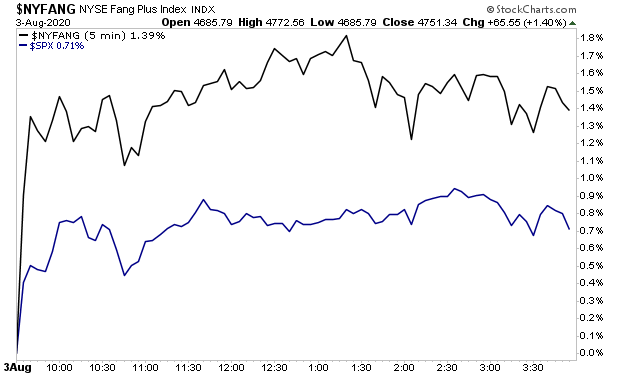

Put simply, the gains came early yesterday. And like most days, they were concentrated in a handful of stocks: the large tech companies/ FANGs. The chart below compares their performance to that of the S&P 500 for the session.

So why are these same companies outperforming so much?

Because the large tech stocks (Microsoft, Apple, Amazon, Facebook) are where central banks are buying.

Together these companies account for nearly 20% of the stock market. And if central banks can get them to rally, the rest of the market will follow.

Put another way, if you were going to rig the market, these are the companies you’d be buying.

And with the same stocks moving higher day after day like clockwork, it’s pretty clear it’s central banks doing the buying.

We know the Swiss National bank buys these companies. And I strongly suspect the Fed is doing it to via some backdoor method.

Regardless of who is doing the buying, “someone” is ramping the market using these companies.

At the end of the day, it all boils down to what I’ve been saying since 2017… that the Fed and other central banks are trapped in a vicious cycle through which it INTENTIONALLY creates bubbles to deal with each successive bust.

We had the Tech Bubble in the ’90s.

The Housing Bubble in the mid-00s.

And now the Everything Bubble in 2020.

On that note, we’re putting together an Executive Summary on how to play this move.

It will identify which investments will perform best during the Fed’s next bubble, including a unique play that could more than double the performance of the S&P 500.

This Executive Summary will be available exclusively to subscribers of our Gains Pains & Capital e-letter. To insure you receive a copy when it’s sent out, you can join here:

https://phoenixcapitalmarketing.com/TEB.html

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research